2023-03-08

Image: profitkonsisten.com

Prepare yourself for an enthralling journey as we delve into the captivating world of forex trading. As aspiring traders, comprehending the intricacies of lot sizes is paramount to unlocking your full potential. Imagine unlocking the secrets to optimize your trades and maximizing your profits. In this comprehensive guide, we’ll empower you with the knowledge to navigate this dynamic market and make informed decisions about how many lots you should trade.

What Exactly Are Lots in Forex?

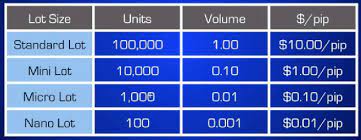

Envision a lot as a standardized unit of measurement in forex trading. It represents a specific amount of the base currency you’re trading. Typically, one lot equals 100,000 units of the base currency. For instance, if you trade the EUR/USD currency pair, one lot represents 100,000 euros. Understanding lot sizes is crucial to calculating your potential profits and losses.

Determining How Many Lots to Trade

Venturing into the world of forex trading without a clear understanding of your risk tolerance is akin to navigating a stormy sea without a compass. Before you start placing trades, carefully assess your financial situation, risk tolerance, and trading strategy. These factors will guide you in determining how many lots to trade.

- Risk Tolerance: Your risk tolerance serves as a compass, guiding you through the turbulent waters of the forex market. Determine the maximum amount of money you’re willing to risk on a single trade. This will help you set limits and prevent emotional decision-making during market fluctuations.

- Trading Strategy: Different trading strategies demand varying lot sizes. Scalpers, who seek quick profits from small price movements, may opt for smaller lot sizes. Conversely, swing traders, who hold positions for longer periods, might prefer larger lot sizes to capitalize on broader market trends.

Leverage and Its Impact

Leverage, a double-edged sword in the realm of forex trading, can amplify both your profits and losses. It allows traders to control larger positions with a smaller initial investment. While this can increase your potential returns, it also magnifies your risks. Use leverage wisely and only if you fully understand its implications.

Image: trueforexfunds.com

The Optimal Lot Size for Beginners

Navigating the forex market as a novice trader requires a cautious approach. Start with smaller lot sizes, such as 0.01 lots or micro lots, which represent 1,000 units of the base currency. These smaller lot sizes limit your potential losses while you gain experience and confidence in your trading skills.

Professional Guidance: Seeking Expert Advice

Empower yourself by seeking guidance from experienced forex traders or reputable trading platforms. They can provide invaluable insights, trading strategies, and risk management techniques tailored to your individual needs. Don’t hesitate to tap into their expertise to enhance your trading decisions.

How Many Lots Are Allowed In Forex

Conclusion: Trading with Confidence and Competence

Unveiling the mysteries of lot sizes in forex trading is a transformative step toward becoming a successful trader. By carefully considering your risk tolerance, trading strategy, leverage, and starting with smaller lot sizes, you arm yourself with the knowledge and confidence to navigate the dynamic forex market. Remember, education and practice are your steadfast companions on this enriching journey. Trade wisely, and may your profits soar to unprecedented heights!