Introduction

Managing foreign exchange (forex) exposure is crucial for businesses operating globally. Accurately calculating unadjusted forex gain or loss helps companies assess the impact of currency fluctuations on their financial performance and make informed decisions. This detailed article provides a step-by-step guide on calculating unadjusted forex gain loss, discusses the latest trends, shares expert tips, covers frequently asked questions, and concludes with a call to action.

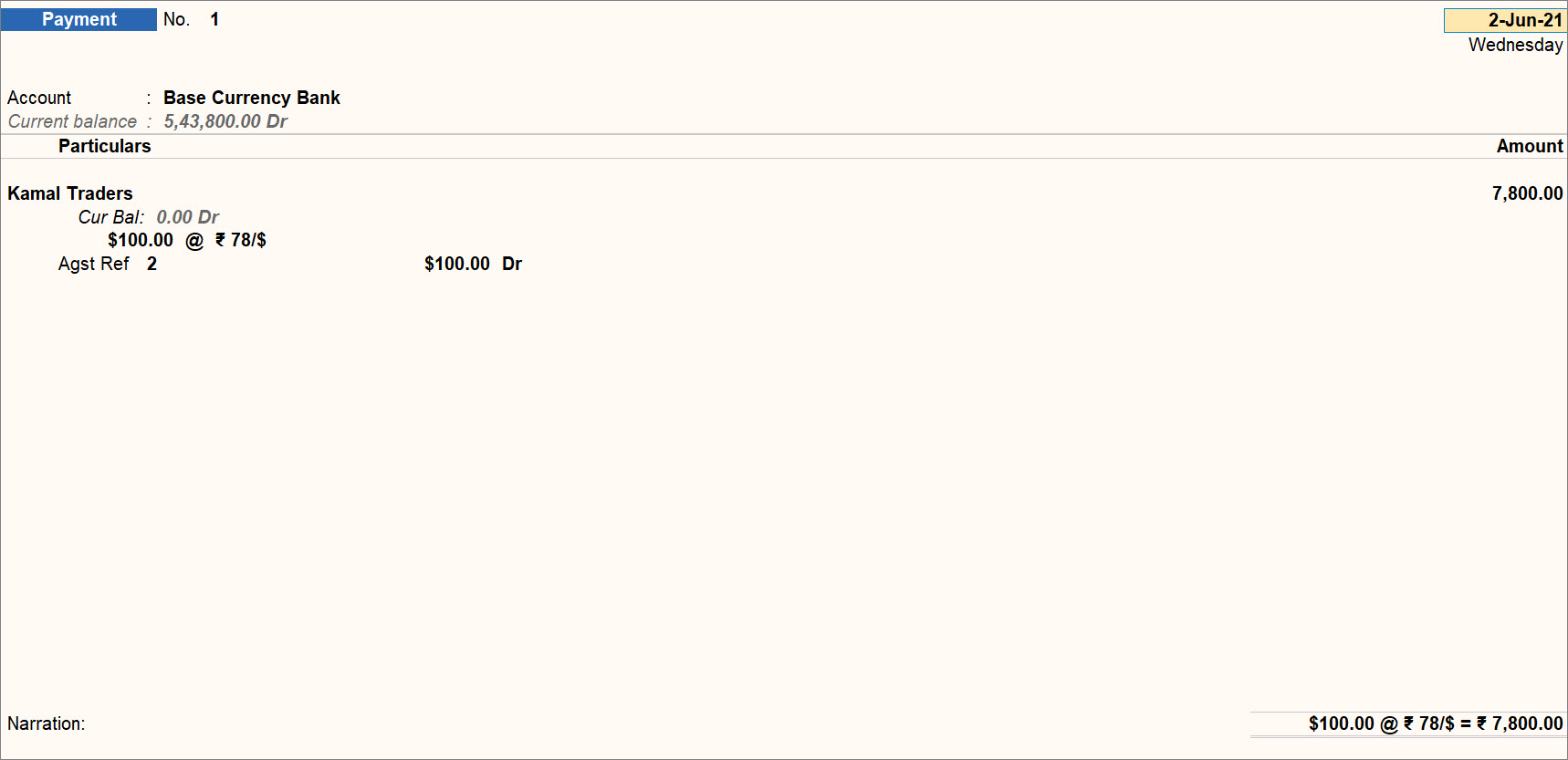

Image: help.tallysolutions.com

Understanding Unadjusted Forex Gain Loss

Unadjusted forex gain or loss refers to the unrealized changes in the value of a company’s foreign currency-denominated assets or liabilities due to currency fluctuations. It is calculated before considering any hedging or risk management practices. This metric is significant because it provides an indication of potential exchange rate risks and the impact of currency fluctuations on the company’s financial position.

Calculating Unadjusted Forex Gain Loss

Unadjusted forex gain or loss can be calculated using the following steps:

- Identify foreign currency-denominated assets and liabilities: Determine all assets and liabilities that are denominated in foreign currencies.

- Obtain current exchange rates: Use reliable sources to obtain the current exchange rates between the foreign currencies and the company’s reporting currency.

- Apply the exchange rates: Convert the value of each foreign currency-denominated asset or liability into the reporting currency using the current exchange rates.

- Compare to balance sheet values: Calculate the difference between the converted values and the original balance sheet values in the reporting currency.

- Aggregate the differences: Sum up the positive and negative differences to determine the unadjusted forex gain or loss.

