Have you ever embarked on an international adventure only to be bewildered by the challenges of currency exchange? As an Indian citizen, understanding the ins and outs of foreign exchange is crucial for a seamless and stress-free journey. In this comprehensive guide, we will delve into the world of Forex cards and provide you with a clear roadmap on how to apply for one as an Indian citizen. Join us as we unlock the secrets to unlocking international financial freedom.

Image: www.mid-day.com

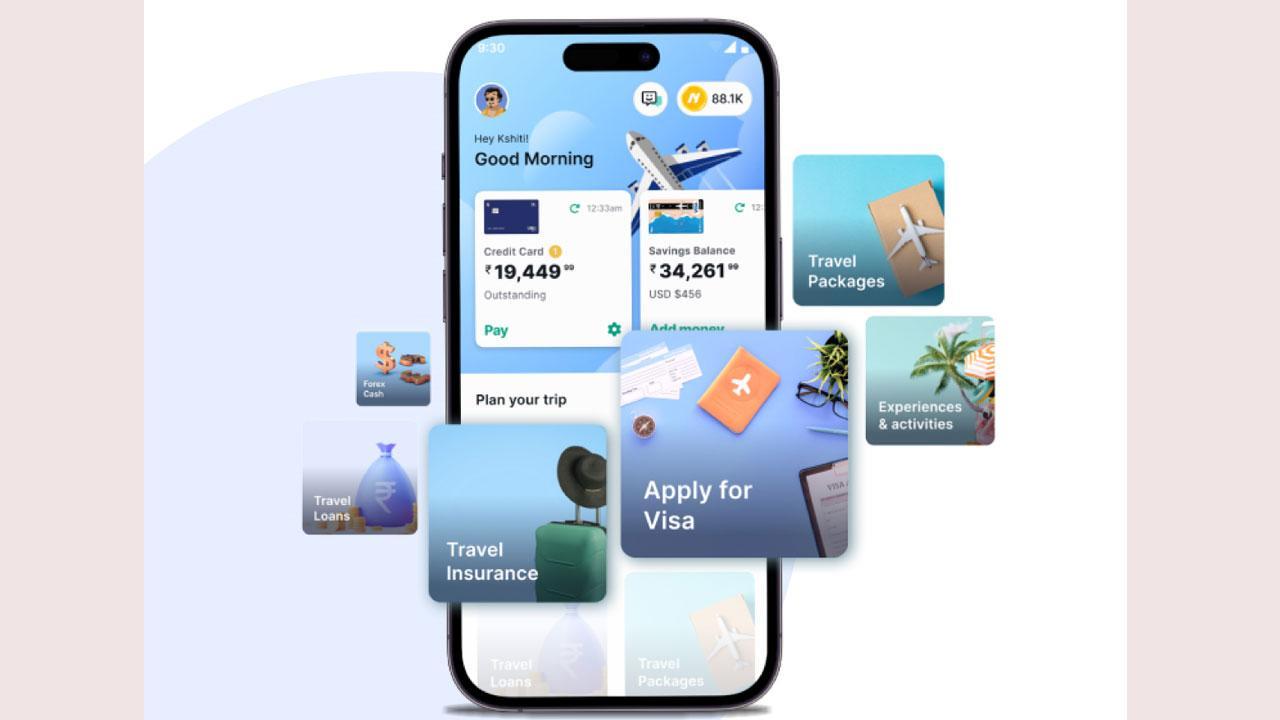

Unveiling the Magic of Forex Cards: A Gateway to Global Transactions

Forex cards, also known as multi-currency cards or travel cards, are indispensable tools for international travelers. These cards allow you to load multiple foreign currencies onto a single card, eliminating the need to carry large amounts of cash and saving you from the often-exorbitant exchange rates offered at exchange bureaus. With a Forex card, you can make purchases, withdraw cash, and enjoy a host of other financial services while abroad, all with the convenience of a single card.

Applying for a Forex Card as an Indian Citizen: A Simplified Guide

Applying for a Forex card as an Indian citizen is a relatively straightforward process. Most major banks and financial institutions in India offer Forex cards, and the requirements vary slightly among them. Typically, you will need to provide the following documents:

- Identity proof (Aadhaar card, PAN card, or passport)

- Address proof (utility bill, rental agreement, or bank statement)

- Income proof (salary slips, income tax returns, or bank statements)

li>Proof of travel (flight tickets or visa)

Once you have gathered the necessary documents, you can visit the website or branch of your preferred bank and fill out an application form. The application process usually takes a few days to complete, and you will be notified once your card is ready for collection. Forex cards usually come with a validity of 3-5 years, and you can reload them as many times as you need during their validity period.

Benefits of Using a Forex Card for Indian Travelers

The benefits of using a Forex card for Indian travelers are numerous. Here are some key advantages:

- Competitive Exchange Rates: Forex cards offer competitive exchange rates compared to exchange bureaus or credit cards, saving you money on every transaction.

- Convenience: Forex cards allow you to carry multiple currencies on a single card, eliminating the need to carry large amounts of cash or exchange currencies multiple times.

- Security: Forex cards are chip-enabled and PIN-protected, ensuring the highest level of security for your transactions.

- Emergency Assistance: Many Forex cards offer emergency assistance services, such as card replacement or cash advances, providing peace of mind during your travels.

- Worldwide Acceptance: Forex cards are accepted at millions of merchants and ATMs worldwide, giving you the flexibility to spend and withdraw money wherever you go.

Image: www.extravelmoney.com

Tips for Choosing the Right Forex Card

When choosing a Forex card, it is important to consider the following factors:

- Currency Options: Ensure that the Forex card supports the currencies you will be using during your travels.

- Exchange Rates: Compare the exchange rates offered by different Forex card providers to get the best deal.

- Fees: Be aware of any fees associated with the Forex card, such as transaction fees, loading fees, and withdrawal fees.

- Customer Service: Choose a Forex card provider that offers reliable and responsive customer service in case you need assistance while abroad.

- Expiration Date: Pay attention to the expiration date of the Forex card and make sure it covers the duration of your travels.

FAQs on Forex Cards for Indian Citizens

Q: Is it mandatory to have a Forex card for international travel?

A: No, it is not mandatory to have a Forex card for international travel. However, it is highly recommended as it offers a convenient and cost-effective way to manage your finances while abroad.

Q: What is the maximum amount of money that I can load onto my Forex card?

A: The maximum amount of money that you can load onto your Forex card depends on the provider and the card you choose. However, it is generally limited to the equivalent of USD 250,000 per financial year.

Q: Can I use my Forex card for online transactions?

A: Yes, most Forex cards can be used for online transactions as long as they are accepted by the merchant.

How Can An Indian Citizen Apply For A Forex Card

Conclusion: Unlock the World with the Power of a Forex Card

Applying for a Forex card as an Indian citizen is a simple and straightforward process. With its numerous benefits and conveniences, a Forex card is an indispensable tool for international travelers. Whether you are an experienced globetrotter or embarking on your first international adventure, a Forex card will empower you with financial freedom and peace of mind during your travels. Embrace the world of foreign exchange and unlock a new level of convenience and savings with your Indian citizen Forex card.

Are you ready to enhance your travel experience with a Forex card? Ask your bank today and embark on a seamless and stress-free journey around the world!