Introduction

In today’s globalized economy, foreign exchange (forex) plays a vital role in facilitating international trade, investments, and personal transactions. For individuals and businesses alike, understanding the timeframes involved in forex payments can be crucial in optimizing financial planning and mitigating potential risks. In this comprehensive guide, we will delve into the intricacies of SBI forex payment processing, empowering you with knowledge to navigate the process seamlessly, ensuring swift and secure transactions.

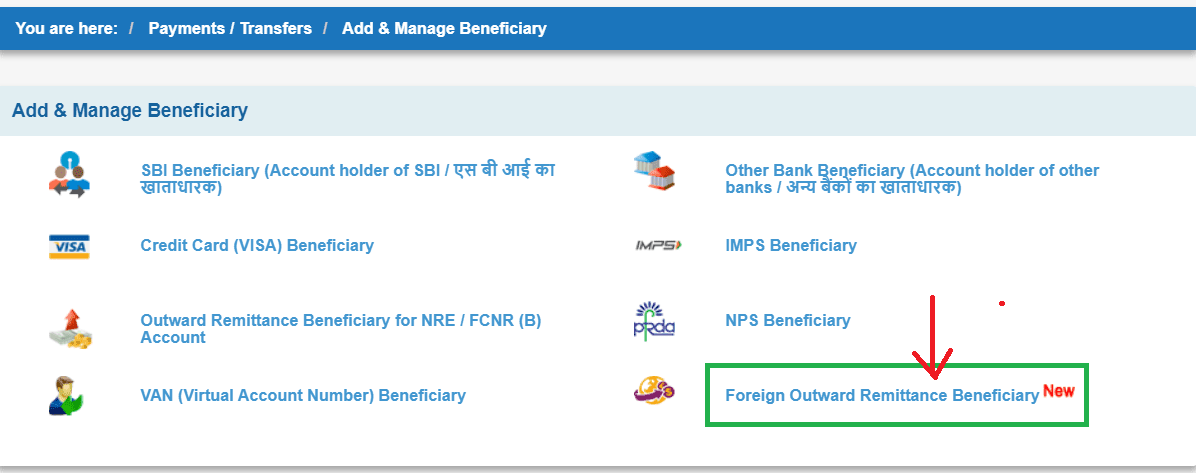

Image: www.bankindia.org

Timelines for SBI Forex Payments

The processing time for SBI forex payments can vary depending on several factors, including the payment method, destination country, and bank regulations. Here’s a breakdown of typical timelines:

Online Forex Transactions:

For online forex transfers initiated through SBI’s internet banking platform, processing usually takes 1-2 business days. The exact time may vary based on the receiving bank’s payment processing timeframe.

Bank-to-Bank Forex Transfers:

If you opt for a bank-to-bank wire transfer, the processing time can range from 2-5 business days, depending on the destination country and the receiving bank’s protocols.

SWIFT Transfers:

SBI utilizes the SWIFT network for international forex payments, which generally takes 1-3 business days to complete. SWIFT transfers may involve additional processing time for certain countries or if the transaction requires manual intervention due to compliance checks or other factors.

Factors Influencing Payment Processing Time

Apart from the payment method, the following factors can impact the processing time for SBI forex payments:

Destination Country:

Forex payments to certain countries with stricter regulations or complex banking systems may take longer to process than payments to more developed financial hubs.

Compliance Checks:

SBI adheres to stringent anti-money laundering and counter-terrorism financing regulations. Enhanced due diligence checks or documentation requirements can prolong the processing time.

Bank Holidays:

Processing timelines can be extended during bank holidays or weekends, as financial institutions are closed.

Peak Transaction Periods:

During periods of high transaction volume, such as the end of the month or year, processing times may experience slight delays.

Image: forexrateindia.com

How Much Time Sbi Takes For Forex Payment

Tips for Expediting SBI Forex Payments

To minimize delays and ensure prompt forex payments, consider the following tips:

Choose the Right Payment Method:

For urgent transactions, online forex transfers or SWIFT transfers may be more suitable due to faster processing times.

Initiate Transactions Early:

Allow ample time for payment processing by initiating transactions well in advance of the intended delivery date.

Provide Accurate Information:

Ensure the beneficiary’s account details are correct to avoid potential delays due to erroneous information.

Monitor Transaction Status Regularly:

Track the status of your forex payments through online banking or by contacting SBI customer support to identify any potential issues and respond promptly.

Communicate with Beneficiaries:

Inform the receiving party about the expected payment date and provide them with the relevant transaction details to facilitate prompt reconciliation.

Conclusion

Understanding the timeframes involved in SBI forex payments equips you with the knowledge to plan your international transactions effectively. By adhering to the guidelines and leveraging the tips outlined in this guide, you can optimize the processing timeline, ensuring swift and secure transfers of your forex funds. Remember, timely and efficient forex payments are essential for maintaining global financial connectivity and facilitating seamless international business transactions.