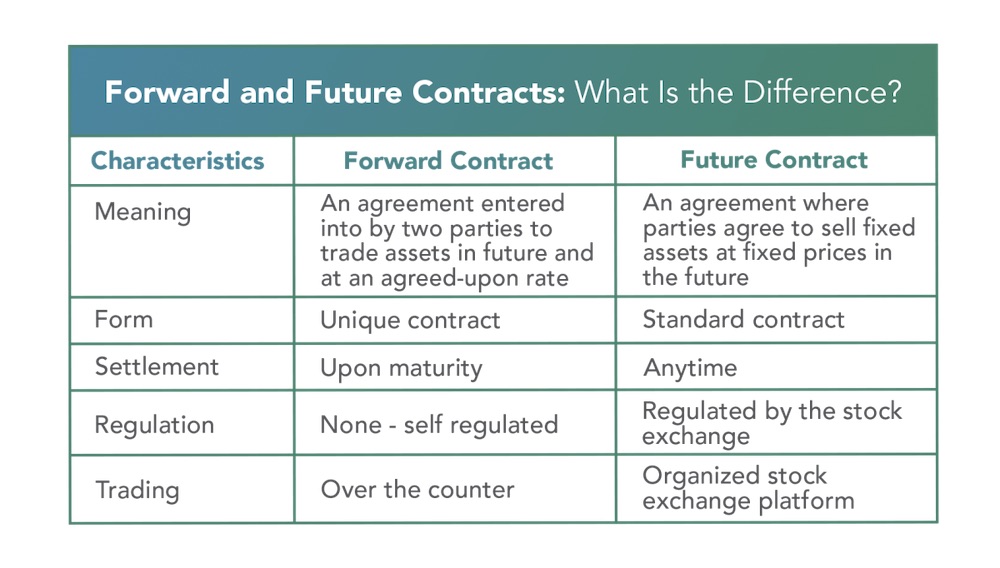

Forward contracts are a financial instrument used in Forex trading to lock in an exchange rate for a transaction that will take place in the future. They are similar to futures contracts, but they are not traded on an exchange.

Instead, forward contracts are agreed upon between two parties, and the terms of the contract are not standardized.

Image: forexezy.com

How Forward Contracts Work

In a forward contract, the buyer and seller agree to exchange a certain amount of currency at a certain exchange rate at a future date. The exchange rate is set when the contract is entered into, and it does not change, regardless of how much the underlying currency’s value fluctuates.

Calculating a Forward Rate

The forward rate is calculated using the spot rate plus or minus a premium or discount. The premium or discount is based on the interest rate differential between the two currencies involved in the contract.

For example, if the spot rate for EUR/USD is 1.1000 and the one-month LIBOR rate for the Euro is 1%, while the one-month LIBOR rate for the US dollar is 0.5%, then the one-month forward rate for EUR/USD would be 1.1036. This is because the Euro is expected to appreciate against the US dollar over the next month, and the forward rate reflects this expectation.

Booking a Forward Contract

When a forward contract is booked, the buyer and seller will exchange a certain amount of currency at the agreed-upon exchange rate. The buyer will receive the foreign currency, and the seller will receive the domestic currency.

Forward contracts are typically used to hedge against currency risk. If a company knows that it will be receiving a certain amount of foreign currency in the future, it can enter into a forward contract to lock in the exchange rate. This will protect the company from the risk of the foreign currency depreciating against the domestic currency.

Image: tigrayjustice.site

Benefits of Using Forward Contracts

There are several benefits to using forward contracts, including:

- Price certainty – Forward contracts allow businesses to lock in a currency rate for a specific date in the future, offering protection against exchange rate fluctuations.

- Risk management – By eliminating the risk of adverse exchange rate fluctuations, businesses can mitigate the impact of currency movements on their profit margins.

- Enhanced financial planning – Forward contracts allow businesses to budget and plan their finances more effectively by forecasting future currency-related cash flows.

Latest Trends and Developments

In recent years, there have been several trends in the forward contract market. One trend is the increasing use of forward contracts by non-financial companies. In the past, forward contracts were primarily used by banks and other financial institutions. However, non-financial companies have begun to recognize the benefits of using forward contracts to manage their currency risk.

Another trend is the development of new forward contract products. In addition to the traditional forward contract, there are now several other types of forward contracts available, such as currency swaps and options on forward contracts.

Tips and Expert Advice

Several tips and expert advice can help you use forward contracts effectively:

- Understand the risks involved- Forward contracts are considered leveraged products and carry the risk of potential losses. It’s crucial to have a thorough grasp of the associated risks before engaging in forward contracts.

- Determine your risk tolerance – Before entering into any forward contracts, determine your risk tolerance level, as this will help you guide your trading decisions and maximize profit while minimizing potential losses.

FAQ

- What is a forward contract?

A forward contract is a financial agreement between two parties to exchange a set amount of currency at a predetermined rate on a specific future date. - What are the benefits of using forward contracts?

Forward contracts offer protection against currency fluctuations, enabling businesses to plan and budget more effectively.

How Forward Contract Booked In Forex Trading

Conclusion

Forward contracts are a valuable tool that can be used to manage currency risk. By understanding how forward contracts work, you can use them to protect yourself from the risk of currency fluctuations.

If you are new to forward contracts, it is important to consult with a financial advisor to learn more about the risks and benefits of using them.