Delve into the Dynamics of Pip Values

In the vast and intricate realm of foreign exchange (forex), precision reigns supreme. As traders navigate the currency markets, they encounter a fundamental unit of measurement known as the pip (point in percentage). Understanding the intricacies of pip values is paramount to maximizing gains and minimizing losses in this dynamic financial arena.

Image: monstersoundpro.com

What Defines a Pip?

At its core, a pip represents the smallest price increment for a given currency pair. In most major currency pairs, a pip is equivalent to 0.0001, or 1/100th of a percentage point. For instance, if the EUR/USD exchange rate changes from 1.1234 to 1.1235, a single pip has been gained or lost. However, certain pairs, such as the Japanese yen (JPY) pairs, have a smaller pip value, typically set at 0.01, representing 1/100th of a percentage point.

The Significance of Pips

Pips serve as the cornerstone of forex trading. They enable traders to quantify profits and losses, set stop-loss and take-profit orders, and assess risk-reward ratios. In a highly liquid market, even small pip movements can translate into significant gains over time. For traders utilizing high leverage, even marginal pip fluctuations can have a substantial impact on their account balance.

Factors Influencing Pip Values

The pip value for a currency pair is determined by a confluence of factors, including:

- Currency Pair Volatility: The more volatile a currency pair, the greater the potential pip range, leading to larger potential gains and losses.

- Market Conditions: During periods of high market volatility, such as economic data releases or geopolitical events, pip values tend to increase as market participants seek to execute trades rapidly.

- Trading Platform: Different forex trading platforms may offer varying pip values for the same currency pairs, influenced by factors such as liquidity and spreads.

Image: www.youtube.com

Maximizing Pip Value in Forex Trading

To optimize pip value in forex trading, traders can employ several strategies:

- Selecting Volatile Currency Pairs: Choosing pairs with inherent volatility increases the potential for larger pip movements, allowing traders to capitalize on market fluctuations.

- Trading During High-Volume Periods: Participating in the market during peak trading hours, such as the London or New York sessions, enhances liquidity and reduces spreads, providing better opportunities for favorable pip values.

- Utilizing Stop-Loss Orders: Placing stop-loss orders at strategic pip values enables traders to mitigate losses by automatically exiting trades when predetermined pip levels are breached.

- Understanding Correlation Patterns: Recognizing the correlation between currency pairs can help traders identify potential pip value opportunities by exploiting price movements in connected assets.

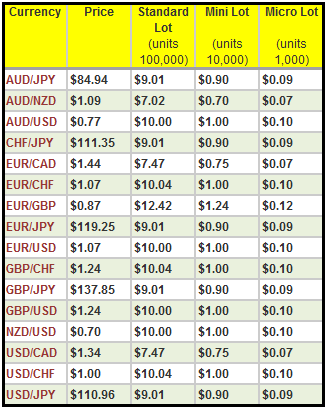

Highest Pip Value In Forex Market

Conclusion

Unraveling the intricacies of pip values equips forex traders with a potent tool to navigate the currency markets effectively. By comprehending the factors that influence pip values, employing strategic trading techniques, and adapting to market conditions, traders can optimize their profit potential and elevate their forex trading performance to new heights. As the adage goes, “In forex, it’s all about the pips.”