The Impact of Unadjusted Forex Gain Loss

Unadjusted forex gain loss can impact a company’s financial performance in several ways:

- Fluctuating profits: Currency fluctuations can lead to gains or losses, which can affect a company’s net income and profitability.

- Cash flow implications: Changes in foreign currency values can impact the value of accounts receivable and accounts payable, affecting a company’s cash flow position.

- Financial statement translation: Companies with foreign subsidiaries must translate their financial statements into the reporting currency, which can introduce forex gains or losses due to exchange rate changes.

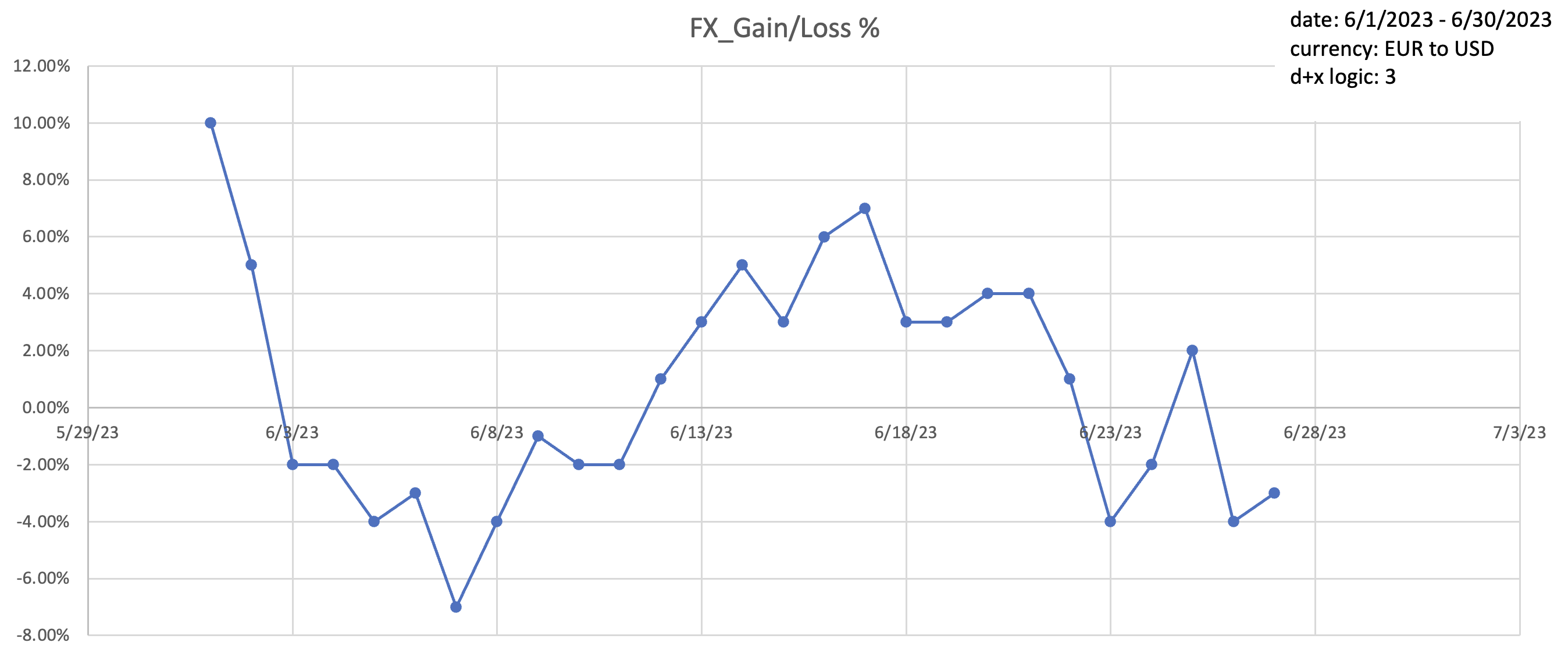

Image: www.chegg.com

Latest Trends and Developments

Recent trends and developments in forex management include:

- Increased use of hedging instruments: Companies are increasingly using financial instruments such as forward contracts, options, and swaps to mitigate forex risks.

- Technological advancements: Digital platforms and online tools make it easier for companies to monitor exchange rates and manage forex exposures.

- Greater regulatory focus: Regulatory bodies are paying more attention to forex risk management practices and disclosure requirements.

Tips and Expert Advice

For effective forex management, consider the following tips and expert advice:

- Monitor exchange rates closely: Stay informed about global economic conditions and market trends that may impact exchange rates.

- Consider hedging strategies: Employ hedging instruments to manage forex risks and protect against potential losses.

- Optimize foreign currency invoicing: Negotiate contracts with customers and suppliers in the most favorable currencies to reduce forex risks.

Frequently Asked Questions (FAQs)

Q: How does unadjusted forex gain or loss differ from realized forex gain or loss?

A: Unadjusted forex gain or loss reflects unrealized changes in foreign currency exposure, while realized forex gain or loss represents actual realized gains or losses from foreign currency transactions.

Q: Is it necessary to hedge all forex exposures?

A: While hedging can help mitigate risks, it is not always necessary to hedge all exposures. Companies should weigh the costs and benefits of hedging vs. the potential risks and rewards of currency fluctuations.

How Telly Calculate Unadjusted Forex Gain Loss

Conclusion

Understanding and accurately calculating unadjusted forex gain loss helps businesses make informed decisions about managing foreign currency risks. By adopting effective forex management strategies, companies can minimize potential losses and enhance their financial performance. Are you interested in learning more about forex management best practices and strategies?