Introduction:

In the dynamic world of forex trading, traders are constantly seeking innovative strategies to maximize their profits and mitigate risks. Among the various technical analysis tools, the Ichimoku Cloud stands out as a comprehensive and adaptable approach. This powerful indicator combines multiple data points to provide traders with a comprehensive view of market trends, support and resistance levels, and potential trading opportunities. If you’re eager to harness the power of the Ichimoku Cloud to elevate your forex trading, this comprehensive guide will equip you with the knowledge and insights you need.

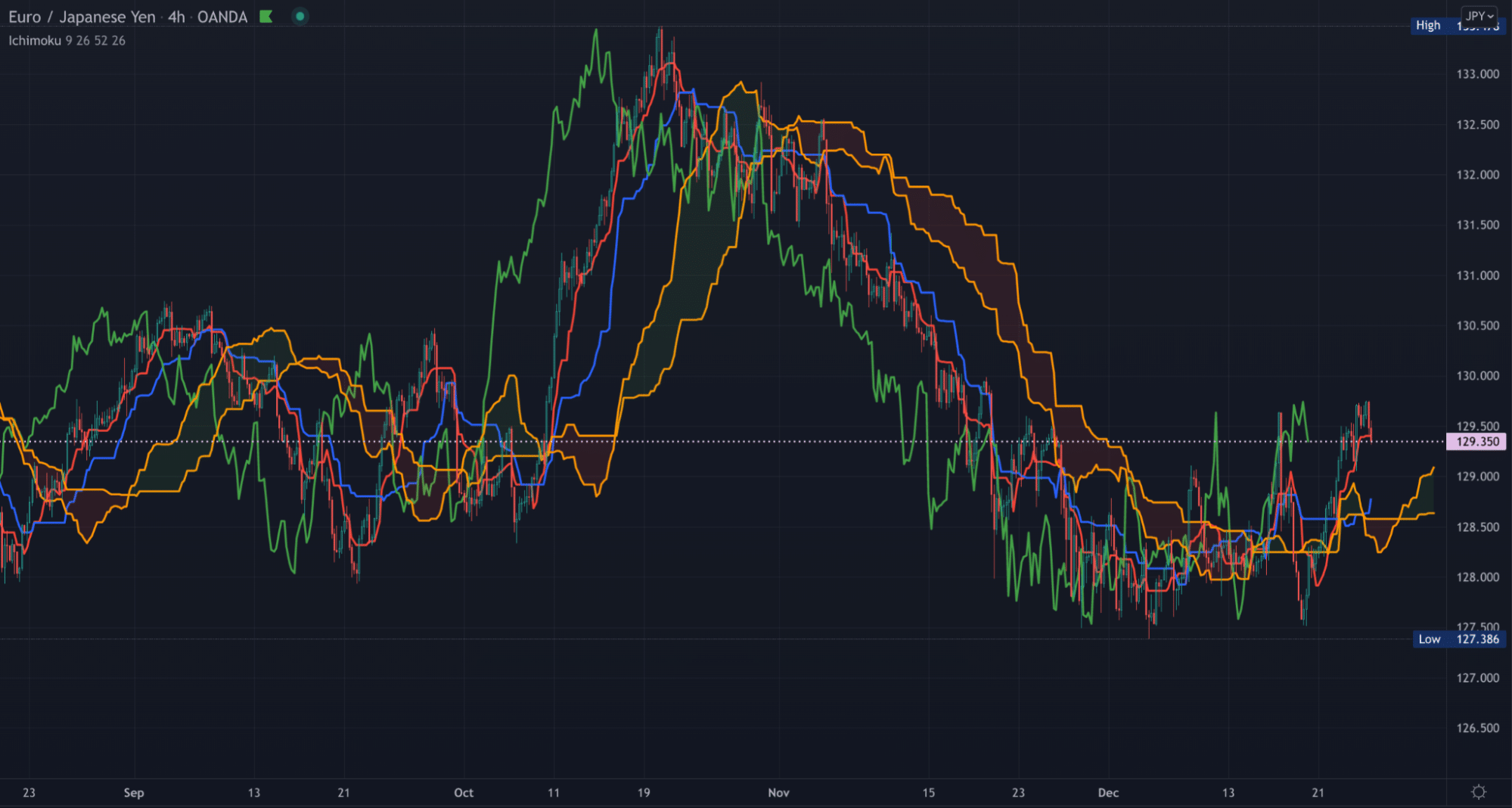

Image: forexrobotnation.com

Delving into the Ichimoku Cloud:

