Unleash the Lucrative World of Forex Market

In today’s fast-paced financial landscape, the foreign exchange market (forex) has emerged as a lucrative avenue for traders seeking profit. However, navigating the complexities of forex trading requires a deep understanding of market dynamics and a robust trading strategy. To embark on this exciting journey, opening a live forex trading account is the first crucial step. This comprehensive guide will walk you through the process, empowering you to seize the opportunities and minimize the risks involved in the fascinating realm of forex.

Image: blog.fxcc.com

Opening a Live Forex Account: A Step-by-Step Journey

To open a live forex account, follow these simple steps:

- Choose a Reputable Broker: Conduct thorough research to identify a reliable broker regulated by reputable authorities. Transparency, low spreads, and customer support are key factors to consider.

- Fill Out the Application Form: Provide accurate personal and financial information on the broker’s website. This may include details such as name, address, phone number, and trading experience.

- Submit Supporting Documents: Most brokers require proof of identity and address, such as a passport or driver’s license, and a utility bill or bank statement.

- Fund Your Account: Decide on the initial deposit amount and choose the most convenient funding method offered by the broker. Wire transfers, credit/debit cards, and electronic payment systems are common options.

- Activate the Account: Once your application and documents are approved, the broker will activate your live trading account, allowing you to access the forex market and execute trades.

Essential Tips for Forex Trading Success

Now that you know how to open a live forex account, implementing the following tips will enhance your trading experience:

- Develop a Solid Trading Plan: Define your trading objectives, risk tolerance, and entry/exit strategies. A well-structured plan ensures consistent decision-making and minimizes emotional trading.

- Master Risk Management Techniques: Implement stop-loss orders, position sizing, and hedging strategies to manage risk and preserve capital. Risk management is paramount for long-term success in the forex market.

Frequently Asked Questions About Forex Trading Accounts

Q: What is a demo account?

A: A demo account is a virtual trading environment that allows you to trade with simulated funds, providing a risk-free way to practice and test strategies before risking real capital.

Q: What is a spread?

A: The spread is the difference between the bid price (the price at which you can sell) and the ask price (the price at which you can buy) of a currency pair. Spreads represent the broker’s commission on each trade.

Q: How do I choose the right leverage for my trading?

A: Leverage is a tool that allows you to magnify your trading position, increasing potential profits but also risks. Choose leverage that suits your risk tolerance and trading experience.

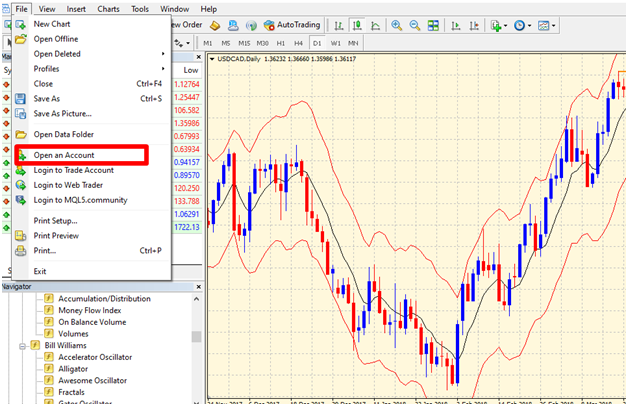

Image: www.instaforex.com

How Open Forex Currency Trading Acount

Conclusion

Opening a live forex trading account marks the beginning of an exciting journey in the world of finance. By following the steps outlined in this guide, you can navigate the process seamlessly. Remember to prioritize research, risk management, and a well-defined trading plan. Engage with the FAQs to clarify any lingering queries. If you find the world of forex trading captivating, I encourage you to explore further and delve deeper into the intricacies of this dynamic market. Embrace the challenges and reap the rewards that await in the ever-evolving landscape of forex.