Imagine a colossal orchestra, where each note played by a musician contributes to a harmonious symphony. In the realm of global currencies, the central bank serves as the maestro, skillfully conducting the foreign exchange (forex) market to maintain financial stability and drive economic growth.

Image: socialsci.libretexts.org

Understanding the Forex Market

The forex market is the world’s largest and most liquid financial market, where currencies are exchanged 24 hours a day, five days a week. Its complexity arises from the simultaneous buying and selling of two currencies, such as exchanging euros for US dollars. This exchange rate determines the value of one currency relative to another and significantly impacts international trade, investments, and travel.

Central Banks: The Orchestrators

Central banks play a pivotal role in managing the forex market by implementing various monetary policies and interventions. Their primary objective is to maintain price stability, control inflation, and promote sustainable economic growth within their respective jurisdictions.

Monetary Policy Tools

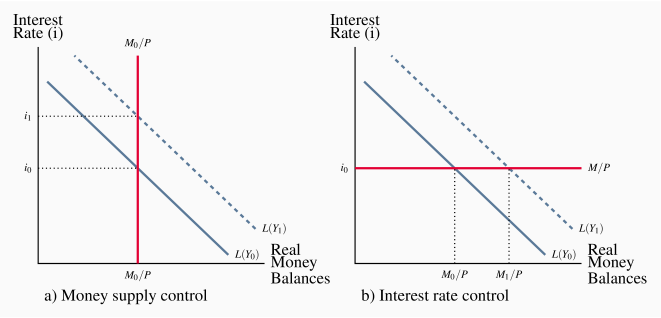

Central banks wield a range of monetary policy tools to influence the forex market:

- Interest Rates: Adjusting interest rates affects the cost of borrowing, which can influence the demand for a currency. Increasing interest rates makes the currency more attractive to investors, strengthening its value.

- Quantitative Easing (QE): Central banks can purchase long-term bonds or other financial assets to increase the supply of money in the economy. This lowers interest rates and devalues the currency.

- Open Market Operations: Buying and selling government bonds in the open market allows central banks to regulate the money supply and influence interest rates.

Image: www.seputarforex.com

Exchange Rate Interventions

In addition to monetary policy, central banks may intervene directly in the forex market to stabilize exchange rates. This is typically done through:

- Foreign Exchange Reserves: Central banks maintain significant reserves of foreign currencies. They can buy or sell these reserves to influence the supply and demand of specific currencies.

- Currency Pegs: Some central banks peg their currency to another currency, such as the US dollar. This involves actively buying or selling their own currency to maintain a fixed exchange rate.

Implications for Market Participants

The actions of central banks in the forex market have far-reaching implications for various market participants:

- Exporters and Importers: Exchange rate fluctuations impact the competitiveness of exports and imports. Central bank interventions can mitigate these effects.

- Investors: Forex rates affect the value of investments denominated in foreign currencies. Central bank policies can influence investor sentiment and risk appetite.

- Multinational Corporations: Exchange rates impact the profitability of multinational corporations with operations in different countries. Central bank interventions can reduce exchange rate volatility.

The Delicate Balance

Central banks’ control over the forex market is a delicate balancing act. While they aim to maintain stability, excessive interventions can distort market signals and undermine the efficient allocation of resources.

How Does Central Bank Control Forex

https://youtube.com/watch?v=k8KPoFVjtmA

Conclusion: The Enduring Symphony

The central bank’s orchestration of the forex market is an ongoing endeavor, shaping the global financial landscape. Through monetary policy tools and exchange rate interventions, central banks strive to harmonize economic growth with price stability. Understanding their role provides invaluable insights into the intricacies of international finance and the interconnected nature of the global economy.