Introduction:

Image: www.forex.academy

Venture into the captivating world of forex trading, where financial markets dance to the rhythm of global economic forces. With its potential for lucrative returns, it beckons countless aspiring traders. However, one crucial question lingers: how much capital is required to ignite your forex trading journey? This comprehensive guide will illuminate this pivotal aspect, guiding you towards informed decision-making.

The Forex Trading Landscape

Forex trading, or foreign exchange trading, involves the exchange of one currency for another, representing the largest and most liquid financial market globally. Traders navigate the fluctuations in currency values, aiming to profit from these changes. However, unlike the stock market where you purchase shares of companies, forex trading operates on a margin, allowing traders to control positions larger than their initial capital. This leverage amplifies potential profits but also amplifies risks.

Capital Requirements: A Balancing Act

The amount of capital required for forex trading depends on a delicate balance between factors such as trading style, risk tolerance, and trading account type. For instance, scalpers who execute frequent trades with small profit targets require less capital than swing traders who hold positions for longer durations. Similarly, conservative traders with a low risk appetite may opt for smaller positions, while aggressive traders may leverage more capital.

Minimum Capital Threshold

Most reputable forex brokers impose a minimum capital requirement to open a trading account, typically ranging from $100 to $500. However, this threshold is merely a starting point; seasoned traders often recommend a higher initial investment. A sufficient capital base provides a cushion against potential losses and allows for more flexibility in trade execution.

Recommended Capital Investment

While the exact amount varies, financial experts generally advise allocating 1-2% of your investable capital to forex trading. This conservative approach ensures that a substantial market downturn would not jeopardize your financial well-being. As your experience and knowledge grow, you can gradually increase your trading capital commensurate with your risk tolerance.

Types of Trading Accounts

Forex brokers offer various account types tailored to different trading styles and capital levels. Micro accounts, suitable for beginners, allow trading with lower minimum deposits and smaller lot sizes. Standard accounts cater to a wider range of traders, while VIP accounts offer tailored services and reduced commissions for high-volume traders. Choosing the appropriate account type is crucial to align with your trading objectives.

Risk Management as a Guiding Star

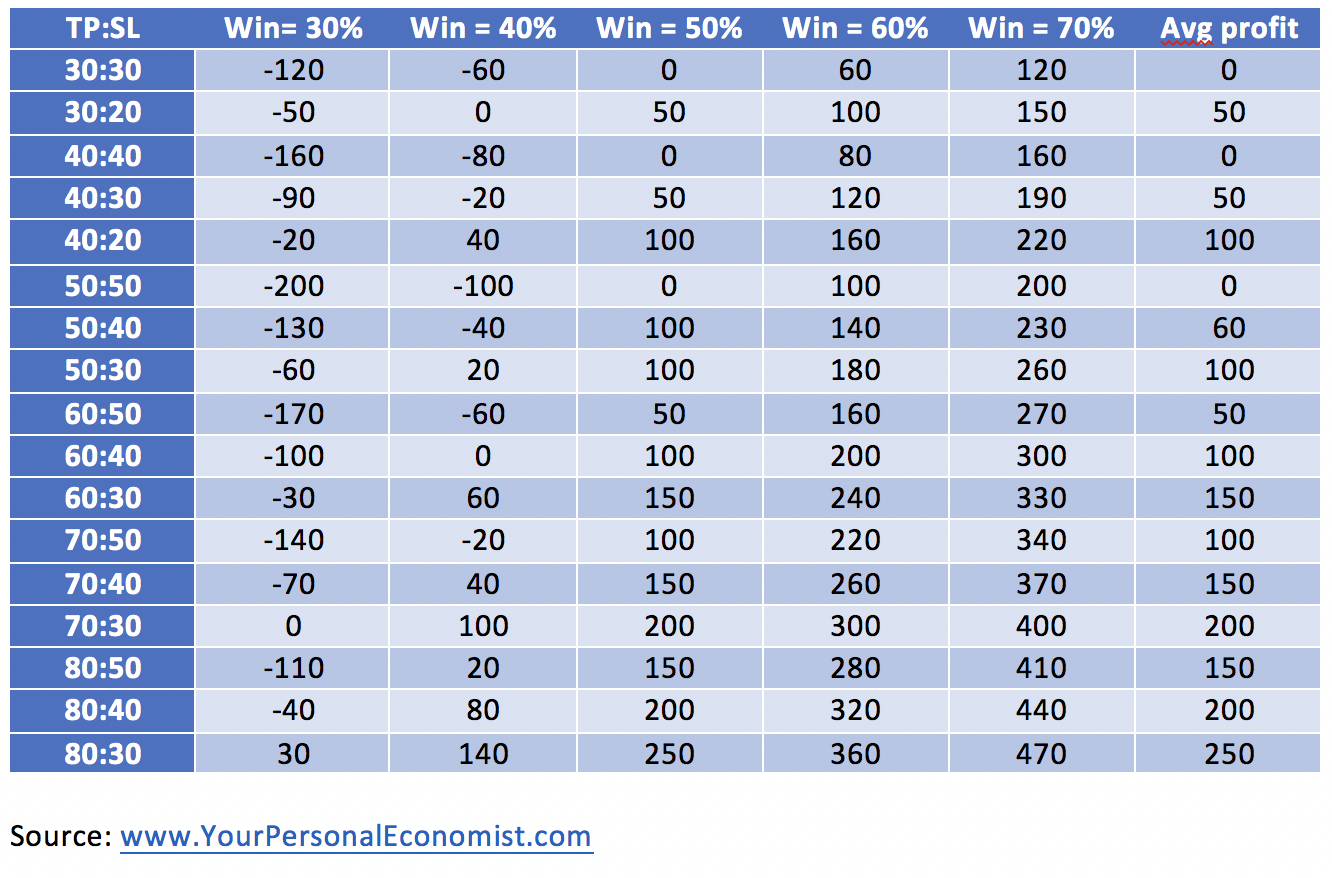

Capital preservation should be the cornerstone of your forex trading strategy. Implementing sound risk management practices, such as using stop-loss orders and maintaining a healthy risk-to-reward ratio, is paramount to mitigate losses and protect your capital. Remember, the potential for profit should always be weighed against the potential for loss.

Conclusion:

Navigating the forex trading arena requires a calculated approach to capital allocation. While the minimum capital requirement is often modest, a prudent initial investment is recommended to withstand market volatility and provide trading flexibility. Seasoned traders advocate allocating 1-2% of investable capital, gradually increasing it as experience and knowledge grow. By adhering to sound risk management principles, traders can venture into the forex markets with a clear understanding of the capital requirements and a strategic plan to protect their financial well-being. As the adage goes, “knowledge is power,” and this guide empowers you with the insights to embark on your forex trading journey with confidence and informed decision-making.

Image: db-excel.com

How Much Money Is Required To Forex Trading