Trading on the foreign exchange market, popularized as forex or FX, comprises an ever-evolving landscape, with institutional traders and their trading strategies noticeably determining market dynamics. It’s estimated that these major players contribute to a whopping 70-80% of the daily turnover in the global financial exchange. Institutional traders encompass a spectrum of financial titans, including banks, hedge funds, and investment firms, each with its distinctive risk appetite and trading strategy. A crucial insight into this arena pertains to the volume of trades, expressed in lot sizes.

Image: howtotrade.com

Understanding Forex Lot Sizes

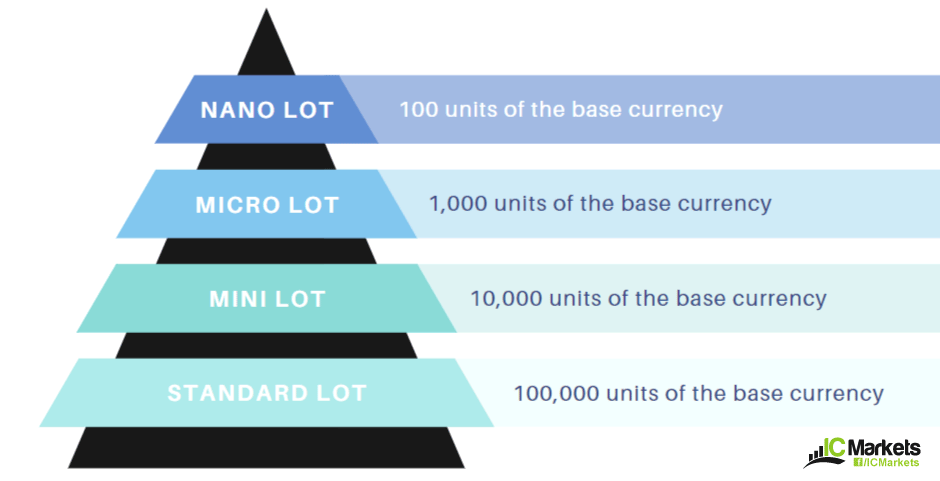

In the forex market, standard lot sizes are commonly denominated in 100,000 units of the base currency. However, many institutional traders delve into the realm of liquidity by executing trades in colossal magnitudes. These bulk trades, often exceeding a single lot size, introduce the necessity to comprehend lot multiples. Lot multiples, eloquently known as contracts, enable this exclusive fraternity to orchestrate trades spanning millions, billions, or even trillions of dollars with exceptional dexterity.

Delving into the Trading Strategies of Institutional Traders

Institutional traders unflinchingly pursue a diverse ensemble of trading strategies, ranging from trend following to scalping, though their hallmark approach centers on sophisticated risk management techniques and in-depth market analysis. Various institutional trading strategies warrant specific lot size requirements, contingent on available capital, risk tolerance, and investment objectives.

In essence, the Forex ecosystem pulsates with institutional traders driving the rhythm of the financial exchange. Through the strategic deployment of capital and advanced trading techniques, they orchestrate trades in labyrinthine proportions, influencing market dynamics in a fashion that smaller players perchance cannot fathom. Be it trend trading, scalping, or value investing, institutional traders assume outsized positions, often spanning hundreds or thousands of lots.

Institutional Trading Strategies and Lot Sizes: A Deeper Dive

Let’s unveil the intricacies of how lot sizes intertwine with institutional trading strategies:

Trend traders: These forex rock stars capitalize on prevailing market trends, hoping to ride the currency rollercoaster to glorious profits. To maximize their earnings, they often employ larger lot sizes, ranging from hundreds to thousands.

Scalpers: Welcome to the adrenaline-pumping world of scalping! These lightning-fast traders pursue minuscule profits from fleeting market fluctuations. Scaling demands rapid-fire execution, often necessitating smaller lot sizes, typically ranging from a few to dozens.

Value investors: Think of value investors as the sherlocks of the forex market, meticulously searching for undervalued currencies with the potential to surge in value. They tend to favor mid-sized lot sizes, spanning dozens to hundreds, seeking the ideal balance between risk and reward.

Image: www.icmarkets.com

Institutional Traders: The Powerhouse of Forex Trading

Institutional traders are the powerhouses of the foreign exchange market, steering its course through their voluminous trades. Their influence on exchange rates, liquidity, and overall market stability is undeniable. Institutional traders, armed with advanced analytical tools, proprietary trading platforms, and dedicated research teams, possess a prowess that often eclipses their retail counterparts.

The Nuts and Bolts of Institutional Trading Strategies

As previously hinted, institutional traders are no strangers to a plethora of trading strategies, but these three take center stage:

-

Trend following: These traders hitch their wagon to the momentum of ongoing trends, recognizing that the trend often remains their friend. By capitalizing on market direction, they aim to hop aboard gravy trains, not roller coasters.

-

Scalping: Scalpers fancy the thrill of the chase, diving headfirst into short-term market oscillations. Their modus operandi involves executing a multitude of trades within a single trading session, amassing profits from minor price fluctuations.

-

Value investing: Value investors, with an almost psychic ability, seek to identify currencies that the market has unjustly undervalued. Their strategy hinges on the belief that prices eventually gravitate towards intrinsic value, presenting opportune moments to scoop up undervalued assets at bargain-bin prices.

Now, let’s get granular and explore how lot sizes align with different institutional trading strategies:

-

Trend traders: These trend-riding maestros often favor larger lot sizes, typically ranging from hundreds to thousands. By deploying more capital, they can amplify their profits when the trend cooperates.

-

Scalpers: In the scalper’s realm, smaller lot sizes, usually spanning from a few to dozens, are the name of the game. These traders prioritize swift execution and minimizing risk, making smaller lot sizes their weapon of choice.

-

Value investors: Value investors frequently opt for mid-sized lot sizes, balancing risk and reward with finesse. These lot sizes, typically ranging from dozens to hundreds, allow them to capture potential gains without exposing themselves unduly.

A Glimpse into the Strategies of Forex Titans

To shed further light on institutional trading strategies and lot sizes employed by the market’s heavyweights, let’s delve into specific examples:

-

Central banks: These monetary overlords play a pivotal role in managing national economies, intervening in the forex market to influence currency valuations. Their trades can span millions or even billions of dollars, with lot sizes naturally tailored to their mammoth transactions.

-

Hedge funds: These financial powerhouses pool capital from various investors, executing complex trading strategies across diverse asset classes, including forex. Hedge funds often employ multiple lot sizes depending on the strategy, ranging from hundreds to thousands or even more.

-

Investment firms: Encompassing a vast spectrum of firms, from pension funds to insurance companies, investment firms manage substantial portfolios on behalf of their clients. Their forex trades can span a wide range of lot sizes, reflecting the diversity of their investment strategies and risk appetites.

How Many Forex Lots Do Institutional Traders Trade

In Summary

Institutional traders, the Goliaths of the forex market, wield outsized influence on exchange rates and market dynamics. Their trading strategies and lot sizes are intricately connected, each strategy dictating an optimal lot size range. Trend traders favor larger lot sizes to maximize gains from prolonged trends, scalpers opt for smaller lot sizes to minimize risk in lightning-fast trades, and value investors seek a middle ground with mid-sized lot sizes. By understanding these strategies and lot size preferences, we gain a deeper appreciation for the complex tapestry of the forex market and the pivotal role played by institutional traders.