As an NRI (Non-Resident Indian), managing your finances effectively is crucial for ensuring a fulfilling life abroad. HDFC Bank, a leading financial institution in India, offers NRI account holders the convenience of exchanging foreign currency at competitive rates. This comprehensive guide will shed light on HDFC NRI forex conversion rates, empowering you to make informed financial decisions and optimize your money transfers.

Image: www.sgdtoinr.com

Unveiling HDFC NRI Forex Conversion Rates

HDFC NRI forex conversion rates play a vital role in ensuring you receive the best value for your money when converting foreign currency. These rates are influenced by market fluctuations, such as supply and demand, economic conditions, and central bank policies. By staying informed about HDFC NRI forex conversion rates, you can plan your currency exchanges strategically, maximizing your savings and minimizing potential losses.

Exploring HDFC NRI Forex Conversion Services

HDFC Bank offers a range of forex conversion services tailored to the specific needs of NRI customers. These services include:

-

Online Forex Trading: NRI account holders can access HDFC Bank’s user-friendly online platform to execute forex transactions conveniently and securely from anywhere in the world. This platform enables you to compare rates, place orders, and track your transactions in real-time.

-

Mobile Banking: HDFC Bank’s mobile banking app provides the convenience of converting currency at your fingertips. With just a few taps, you can view live rates, initiate transfers, and receive instant confirmations.

-

Branch Network: HDFC maintains an extensive network of branches across India and globally. NRI customers can visit these branches to exchange currency in person and seek expert advice from dedicated forex specialists.

Factors Influencing HDFC NRI Forex Conversion Rates

Understanding the factors that influence HDFC NRI forex conversion rates is essential for making prudent decisions. Key factors include:

-

Global Economic Conditions: Economic events, such as recessions or boom periods, can impact forex conversion rates.

-

Interest Rate Differentials: Differences in interest rates between India and other countries can affect the value of currencies.

-

Political Stability: Political events, such as elections or geopolitical crises, can create market uncertainty and lead to fluctuations in forex rates.

Image: www.financialexpress.com

Tips for Maximizing Your Forex Returns

- Keep an eye on market trends and fluctuations to identify the most opportune times for currency exchange.

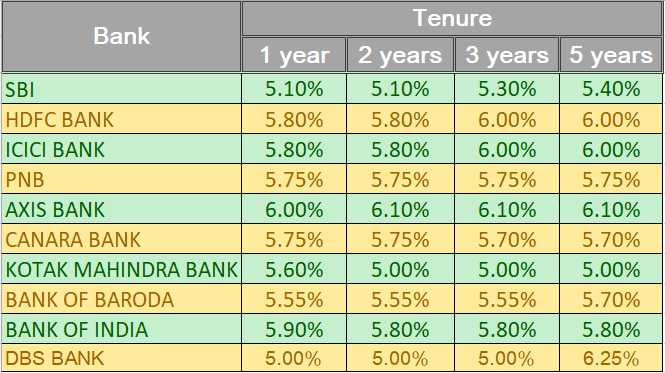

- Compare conversion rates from different banks and financial institutions to secure the most competitive rates.

- Consider using online forex trading platforms for live rate monitoring and execution.

- Consult with financial advisors or experts for personalized guidance and insights.

- Take advantage of special offers or promotions from HDFC Bank for more favorable forex rates.

Hdfc Nri Forex Conversion Rate

Enjoy Exceptional Forex Conversion Rates with HDFC

Trust HDFC NRI forex conversion rates for reliable, transparent, and competitive exchange rates. With a seamless and customer-centric approach, HDFC Bank empowers NRI customers to unlock exceptional value for their money. Whether you’re planning a major investment, purchasing property, or simply transferring funds, HDFC offers a comprehensive suite of services to meet your financial needs. Stay informed about HDFC NRI forex conversion rates, embrace strategic financial planning, and experience the difference.

Disclaimer: HDFC NRI forex conversion rates are subject to change without prior notice. Please refer to HDFC Bank’s official website or contact your nearest branch for the most up-to-date information