Navigating the Interplay between Global Currencies and Fixed-Income Investments

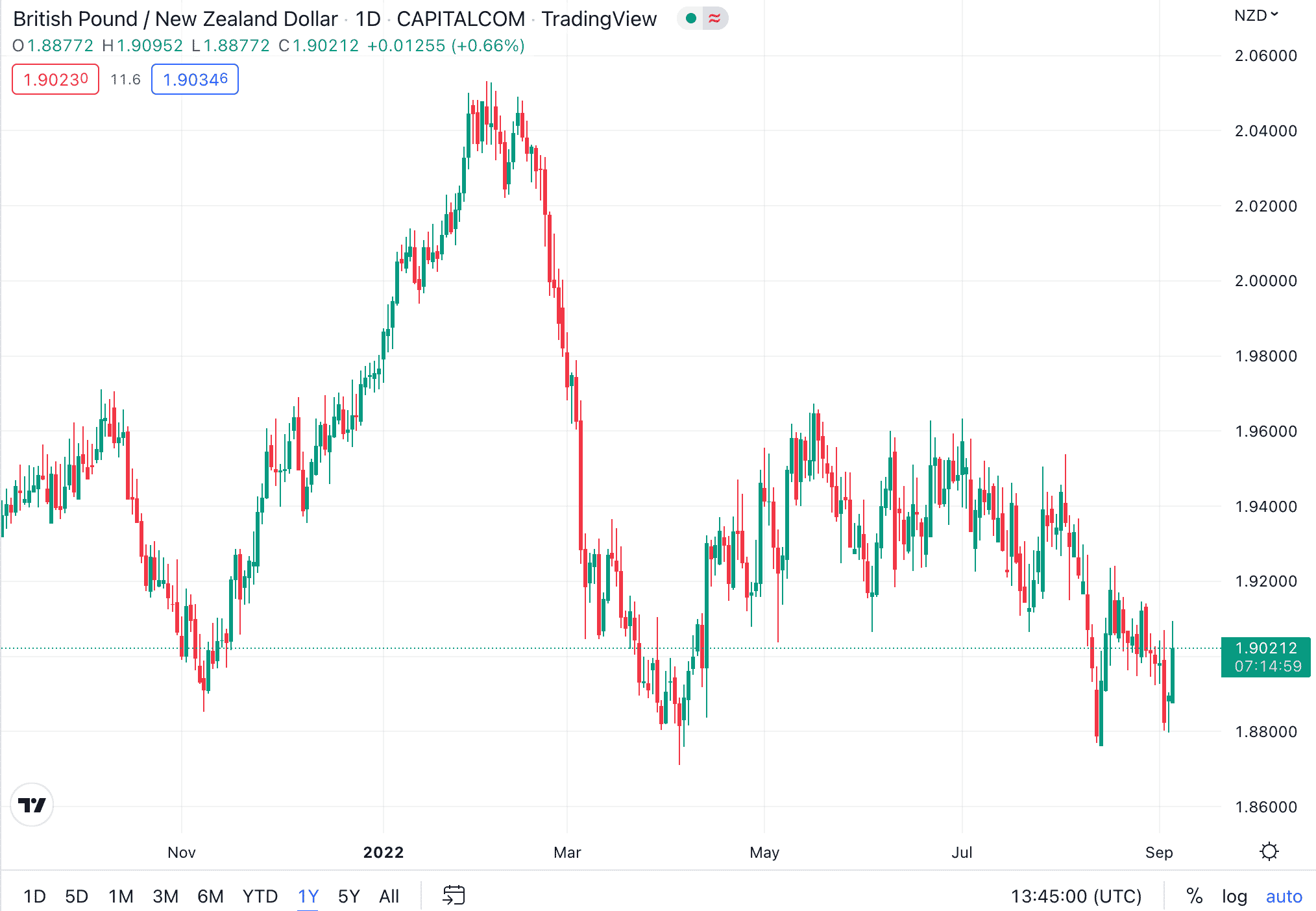

In the ever-evolving realm of finance, long-term bonds have long been regarded as safe havens for investors seeking stability and capital preservation. However, the emergence of volatile forex rates in recent times has cast a shadow of uncertainty over the once-predictable bond market, introducing a new layer of risk for bondholders.

Image: www.business2community.com

Long-term bonds represent a contractual obligation where investors lend money to a government or company for a specified period, typically ranging from 5 to 30 years. In return, bondholders receive regular interest payments known as coupons and the repayment of their principal upon maturity. Historically, these bonds were perceived as low-risk investments, as their value was less susceptible to market fluctuations.

However, the increasingly volatile forex markets have upended this assumption. Fluctuating currency exchange rates impact the value of long-term bonds in a significant way, as they introduce an additional layer of risk that was previously absent. When the domestic currency strengthens against the currency in which the bonds are denominated, the value of the bonds increases for domestic investors. Conversely, when the domestic currency weakens, the value of the bonds decreases.

To illustrate this concept, consider an American investor who purchases Japanese government bonds denominated in Japanese yen (JPY). If the value of the yen falls against the US dollar (USD), the American investor will see the value of their bond investment increase when they convert it back into USD. However, if the value of the yen rises against the USD, the American investor will experience a loss.

This currency risk is particularly pronounced for long-term bonds due to their extended maturities. The longer the bond’s maturity date, the greater the exposure to potential currency fluctuations. As a result, investors in long-term bonds must carefully consider the currency risk associated with their investments and should seek expert advice if necessary.

To mitigate currency risk, investors can consider several strategies, such as diversification across different currencies or hedging their exposure using currency forwards or options. However, these strategies may come with their own costs and complexities, and investors should consult with financial professionals to determine the best approach for their individual circumstances.

Understanding the Impact of Forex Volatility on Bond Yields

The volatility of forex rates also has a direct impact on bond yields, which are the annualized interest rates paid on a bond. When the domestic currency weakens, the central bank may raise interest rates to support the currency. Higher interest rates make the domestic currency more attractive to investors, thereby increasing demand and reducing its volatility. However, higher interest rates also lead to lower bond prices, as investors seek higher-yielding investments.

Conversely, when the domestic currency strengthens, the central bank may lower interest rates to stimulate economic growth. Lower interest rates make the domestic currency less attractive to investors, reducing demand and potentially increasing its volatility. Lower interest rates also lead to higher bond prices, as investors seek safer, long-term investments.

The relationship between forex volatility and bond yields is complex and can vary depending on the economic policies of the central bank and the overall market sentiment. However, investors should be aware of this relationship and consider how forex volatility may impact their bond investments.

Role of Central Banks and Government Policies

Central banks play a pivotal role in managing forex volatility and its impact on long-term bonds. Monetary policies, such as interest rate changes and foreign exchange intervention, can be employed to stabilize currency fluctuations and reduce their impact on bond markets.

For instance, if a currency is experiencing excessive volatility, the central bank may intervene by buying or selling the currency in the foreign exchange market. This intervention can help to stabilize the exchange rate and reduce its impact on bond yields.

Furthermore, governments can implement fiscal policies that support stable economic growth and reduce the likelihood of excessive currency fluctuations. Policies that promote exports, stimulate investment, and reduce inflation can help to strengthen the domestic currency and minimize its volatility.

Image: www.chegg.com

How Long Term Bonds Are Affected By Volatile Forex Rates

Conclusion

The interplay between long-term bonds and volatile forex rates adds a layer of complexity to the investment landscape. Investors must carefully consider currency risk and seek expert advice when necessary to mitigate potential losses. By understanding the impact of forex volatility on bond values and yields, investors can make informed decisions and adjust their strategies accordingly.