In the tumultuous realm of forex trading, volume is a vital indicator that provides astute traders with invaluable insights into market sentiment and future price movements. Comprehending the intricacies of volume calculation empowers forex enthusiasts to navigate the ever-changing market landscape and optimize their trading strategies.

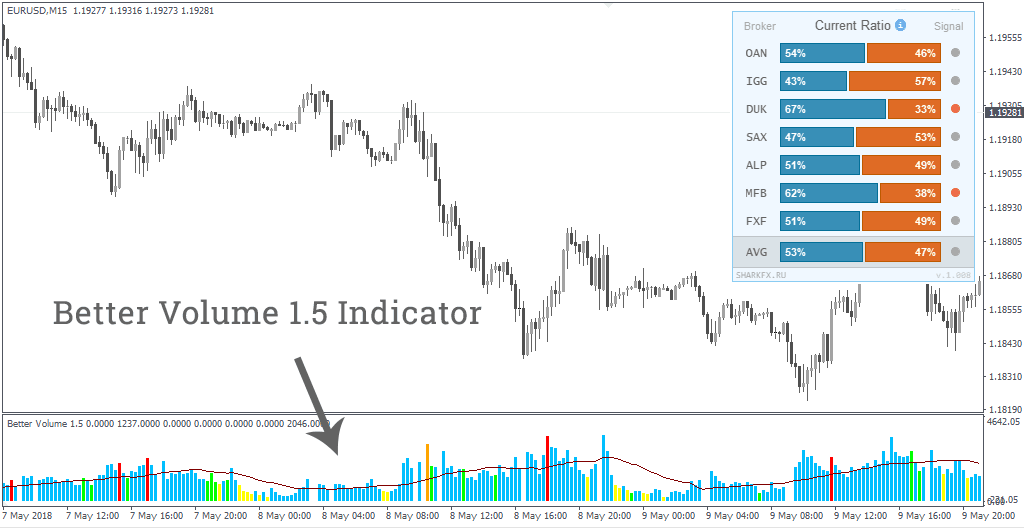

Image: www.pinterest.com

Defining Volume in Forex: The Lifeblood of Currency Trading

Volume in forex trading signifies the total number of currency units exchanged between two currencies during a specific time frame. Forex volume is typically measured in lots, representing standardized units of 100,000 units of the base currency. Understanding volume is imperative because it unveils the intensity of trading activity for a particular currency pair, shedding light on market participation and conviction.

Accuracy in Volume Calculation: A Cornerstone of Informed Decisions

Calculating volume size in forex involves meticulousness and an understanding of the underlying mechanisms. For spot forex transactions, volume is calculated by multiplying the number of standard lots traded by 100,000. For instance, a trade executed with a volume of 2 lots represents the exchange of 200,000 units of the base currency.

In the forwards and futures markets, volume calculation differs slightly. Forward contracts, which involve the exchange of currencies at a predetermined future date, measure volume in terms of the underlying contract size, which varies based on the currency pair and specific market conventions. Similarly, futures contracts, standardized agreements to buy or sell currencies at a specific price on a future date, also have their own distinct contract sizes for volume calculation.

The Power of Volume Analysis: Unlocking Market Insights

Volume analysis is a potent tool that empowers traders to gauge market sentiment, identify potential turning points, and refine trade execution strategies. When combined with other technical indicators like price action and moving averages, volume can provide a comprehensive view of market dynamics.

High volume typically indicates increased market participation and volatility, signaling strong conviction among traders. Conversely, low volume can suggest a lack of interest or indecision in the market, leading to potentially range-bound price action.

Recognizing Volume Divergence: A Harbinger of Market Shifts

Volume divergence, a significant concept in volume analysis, occurs when price action and volume trend in opposite directions. When prices rise but volume decreases, it suggests a potential market reversal or lack of conviction in the ongoing trend. Conversely, when prices fall, and volume increases, it may indicate a strengthening of the downtrend or a potential trend reversal.

Trading Strategies Enhanced by Volume: Maximizing Profitability

Savvy forex traders integrate volume analysis into their trading strategies to optimize their decision-making process. High-volume trades, often indicative of strong market momentum, can provide opportunities for trend-following strategies. Conversely, low-volume trades may warrant a cautious approach or favor range-bound trading tactics.

Conclusion: Volume Mastery, a Path to Forex Trading Excellence

Understanding how to calculate and analyze volume size in forex is a fundamental skill that empowers traders to navigate the complexities of the currency markets. By incorporating volume into their trading toolkit, traders gain a deeper understanding of market sentiment, identify potential trade opportunities, and enhance their overall trading performance. As the saying goes, “Volume speaks louder than price,” so harnessing the power of volume analysis can propel forex traders towards trading success.

Image: howtotradeonforex.github.io

How To Calculate Volume Size In Forex