In the realm of forex trading, demo accounts offer traders a valuable tool for honing their skills and testing strategies without risking actual capital. However, understanding how orders are executed on demo accounts is crucial for leveraging their benefits effectively. This article delves into the intricacies of demo account order execution, examining the key factors that influence this process and providing practical insights to enhance your trading performance.

Image: www.forexfactory.com

The Role of Demo Accounts in Forex Trading

Demo accounts, also known as practice accounts, simulate real-world trading conditions, allowing traders to experience the ebb and flow of currency markets without the financial risks associated with live trading. These accounts are typically funded with virtual money, granting traders the freedom to practice various trading strategies and evaluate their effectiveness before committing real funds.

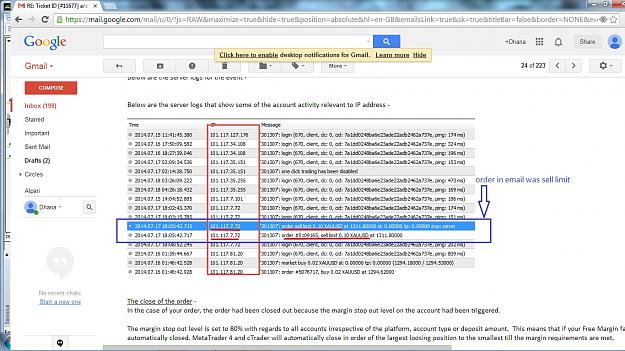

Navigating the Complexities of Demo Account Order Execution

While demo accounts provide a controlled environment for beginners to gain experience, certain nuances differentiate them from live trading platforms. Understanding these distinctions is essential for optimizing your demo trading strategy.

-

Delayed Execution:

In real-time trading, orders are executed instantaneously at the prevailing market price. However, demo accounts often introduce a delay in order execution. This delay helps ensure that traders do not take advantage of real-time market fluctuations by modifying their orders after initiation.

-

Image: forex-technicalanalysistrader.blogspot.comPreset Conditions:

Demo accounts often have predefined parameters that govern order execution, such as maximum trade size and stop-loss levels. These restrictions ensure that demo traders do not engage in excessive risk-taking behaviors that could lead to significant losses in a live trading environment.

-

Market Depth Limitations:

Demo accounts may not provide real-time market depth information, which can influence the execution price of orders. Traders should be aware of this limitation and understand that demo trade executions may not accurately reflect the outcomes of live trading.

Leveraging Demo Account Order Execution to Enhance Your Trading Skills

Despite the nuances associated with demo account order execution, these virtual platforms remain an invaluable resource for traders. By understanding the unique execution characteristics of demo accounts, individuals can maximize their learning experience and prepare themselves for the complexities of live trading:

-

Practice Risk Management:

The absence of financial risks in demo trading provides a safe environment for traders to experiment with different risk management strategies. They can test various stop-loss levels, position sizing techniques, and risk-to-reward ratios without the fear of monetary losses.

-

Master Technical and Fundamental Analysis:

Demo accounts allow traders to execute trades based on technical indicators, chart patterns, and fundamental analysis techniques. By analyzing the outcomes of these trades, individuals can validate their trading strategies and identify potential flaws or areas for improvement.

-

Develop Emotional Discipline:

The pressure and stress associated with live trading can significantly impact decision-making. Demo accounts remove these emotional barriers, enabling traders to practice controlling their emotions and executing trades rationally.

How Demo Account Orders Executed On Forex

Conclusion

Demo accounts in forex trading provide a valuable platform for traders to hone their skills and develop their trading knowledge. Understanding the execution characteristics of demo accounts, including delayed execution, preset conditions, and market depth limitations, is crucial for maximizing their benefits. By leveraging demo trading strategically, traders can enhance their risk management practices, master technical and fundamental analysis techniques, and cultivate emotional discipline, setting themselves up for success in live trading.