Introduction:

Image: ymevirumo.web.fc2.com

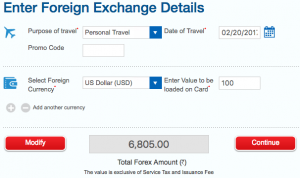

Navigating the world of international finance can be a daunting task, especially when it comes to understanding foreign exchange rates. If you’re planning an overseas adventure or managing global transactions, you’ve likely encountered the term “forex rates.” In this comprehensive guide, we’ll shed light on HDFC forex rates as of 17.09.19, empowering you to make informed financial decisions.

HDFC (Housing Development Finance Corporation) is India’s leading housing finance company and a prominent player in the country’s forex market. Its competitive exchange rates and extensive branch network make it a popular choice among individuals and businesses alike.

HDFC Forex Rates: A Snapshot

As of 17.09.19, HDFC’s forex rates are as follows:

- USD/INR: 71.75 – 71.78

- GBP/INR: 95.09 – 95.17

- EUR/INR: 79.36 – 79.44

These rates fluctuate constantly due to various factors such as global economic conditions, political events, and supply and demand.

Unveiling the Dynamics of Forex Rates

Forex rates are determined by a complex interplay of factors that influence the value of one currency relative to another. Here are some key drivers:

- Inflation: When inflation is high in a particular country, it reduces the purchasing power of its currency, making it less valuable compared to others.

- Interest Rates: Higher interest rates generally strengthen a currency by making it more attractive for investors seeking higher returns.

- Economic Growth: A strong economy tends to attract foreign investment, increasing demand for its currency and thus appreciating its value.

- Political Stability: Political uncertainty or economic crisis can weaken a currency as investors seek safer havens.

- Supply and Demand: The simple rule of supply and demand applies to forex markets as well, with changes in currency availability affecting rates.

Tips for Making Informed Decisions

Understanding the dynamics of forex rates is crucial for making informed financial decisions. Consider these tips:

- Monitor Market Trends: Keep abreast of global economic news and developments that could impact currency values.

- Compare Rates: Don’t rely solely on HDFC’s rates; compare them with other banks and exchange bureaus to get the best deal.

- Consider Transaction Fees: Hidden fees can add up, so inquire about any additional charges associated with forex transactions.

- Plan Ahead: If you’re making a large purchase or transferring funds overseas, planning ahead and locking in a favorable rate can save you money.

- Seek Expert Advice: If you’re unsure about complex forex transactions, consider consulting a financial advisor for guidance.

Conclusion:

Understanding HDFC forex rates is essential for navigating the complexities of international finance. By monitoring market trends, comparing rates, considering fees, and planning ahead, you can make informed decisions that maximize the value of your hard-earned money.

Remember, forex rates are dynamic, so staying updated with the latest information is crucial. Evolving with market conditions and embracing the opportunities they present will empower you to make wise financial choices.

Image: www.cardexpert.in

Hdfc Forex Rates 17.09.19