Flat forex markets, characterized by a prolonged period of low volatility and minimal price fluctuations, can be frustrating and pose unique challenges for traders. Fortunately, by understanding the causes and adopting effective strategies, traders can mitigate the risks and potentially profit even in these seemingly inactive conditions.

Image: www.forex.academy

Understanding Flat Forex Markets

Flat forex markets typically occur due to a lack of market-moving news, economic data releases, or geopolitical events. During these periods, market sentiment remains relatively stable, and currency pairs often trade within a narrow range for extended periods. Factors that can contribute to flat markets include economic stability, central bank interventions, or a balancing of opposing market forces.

Strategies for Flat Forex Markets

1. Range Trading:

Flat markets provide an ideal environment for range-trading strategies, where traders seek to capitalize on the limited price movements. By identifying support and resistance levels, traders can establish buy and sell orders within the expected trading range.

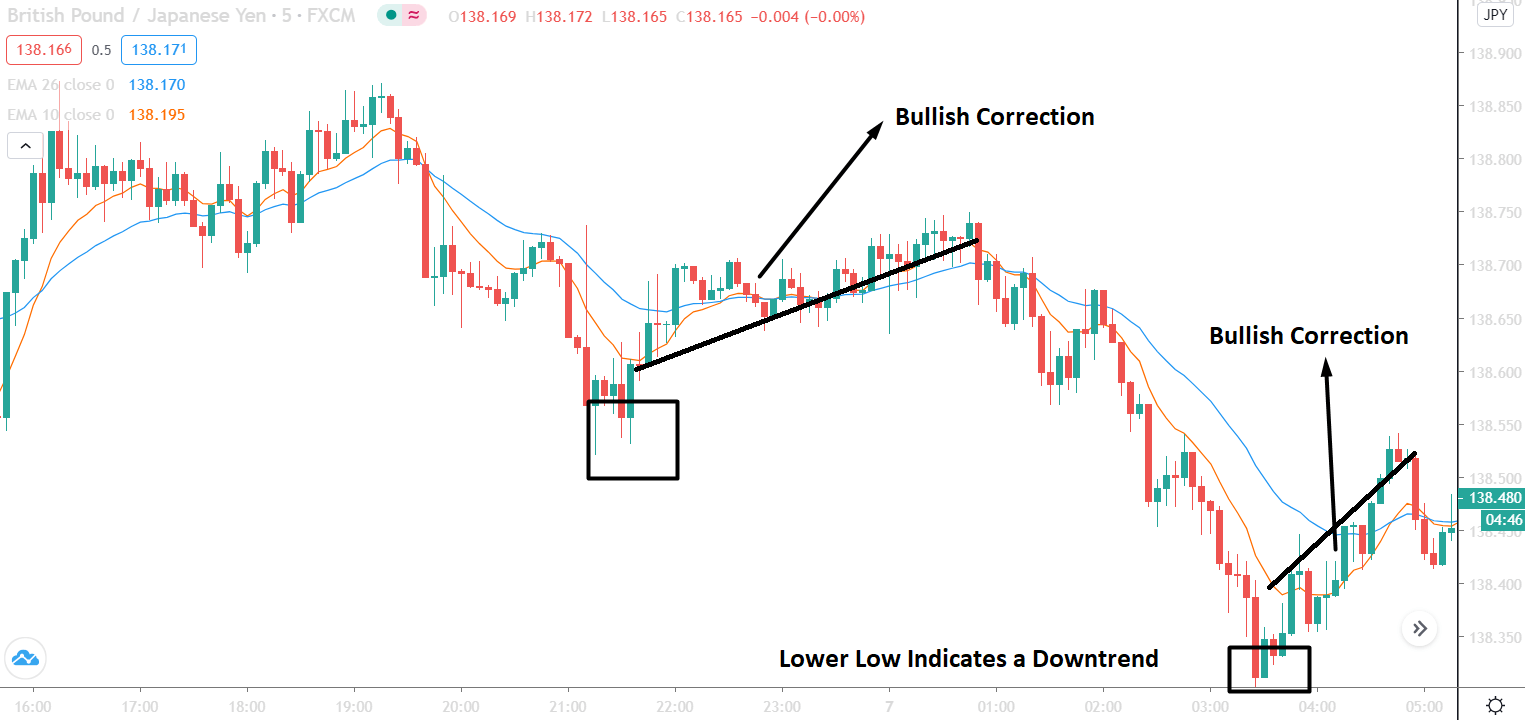

2. Trend Following:

Even in seemingly directionless markets, subtle trends can emerge. By using technical analysis tools such as moving averages and trendlines, traders can identify potential breakouts and enter trades in the direction of the prevailing trend.

3. Volatility Breakouts:

Flat markets can offer opportunities for volatility breakouts. Traders can monitor volatility indicators such as the Average True Range (ATR) or Bollinger Bands to identify potential periods of increased price fluctuations and position themselves accordingly.

4. News Trading:

While market-moving news events are typically infrequent during flat markets, traders can carefully monitor news feeds for potential catalysts. By being prepared to react quickly to unexpected news releases, traders can seize opportunities for profitable trades.

Expert Insights

“In flat markets, discipline and patience are crucial,” says renowned trader Nicolas Darvas. “Traders should avoid emotional trading and focus on following their predefined strategies.”

“Volatility breakouts can provide excellent trading opportunities,” advises professional forex trader Adam Grimes. “Traders should be prepared to enter trades quickly when volatility indicators suggest a breakout is imminent.”

Image: homecare24.id

How To Avoid Flat Markets Forex

Conclusion

Flat forex markets present both challenges and opportunities for traders. By understanding the causes of flat markets and adopting effective strategies, traders can navigate these conditions and potentially generate profits. Range trading, trend following, volatility breakouts, and news trading are all viable approaches for maximizing returns in flat markets. Remember, discipline, patience, and adaptability are key to success in all market conditions.