Introduction

Navigating the intricacies of foreign exchange can be daunting, especially when dealing with currencies like the US Dollar (USD) and Indian Rupee (INR). Enter HDFC Bank, a leading financial institution offering seamless forex services. This article will delve into the world of HDFC forex rates, demystifying the conversion process from USD to INR and empowering you with valuable insights.

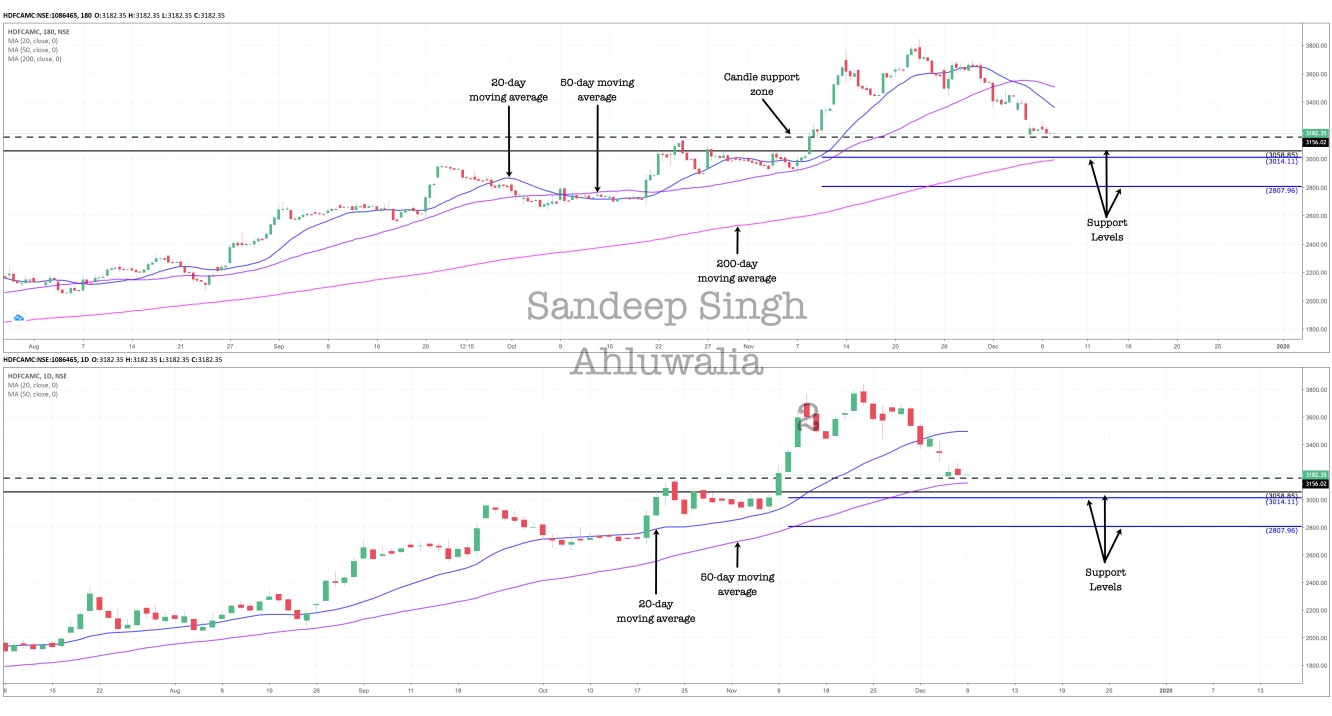

Image: www.themeetinghouse.net

Understanding Forex Rates

Foreign exchange rates are the prices at which one currency can be exchanged for another. These rates fluctuate constantly due to various factors, including economic conditions, political events, and global supply and demand. When exchanging USD for INR, it’s crucial to understand the prevailing rate offered by HDFC Bank.

HDFC Forex Rates: Your Guide to Conversion

HDFC Bank provides competitive forex rates for both individuals and businesses. Their website and mobile banking platform offer live rates, allowing you to monitor fluctuations in real-time. To get the best exchange rate, consider checking these platforms throughout the day, as rates tend to vary based on the time of day and economic events.

Factors Influencing HDFC Forex Rates

HDFC forex rates are primarily driven by market forces. Factors such as interest rate differentials, inflation rates, and political stability in both the US and India play a significant role. Additionally, global economic events and demand for both currencies influence their respective values.

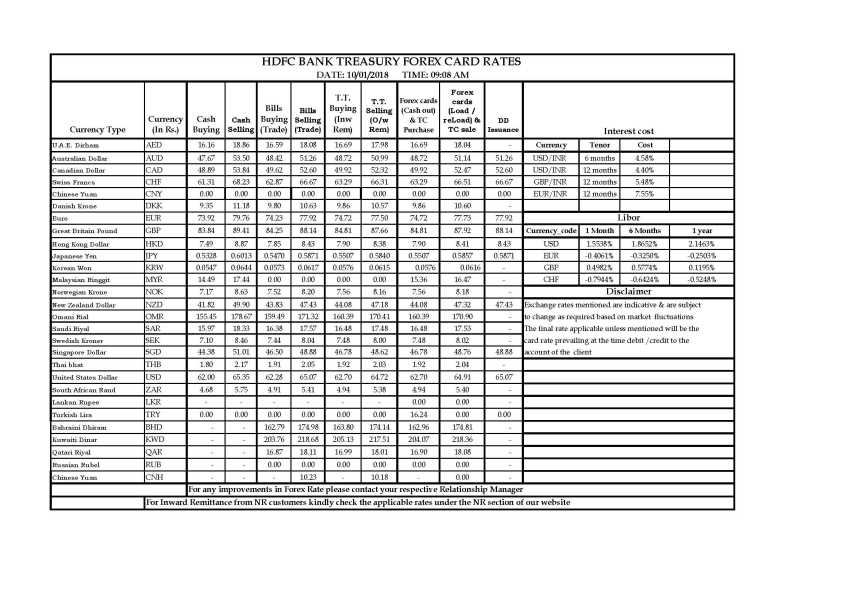

Image: www.pdfprof.com

Steps for Converting USD to INR with HDFC Bank

Convert USD to INR with ease by following these simple steps:

-

Visit the HDFC Bank website or use their mobile banking app.

-

Select the “Forex” option and choose “Buy Currency.”

-

Enter the amount of USD you wish to exchange.

-

Check the prevailing HDFC forex rate for USD to INR.

-

Confirm the transaction and make the payment.

-

Receive your INR funds into your HDFC Bank account.

Benefits of HDFC Forex Services

HDFC Bank’s forex services offer numerous advantages:

-

Competitive exchange rates: Maximize your funds by securing the best rates available.

-

Transparency: Real-time rates and clear fee structures ensure a transparent conversion process.

-

Convenience: Convert currencies online or through the mobile banking app, saving time and effort.

-

Wide network: With branches across India, HDFC Bank provides accessible forex services wherever you need them.

Hdfc Forex Rate Usd To Inr

Conclusion

Understanding HDFC forex rates and leveraging their services empowers you to make informed decisions when exchanging currencies. By monitoring rates, considering market factors, and utilizing HDFC Bank’s competitive platform, you can navigate foreign exchange transactions with confidence. Whether you’re planning an international trip, investing in global markets, or managing your business’s finances, HDFC Bank provides a trusted and efficient solution for all your USD to INR conversion needs.