Introduction

In today’s globalized world, convenient and secure access to funds while traveling abroad has become indispensable. Two popular options that cater to this need are HDFC Regalia Credit Cards and Forex Cards. While both offer distinct advantages, understanding their differences is crucial for making an informed choice that aligns with your travel requirements.

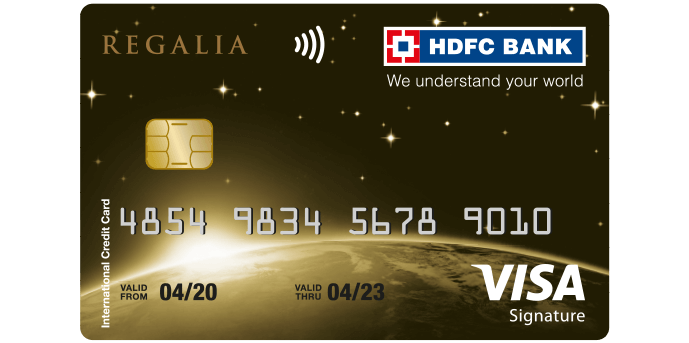

Image: v.hdfcbank.com

HDFC Regalia Credit Card: A Versatile Companion

HDFC Regalia Credit Cards are globally recognized and offer a wide range of benefits, including:

- Reward Points: Earn reward points on every transaction, which can be redeemed for flights, hotel stays, and other exclusive experiences.

- Lounge Access: Enjoy complimentary access to airport lounges around the world, providing a sanctuary for relaxation and comfort during layovers.

- Travel Insurance: Comprehensive travel insurance coverage protects you and your loved ones against unexpected events such as medical emergencies or baggage loss.

- Contactless Payments: Tap-and-pay with ease using contactless technology, enhancing convenience and security.

Forex Card: Designed Specifically for Overseas Expenses

Forex Cards are prepaid cards that allow you to store foreign currency before your trip. They offer the following advantages:

- Locked-in Exchange Rates: Purchase foreign currency at a fixed exchange rate before you travel, eliminating fluctuations that can erode your budget.

- No Transaction Fees: Avoid hefty foreign exchange fees and enjoy competitive exchange rates.

- Security: Forex Cards are more secure than carrying cash, reducing the risk of theft or loss.

Key Differences: Choosing the Right Card for You

To determine the best fit for your travel needs, consider the following key differences between HDFC Regalia Credit Cards and Forex Cards:

- Purpose: HDFC Regalia Credit Cards serve as comprehensive travel companions with a range of benefits, while Forex Cards are specifically designed for managing overseas expenses.

- Spending Flexibility: Credit cards offer greater flexibility by allowing you to make purchases based on your available credit limit. Forex Cards, on the other hand, have a fixed amount of funds available.

- Reward Points: Credit cards earn reward points that enhance the value of your purchases, while Forex Cards do not accumulate rewards.

- Benefits and Insurance: Credit cards typically provide a wider range of travel-related benefits and insurance coverage, such as lounge access and travel insurance. Forex Cards generally offer limited benefits.

- Suitability: HDFC Regalia Credit Cards are ideal for frequent travelers who appreciate versatility and rewards, while Forex Cards are better suited for those looking for a secure and cost-effective way to manage overseas expenses.

Image: cardinfo.in

Expert Insights and Actionable Tips

Financial expert, Ms. Aarti Sharma, advises, “When choosing between an HDFC Regalia Credit Card and a Forex Card, carefully consider your travel patterns and spending habits. Credit cards offer greater flexibility and rewards, but Forex Cards provide locked-in exchange rates and reduced transaction fees.”

To maximize the benefits of your choice, follow these actionable tips:

- Plan Ahead: Determine your estimated overseas expenses and load sufficient funds onto your Forex Card or consider the appropriate credit limit for your credit card.

- Compare Exchange Rates: Research exchange rates and consider acquiring currency at the most favorable rates.

- Notify the Card Issuer: Inform the card issuer about your travel dates to avoid card blocking due to unusual overseas transactions.

- Use the Right Card: Choose the card that best aligns with your travel needs, whether it’s an HDFC Regalia Credit Card for versatility and rewards or a Forex Card for cost-effectiveness and security.

Hdfc Regalia Credit Card And Forex Card Are Different

Conclusion

Choosing between HDFC Regalia Credit Cards and Forex Cards depends on your individual travel requirements. Credit cards offer a comprehensive travel experience with rewards and benefits, while Forex Cards provide a secure and cost-effective way to manage overseas expenses. By understanding their key differences, you can make an informed decision that empowers your travels and enhances your financial well-being.