The Ichimoku Cloud, developed by Japanese trader Goichi Hosoda, is a technical indicator that encompasses five lines and a shaded cloud to present a complete picture of the market’s behavior. Each component of the Ichimoku Cloud serves a specific purpose, collectively providing traders with a deep understanding of price action and market momentum.

The Tenkan-sen (Conversion Line) and Kijun-sen (Base Line) form the foundation of the Ichimoku Cloud. The Tenkan-sen represents the average of the highest and lowest prices over the past nine periods, while the Kijun-sen is the average of the highest and lowest prices over the past 26 periods. These lines act as dynamic support and resistance levels, providing traders with potential entry and exit points.

The Senkou Span A and Senkou Span B form the Ichimoku Cloud itself. The Senkou Span A is plotted 26 periods ahead of the current price, while the Senkou Span B is plotted 52 periods ahead. These lines represent future potential support and resistance levels, helping traders identify potential trend reversals.

The Chikou Span, the final component of the Ichimoku Cloud, is a lagging indicator that plots the closing price of the current period 26 periods behind. This line helps traders assess the strength and direction of the current trend, and potential divergences between price and the Chikou Span can indicate potential trading opportunities.

Unveiling the Benefits of the Ichimoku Cloud:

The Ichimoku Cloud offers a multitude of benefits for forex traders, making it a powerful tool for both novice and experienced traders alike.

- Comprehensive market overview: By combining multiple indicators into a single visual representation, the Ichimoku Cloud provides traders with a comprehensive view of the market, allowing them to make informed trading decisions.

- Identification of support and resistance levels: The Tenkan-sen, Kijun-sen, Senkou Span A, and Senkou Span B lines act as dynamic support and resistance levels, enabling traders to identify potential areas of price reversals.

- Trend confirmation: The Ichimoku Cloud helps traders confirm the direction of the prevailing trend, reducing the likelihood of false signals and increasing the probability of successful trades.

- Potential trading opportunities: The Ichimoku Cloud provides traders with potential trading opportunities by highlighting areas of convergence and divergence between price and the indicator’s components.

- Adaptability to different time frames: The Ichimoku Cloud can be applied to various time frames, from short-term scalping to long-term trend trading, making it suitable for traders with diverse trading strategies.

Practical Applications for Profitable Trading:

To harness the power of the Ichimoku Cloud effectively for forex trading, traders must understand how to interpret and apply its signals in real-time market conditions.

- Bullish signals: When the price is above the Ichimoku Cloud, and the Tenkan-sen and Kijun-sen are both rising, it indicates a bullish market sentiment. Traders can consider buying opportunities with a stop-loss order placed below the Kijun-sen.

- Bearish signals: Conversely, when the price is below the Ichimoku Cloud, and the Tenkan-sen and Kijun-sen are falling, it signifies a bearish market trend. Traders may consider short-selling opportunities with a stop-loss order placed above the Kijun-sen.

- Trend continuation signals: If the price is within the Ichimoku Cloud, it suggests a continuation of the prevailing trend. Traders can look for opportunities to ride the trend by placing buy orders above the Senkou Span A and Senkou Span B for an uptrend or sell orders below these levels for a downtrend.

Image: forextraders.guide

How Do I Use Ichimoku Cloud To Trade Forex

Conclusion:

The Ichimoku Cloud is an invaluable tool for forex traders seeking to gain an edge in the dynamic currency markets. By mastering the art of interpreting and applying its signals, traders can improve their risk management, identify potential trading opportunities, and increase their chances of achieving consistent profits. Embrace the power of the Ichimoku Cloud today and unlock a new dimension of trading success in the ever-evolving world of forex.