Foreign Exchange Rates: A Quick Overview

Foreign exchange (forex) rates are the rates at which different currencies can be exchanged for each other. They are determined by the supply and demand for these currencies, as well as by economic factors such as interest rates, inflation, and political stability. Forex rates are constantly fluctuating, which can make it difficult to predict how much a currency will be worth at any given time.

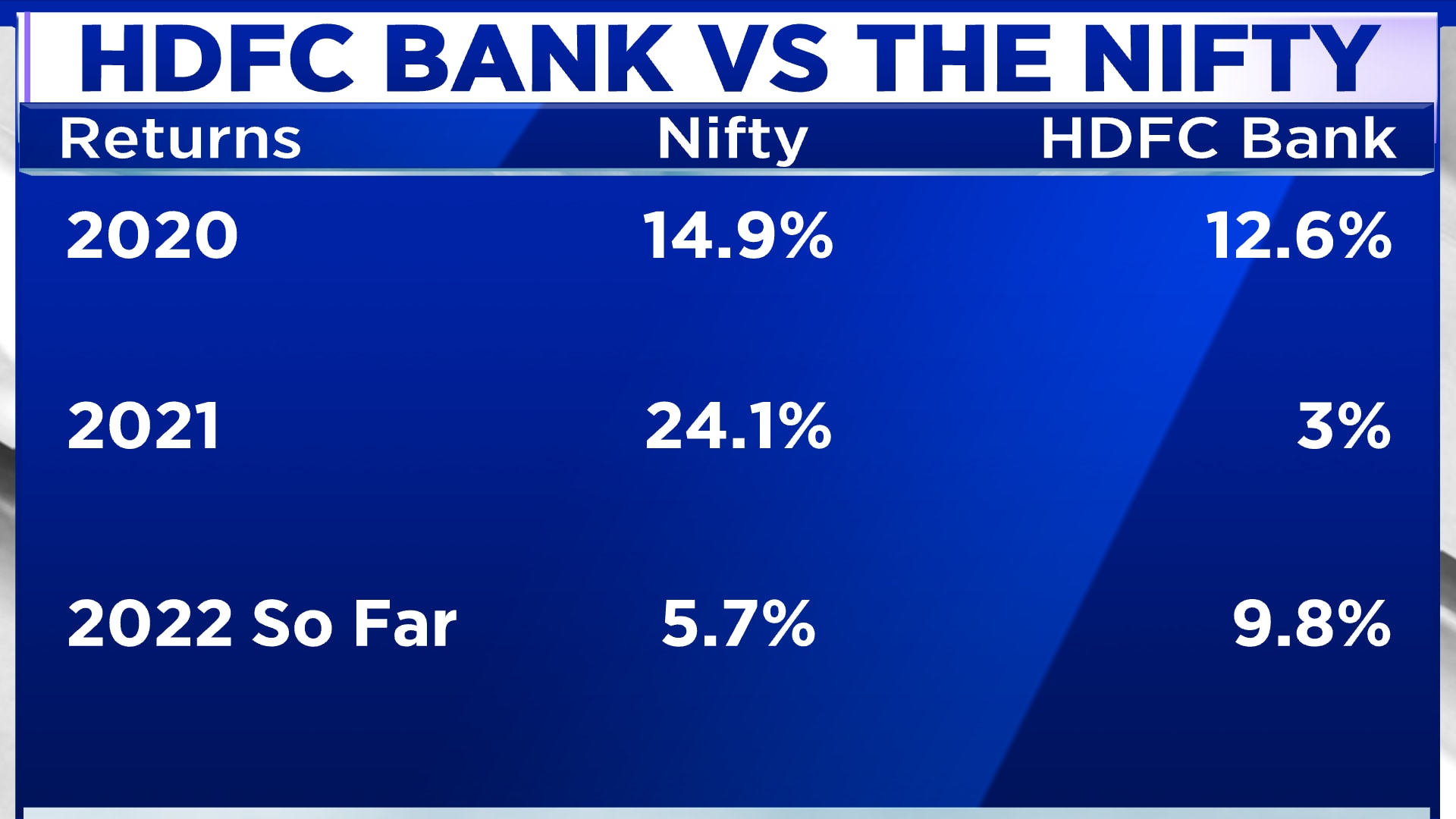

Image: www.cnbctv18.com

Factors Influencing Forex Rates

Several factors can influence forex rates, including:

- Interest rates: Countries with higher interest rates tend to see their currencies appreciate against those with lower interest rates. This is because investors are attracted to investments in countries with higher interest rates, which increases demand for the currency.

- Inflation: Inflation is a general increase in prices and can lead to a depreciation of the currency. This is because a currency’s value is based on its purchasing power. When inflation erodes purchasing power, the value of the currency decreases.

- Political stability: Political instability can lead to currency depreciation. This is because investors are hesitant to invest in countries that are perceived as unstable, which decreases demand for the currency.

HDFC Forex Rates on November 5, 2019

On November 5, 2019, HDFC Bank announced the following forex rates:

| Currency | Buying Rate | Selling Rate |

|---|---|---|

| US Dollar | 71.55 | 71.81 |

| Euro | 79.32 | 79.66 |

| British Pound | 90.35 | 90.71 |

| Japanese Yen | 0.64 | 0.65 |

These rates are subject to change at any time. Please consult with your local HDFC Bank branch for the most up-to-date rates.

Interpreting the Rates

The buying rate is the rate at which HDFC Bank will buy the foreign currency from you. The selling rate is the rate at which HDFC Bank will sell the foreign currency to you. The difference between the buying and selling rates is known as the spread.

In the table above, the spread on the US Dollar is 0.26, on the Euro is 0.34, on the British Pound is 0.36, and on the Japanese Yen is 0.01.

Image: zyfaluyohod.web.fc2.com

Tips for Getting the Best Forex Rates

There are a few things you can do to get the best forex rates:

- Shop around: Compare the rates offered by different banks and currency providers before making a decision.

- Use a currency converter: Currency converters can help you compare the rates offered by different providers.

- Look for discounts: Some banks and currency providers offer discounts for large transactions.

- Be flexible with your travel dates: If possible, travel during off-season or shoulder season when the demand for foreign currency is lower.

FAQs on HDFC Forex Rates

Q1. What is the forex rate for the US Dollar on November 5, 2019?

A. The buying rate for the US Dollar was 71.55, and the selling rate was 71.81.

Q2. What are the factors that influence forex rates?

A. Interest rates, inflation, and political stability are some of the factors that influence forex rates.

Q3. How can I get the best forex rates?

A. Shop around, use a currency converter, look for discounts, and be flexible with your travel dates to get the best forex rates.

Hdfc Forex Rate On 5 Nov 2019

Conclusion

Forecasting forex rates can be a difficult task, but by understanding the factors that influence them, you can increase your chances of getting a good rate on your next currency exchange. HDFC Bank offers competitive forex rates, and it is always a good idea to shop around to get the best rate possible.

If you are interested in learning more about forex rates or getting a currency exchange quote, please visit your local HDFC Bank branch or website.