In India and beyond, the allure of forex option trading has captivated countless individuals seeking financial empowerment. Options, a versatile financial instrument, present both lucrative opportunities and inherent risks. This article delves into the nuances of forex option trading in India, shedding light on its potential profitability and the key considerations for success.

Image: howtotradeonforex.github.io

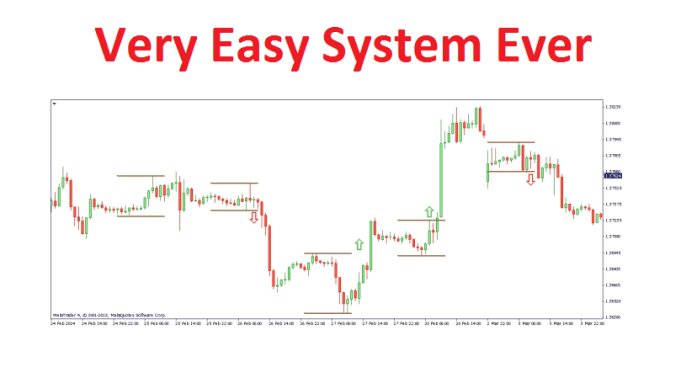

Forex option trading entails the trading of options contracts, which grant the holder the right, but not the obligation, to buy or sell a specific currency pair at a predetermined price on or before a specified date. These contracts provide traders with the flexibility to capitalize on market movements without the full commitment of purchasing or selling the underlying currency pair outright.

Profit Potential: Unveiling the Rewards

The potential profitability associated with forex option trading in India is undeniable. Traders who possess a keen understanding of the market and a disciplined trading strategy can reap substantial returns. Options offer leverage, amplifying the potential for gains while simultaneously increasing the risk involved. Moreover, the diversity of option strategies allows traders to tailor their approach to suit their risk tolerance and investment goals.

However, it is crucial to approach forex option trading with realistic expectations. While significant profits are attainable, consistent gains require a combination of knowledge, skill, and a dash of luck. Beginners are strongly advised to gain a thorough understanding of options trading concepts, market dynamics, and risk management techniques before venturing into live trading.

Essential Considerations: A Blueprint for Success

To navigate the complexities of forex option trading in India and maximize profitability, traders must adhere to a set of essential considerations:

- Market Knowledge: A deep understanding of the Indian forex market and global economic factors is paramount. Traders must stay abreast of market trends, news events, and central bank announcements that may influence currency prices.

- Trading Strategy: Developing a structured trading strategy that outlines entry and exit points, risk management parameters, and profit targets is vital. The strategy should align with the trader’s risk tolerance and investment objectives.

- Risk Management: Implementing a stringent risk management framework is non-negotiable. This includes setting clear stop-loss levels, managing position size, and diversifying trades to mitigate potential losses.

- Broker Selection: Choosing a reputable and regulated broker is essential. Look for a broker that offers low spreads, competitive trading costs, and a platform that suits your trading style.

- Education and Learning: Continuous learning is essential in the ever-evolving world of forex option trading. Attend webinars, read industry publications, and seek mentorship from experienced traders to enhance your knowledge and skills.

Image: www.pinterest.com

How Profitable Is Forex Option Trading In India

Conclusion: Embarking on the Forex Option Trading Journey

Forex option trading in India presents an intriguing opportunity for those seeking financial gain. While the potential rewards are substantial, it is imperative to approach this endeavor with a comprehensive understanding of the risks involved. Arm yourself with knowledge, develop a sound trading strategy, implement robust risk management practices, and select a reputable broker. By meticulously following these guidelines, traders can enhance their chances of achieving profitability in the dynamic world of forex options.