Introduction

Navigating the world of currency exchange can be a perplexing maze, particularly when dealing with large financial institutions like HDFC. Understanding the intricacies of exchange rates is crucial for anyone venturing into international transactions, be it for business, travel, or personal reasons. In this extensive guide, we delve into the HDFC forex rates prevailing on 5th November 2019, providing valuable insights and actionable tips to empower you with informed decision-making.

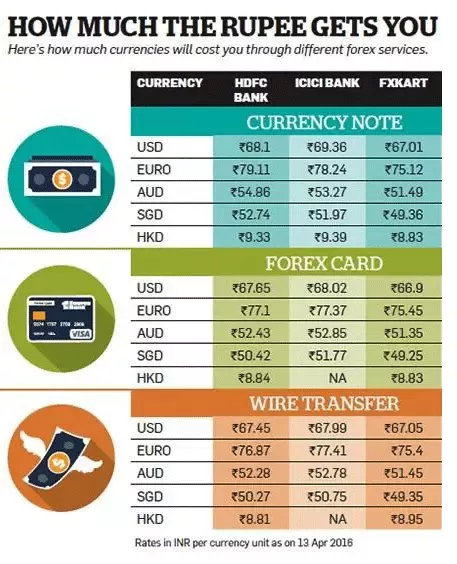

Image: forextipscom.blogspot.com

Understanding Forex Rates: A Foundation

Foreign exchange (forex) rates represent the value of one currency in relation to another. They fluctuate constantly due to a myriad of factors, including economic policies, political stability, and global market sentiments. HDFC, being a leading financial institution in India, plays a significant role in determining forex rates within the country.

HDFC Forex Rates on 5th November 2019: A Market Snapshot

On 5th November 2019, HDFC offered the following forex rates:

| Currency | Buy (INR) | Sell (INR) |

|---|---|---|

| US Dollar (USD) | 71.24 | 71.59 |

| Euro (EUR) | 79.09 | 79.55 |

| British Pound (GBP) | 89.20 | 89.78 |

| Canadian Dollar (CAD) | 54.81 | 55.14 |

| Australian Dollar (AUD) | 48.95 | 49.30 |

Note: These rates are indicative and subject to change based on market conditions.

Factors Influencing HDFC Forex Rates

HDFC forex rates are primarily influenced by the following factors:

- Global Economic Conditions: Economic growth, inflation, and interest rates in India and other countries impact forex rates.

- Political Stability: Political events and changes in government policies can affect currency values.

- Supply and Demand: Forex rates fluctuate based on supply and demand for specific currencies in the market.

- Speculation: Speculators can influence forex rates by buying or selling currencies in anticipation of future price movements.

Image: www.cardexpert.in

How to Use HDFC Forex Rates to Your Advantage

Whether you’re planning a trip abroad or managing international payments, understanding HDFC forex rates can help you maximize your money’s worth:

- Timing Your Transactions: Monitor HDFC forex rates over time to identify the most favorable rates for your desired currency.

- Comparing with Other Providers: Compare HDFC forex rates with those offered by other banks and currency exchange agencies to secure the best deal.

- Negotiating: For large transactions, consider negotiating with HDFC to obtain a better exchange rate.

- Using Forward Contracts: If you anticipate future currency fluctuations, consider using forward contracts to lock in a specific exchange rate today.

Expert Insights: Currency Exchange Best Practices

Renowned financial experts advocate for the following best practices when dealing with currency exchange:

- Stay Informed: Keep up-to-date with economic news and market trends that can impact forex rates.

- Be Patient: Currency exchange rates fluctuate frequently. Don’t rush into transactions; instead, wait for the right timing.

- Minimize Fees: Avoid banks and currency exchange services with high fees. Small margins can make a significant difference in large transactions.

- Consider Using Online Platforms: Online currency exchange platforms often offer competitive rates and convenient services.

Hdfc Forex Rates On 5 Nov 2019

Conclusion

HDFC forex rates on 5th November 2019 provide a glimpse into the dynamic world of currency exchange. Understanding the factors that influence these rates and employing the strategies outlined in this guide will empower you to make informed decisions and navigate international transactions with greater confidence. Remember, currency exchange is a complex field, and seeking professional advice from your bank or a financial advisor is always recommended for significant financial transactions. By staying informed and staying vigilant, you can maximize your money’s value and minimize the risks associated with currency fluctuations.