The foreign exchange market is a vast and complex one, with a number of factors influencing currency rates. One of the most important factors to watch is the interest rates set by central banks. Interest rates affect the cost of borrowing and lending money, which can have a significant impact on the value of a currency.

Image: pdfprof.com

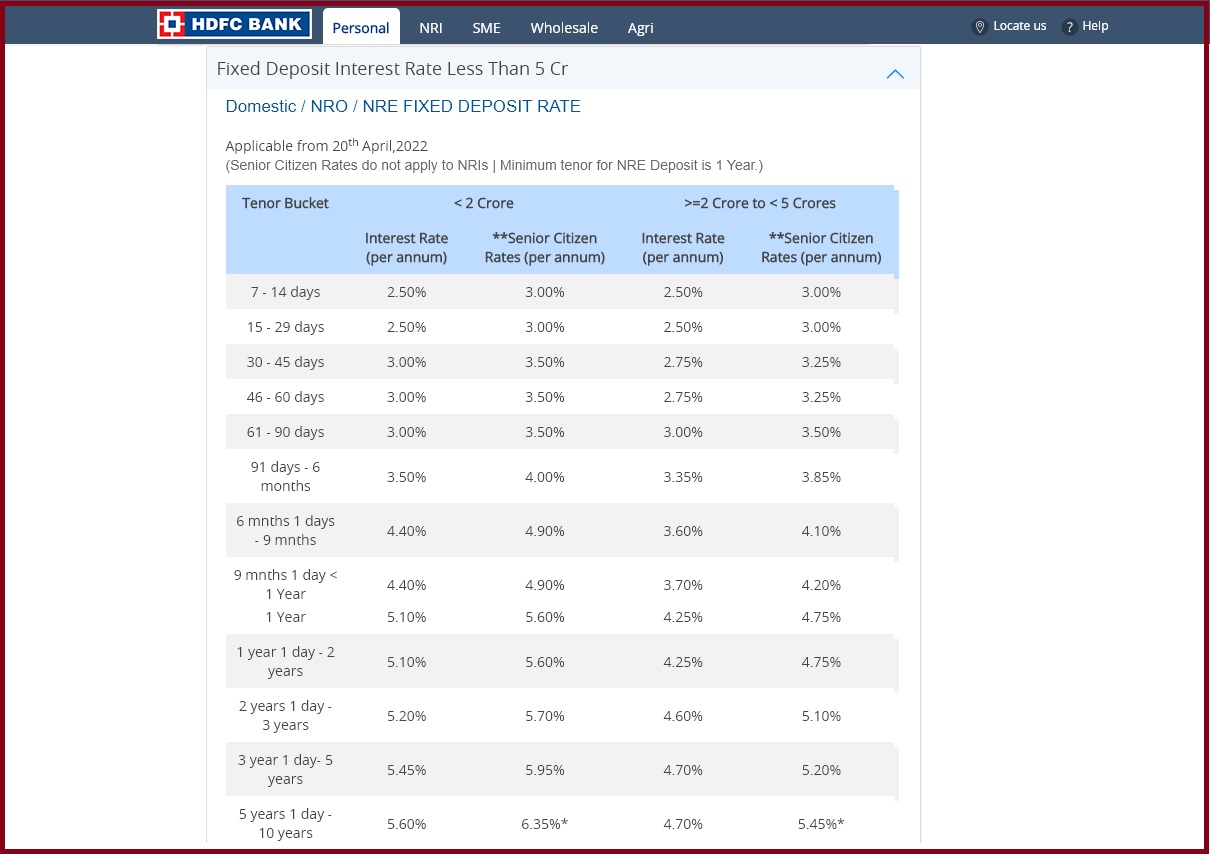

HDFC Rates Forex

HDFC Bank is one of the largest banks in India, and its foreign exchange rates are closely watched by businesses and individuals alike. The bank’s rates are typically competitive, and it offers a variety of services to make it easy to exchange currency.

HDFC Bank’s foreign exchange rates are updated daily, and they are available on the bank’s website. You can also use the bank’s mobile app to check rates and exchange currency.

Factors Affecting Forex Rates

A number of factors can affect foreign exchange rates, including:

- Interest rates: As mentioned above, interest rates can have a significant impact on currency rates. If a country’s interest rates are higher than those of another country, it can make its currency more attractive to investors, which can lead to a rise in its value.

- Economic growth: A country with a strong economy is more likely to have a strong currency. This is because investors are more likely to invest in countries with growing economies, which can lead to a rise in the demand for the country’s currency.

- Political stability: Political stability is another factor that can affect currency rates. If a country is politically unstable, it can make investors less likely to invest in the country, which can lead to a fall in the value of its currency.

- Supply and demand: The supply and demand for a currency can also affect its rate. If there is more demand for a currency than there is supply, its value will rise. Conversely, if there is more supply of a currency than there is demand, its value will fall.

Tips for Getting the Best Forex Rates

If you’re planning to exchange currency, there are a few things you can do to get the best rates:

- Shop around: Compare rates from different banks and currency exchanges before you make a decision. There are a number of online tools that allow you to do this easily.

- Exchange large amounts of currency at once: Banks and currency exchanges typically offer better rates for larger amounts of currency.

- Avoid exchanging currency at airports: Airports are known for having some of the worst foreign exchange rates. If you need to exchange currency at an airport, be sure to compare rates from different providers before you make a decision.

- Use a credit card or debit card: If you’re traveling abroad, you can use a credit card or debit card to make purchases and withdraw cash. This can be a more convenient and cost-effective way to get foreign currency than exchanging cash.

Image: ecpulse.com

FAQs About HDFC Rates Forex

Q: What is the best way to get the best HDFC rates forex?

A: The best way to get the best HDFC rates forex is to shop around and compare rates from different banks and currency exchanges. You can also use a credit card or debit card to make purchases and withdraw cash abroad.

Q: What are the factors that affect forex rates?

A: The factors that affect forex rates include interest rates, economic growth, political stability, and supply and demand.

Hdfc Rates Forex 29.08.2019

https://youtube.com/watch?v=nC1NZtzL4bo

Conclusion

HDFC Bank offers competitive foreign exchange rates and a variety of services to make it easy to exchange currency. By following the tips above, you can get the best rates on your foreign exchange transactions.

Are you interested in learning more about foreign exchange rates? If so, please leave a comment below and I’ll be happy to answer your questions.