Introduction:

Image: www.forex.academy

Imagine being able to move mountains with just the stroke of a finger, wielding the power to multiply your wealth with a click of a button. Sounds like something out of a dream, doesn’t it? Well, for many, Forex trading has become the ultimate gateway to financial freedom, offering a thrilling and lucrative playground where fortunes are made and dreams take flight.

Embarking on this extraordinary adventure requires more than just wishful thinking; it demands a clear understanding of the financial landscape and a strategic approach to investment. While there is no definitive amount that guarantees success in Forex trading, understanding the minimum requirements can help you navigate the complexities of this dynamic market with confidence.

The Bare Minimum:

The bare minimum capital required to start Forex trading is surprisingly low. With some brokers, you can open an account with as little as $10 or even less. However, it’s crucial to recognize that trading with a meager capital can limit your earning potential and increase your exposure to risk.

Striking a Balance:

Forex trading is not a get-rich-quick scheme. It requires a level of financial commitment that balances risk and reward. Seasoned traders suggest that beginners start with a more substantial initial investment, ranging from $500 to $1,000. This provides you with a buffer against market fluctuations and allows you to make informed trading decisions without the pressure of excessive risk.

Risk Management:

The golden rule of Forex trading is to never invest more than you can afford to lose. While there’s always the potential for substantial returns, the inherent volatility of the market can also result in significant losses. As a general guideline, traders recommend risking no more than 1-3% of their account balance on any single trade.

Leverage:

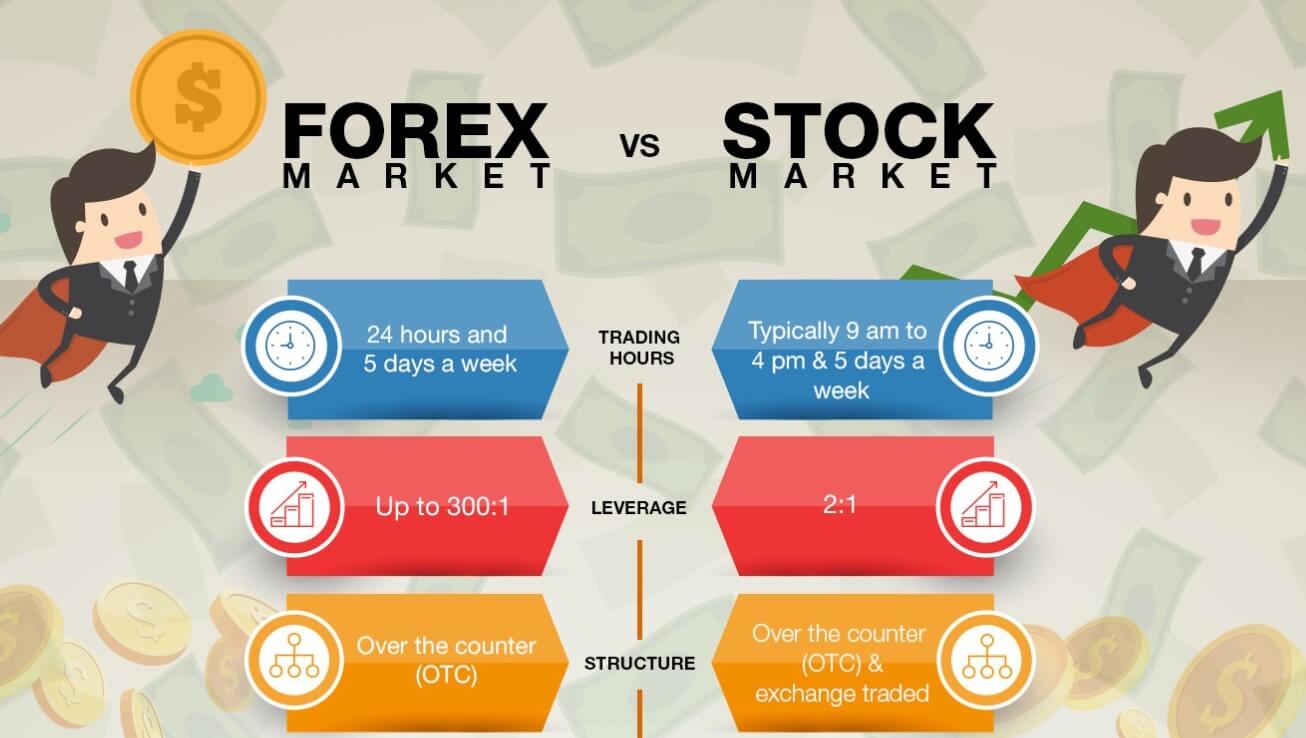

Leverage is a double-edged sword that can amplify both your profits and losses. It allows traders to control larger positions with a smaller investment, potentially increasing their returns. However, it’s crucial to use leverage cautiously and understand its potential risks. Beginner traders are advised to avoid using leverage until they have gained sufficient experience in the market.

Education and Experience:

Investing in Forex is not just about throwing money into the ring; it’s about equipping yourself with the necessary knowledge and skills to navigate the market’s complexities. Dedicate time to studying trading strategies, market analysis techniques, and risk management principles. Consider taking online courses or workshops to enhance your understanding of Forex dynamics.

Additional Factors to Consider:

Beyond the initial investment, several additional factors can influence the amount of capital you may need for Forex trading.

* Trading Frequency: Active traders who place numerous trades daily may require more capital to maintain their trading activity.

* Trading Style: Scalpers who execute short-term trades with small profit targets typically require less capital than swing traders who hold positions for longer periods, aiming for larger gains.

Trading Account Type: Different account types offered by brokers may have varying minimum deposit requirements and trading conditions. Choose an account type that aligns with your trading style and risk tolerance.

Conclusion:

While Forex trading presents boundless opportunities, it’s essential to approach it with a realistic understanding of the financial commitment required. Starting with a manageable investment, educating yourself, and employing sound risk management practices can increase your chances of success in this thrilling and potentially rewarding market. Always remember, the journey to financial freedom through Forex trading is a marathon, not a sprint. So lace up your trading boots, arm yourself with knowledge, and embark on a journey where fortunes can be forged, one trade at a time.

Image: www.pinterest.com.mx

How Much Required To Invest In Forex