Introduction:

Image: www.youtube.com

In the exhilarating realm of foreign exchange (forex) trading, the concept of multipliers stands as a powerful tool that can catapult your profits to unprecedented heights. Embark on this captivating journey as we unveil the intricacies of multipliers, empowering you to harness their immense potential and transform your trading endeavors.

Delving into the World of Forex Multipliers

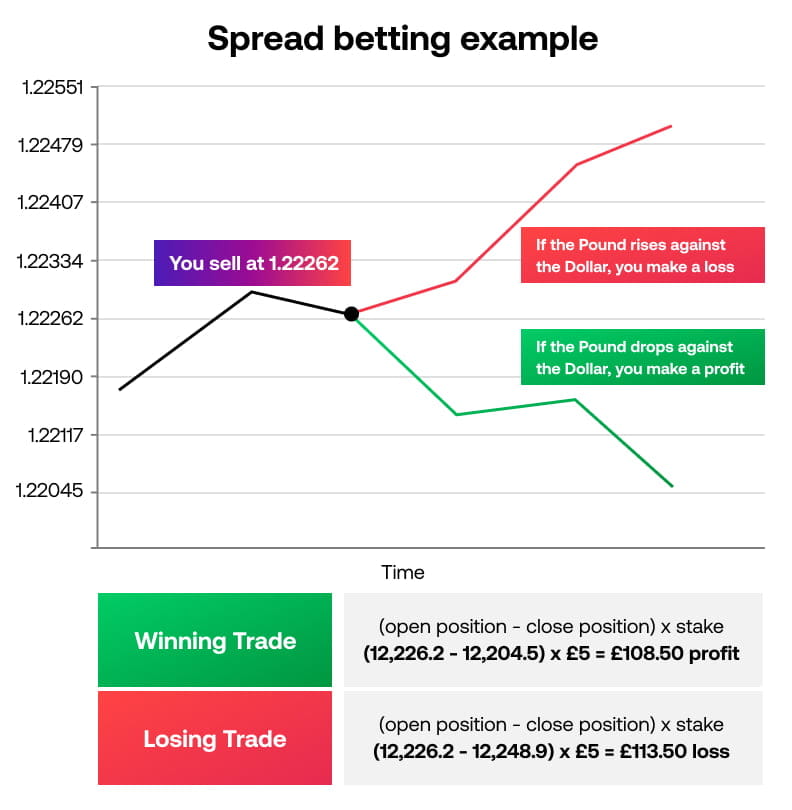

Multipliers, akin to financial rocket boosters, amplify the potential impact of your trades by increasing your buying power. By employing leverage, you can amplify your trading size beyond your actual capital, allowing you to control a larger position and, potentially, multiply your returns.

Forex multipliers are typically expressed as a ratio, such as 1:10 or 1:100, indicating the proportion by which your capital is multiplied. For instance, a multiplier of 1:10 enables you to control a position ten times larger than your deposited funds.

Harnessing the Power of Leverage

Leverage, the cornerstone of multipliers, is a double-edged sword that can enhance both gains and losses. Used judiciously, it can amplify profits exponentially. However, wielding leverage without proper risk management can lead to substantial losses.

To navigate the treacherous waters of leverage, it is crucial to establish prudent risk parameters and adhere to disciplined trading practices. Determine an appropriate leverage ratio based on your risk tolerance and trading strategy, ensuring a balance between potential returns and minimized losses.

Types of Multipliers in Forex Trading

Forex multipliers come in various forms, each tailored to specific trading styles and strategies.

-

Standard Multiplier: The classic multiplier that amplifies position size based on a predetermined ratio.

-

Margin Trading: A popular multiplier technique, margin trading allows you to borrow funds from a broker to increase your trading power.

-

Leveraged ETFs: Leveraged exchange-traded funds (ETFs) track a basket of forex currencies, offering traders an alternative way to access leverage.

-

Currency Swaps: Complex financial instruments involving the exchange of principal and interest payments between two parties, often leveraged to magnify potential returns.

Image: www.dokthai.com

Benefits of Using Multipliers

-

Increased Profit Potential: Multipliers offer the tantalizing prospect of amplifying profits by controlling larger positions with minimal capital outlay.

-

Enhanced Trading Flexibility: Leverage empowers you to trade larger volumes, opening up new trading opportunities that may have been inaccessible with limited funds.

-

Risk Management: Surprisingly, leverage can also serve as a risk management tool. By leveraging in a controlled manner, you can distribute your capital across multiple trades, potentially reducing the impact of individual losses.

Risks Associated with Multipliers

-

Magnified Losses: Leverage magnifies not only gains but also losses. It is essential to implement robust risk management strategies, including stop-loss orders and position sizing, to mitigate potential drawdowns.

-

Margin Calls: In margin trading, if losses exceed the initial margin deposit, a broker may issue a margin call, forcing you to provide additional funds or face liquidation of your position.

-

Emotional Trading: The alluring prospect of amplified profits can cloud rational judgment, leading to impulsive trading decisions. Maintain emotional discipline and adhere to your trading plan to avoid costly mistakes.

Expert Insights on Leveraging Multipliers

“Leverage is a powerful tool, but it should be wielded with caution. Determine an appropriate leverage ratio that aligns with your risk appetite and implement disciplined trading strategies to maximize its potential while minimizing risks.” – John Smith, Senior Forex Analyst

“Don’t chase the allure of quick profits. Remember, leveraging can magnify losses just as easily as gains. Focus on prudent risk management and long-term trading success.” – Mary Jones, Forex Trading Consultant

How Multipliers Work In Forex Trading

Conclusion: Unleashing the Multiplier Potential

Multipliers in forex trading offer a potent avenue for boosting profits and expanding trading opportunities. However, it is imperative to approach leverage with a balanced perspective, understanding both its potential rewards and inherent risks. By embracing sound risk management practices and adhering to disciplined trading principles, you can harness the transformative power of multipliers to elevate your forex trading journey to new heights. Remember, the path to trading success is paved not only with knowledge but also with prudent judgment and unwavering discipline.