In the dynamic world of forex trading, understanding the nuances of trading terminology is crucial for successful navigation. One such key concept is rollover, a vital aspect that influences your trading strategies and profit potential. In this comprehensive guide, we’ll delve into the intricacies of rollover, exploring its definition, significance, and how it affects your forex trades.

Image: libertex.org

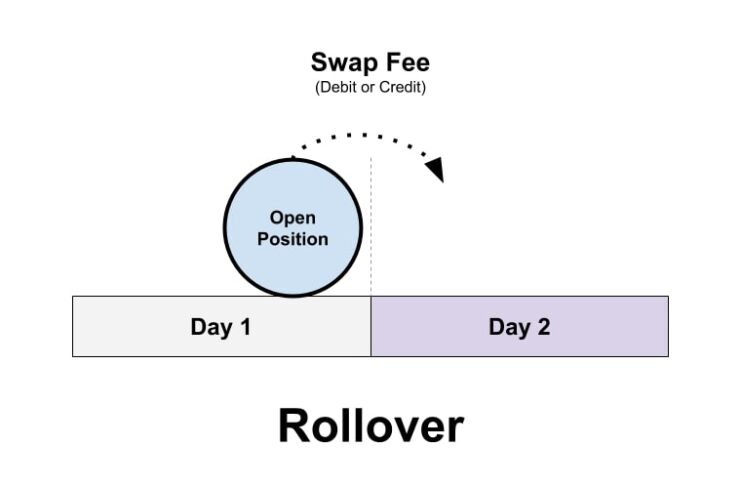

Forex trading involves the exchange of currencies from different countries, and this exchange occurs in the form of currency pairs. However, the market doesn’t operate 24/7, as it’s divided into sessions based on specific regions. When one session closes and the next opens, there’s a brief period where the two sessions overlap – this is known as the “rollover period”.

Rollover in Forex Trading: An Overview

Purpose of Rollover

The primary purpose of rollover is to ensure seamless transition as one trading session ends and the next begins. It allows traders to carry over open positions from the expiring session to the new one, eliminating the need to close and reopen trades manually.

Components of Rollover

Rollover involves two key components: the interest rate differential between the two currencies involved in the currency pair and the rollover premium or discount. The interest rate differential determines whether the trader will pay or receive interest, while the rollover premium or discount represents the cost of borrowing or lending the currencies overnight.

Image: pipsedge.com

Understanding the Impact of Rollover

Rollover Cost/Benefit

The interest rate differential and rollover premium/discount determine whether a trader incurs a cost or earns a benefit from rollover. If the interest rate on the currency you’re buying is higher than that of the one you’re selling, you’ll earn interest. Conversely, if the interest rate on the currency you’re selling is higher, you’ll pay interest.

Currencies Involved

The impact of rollover also depends on the currencies involved. If both currencies have the same interest rate, there’s no rollover cost or benefit. However, if the interest rates differ, the trader will experience the effects of the rollover as described above.

Expert Advice for Managing Rollover

Seasoned forex traders offer valuable advice for effectively managing rollover:

- Consider Interest Rate Differentials: Factors in the interest rate differences between the currencies you trade to anticipate potential rollover costs or benefits.

- Use Rollover Calculators: Utilize online rollover calculators to estimate the exact cost or benefit of rollover for your specific trades.

- Monitor Currency News: Stay updated on economic news and announcements that could impact interest rates and affect rollover.

- Set Stop-Loss Orders: Place stop-loss orders to mitigate potential losses due to adverse rollover.

Frequently Asked Questions on Rollover

To enhance your understanding, here are some commonly asked questions about rollover:

- Q: Can rollover be beneficial?

A: Yes, if the interest rate on the currency you’re buying is higher, you earn interest overnight. - Q: How do I calculate the rollover cost/benefit?

A: Use online rollover calculators or refer to your brokerage platform for detailed calculations. - Q: Is rollover automatic?

A: Yes, if you have an open position at the time of rollover, it’s automatically carried over to the next session.

How Rollover Works In Forex Trading

Conclusion

Grasping the intricacies of rollover is essential for effective forex trading. By understanding the concepts, impact, and strategies related to rollover, traders can optimize their trading decisions, manage risk, and potentially enhance their profit margins. We encourage you to explore additional resources, discuss with experienced traders, and stay abreast of the latest industry developments to further enhance your knowledge and trading skills.

Are you interested in leveraging your understanding of rollover to improve your forex trading strategies? Share your thoughts and experiences in the comments below.