Introduction

Image: www.forex.academy

In the ever-evolving world of finance, cross-border transactions have become more prevalent than ever. Whether you’re a global traveler, an importer or exporter, or an individual seeking to diversify your investments, the need to transfer foreign currency seamlessly and securely is paramount. Today, we delve into HDFC Forex, a leading foreign exchange provider, and provide a comprehensive guide to help you transfer foreign currency to your account effortlessly.

HDFC Forex: A Trusted Name in Currency Exchange

HDFC Forex, a subsidiary of HDFC Bank, has established itself as a trusted player in the foreign exchange market for over two decades. With a vast network of branches and authorized dealers spread across India, HDFC Forex offers a range of services tailored to meet the diverse foreign exchange needs of its customers. Its unwavering commitment to accuracy, transparency, and customer satisfaction has earned it a reputation for reliability and competence.

Understanding Currency Transfer

Currency transfer involves the conversion and movement of funds from one currency to another. When you transfer foreign currency to your account, you exchange the foreign currency for Indian rupees (INR). This exchange is facilitated by a foreign exchange broker or bank, such as HDFC Forex.

HDFC Forex Currency Transfer Process

HDFC Forex offers a streamlined and user-friendly process for currency transfer. You can initiate a transfer through any HDFC Forex branch or online via its secure portal. The process typically involves the following steps:

-

Opening a Foreign Currency Account (FCA): This is an optional but recommended step, especially if you frequently deal with foreign currencies. An FCA allows you to hold and manage multiple foreign currencies in one account, providing greater flexibility and convenience.

-

Currency Quotation: Request a currency quote from HDFC Forex. The exchange rate will be determined by prevailing market conditions and any applicable fees.

-

Provide Source and Destination Account Details: Specify the account from which the foreign currency will be deducted and the account to which the INR equivalent will be credited.

-

Transaction Execution: Once the details are confirmed, HDFC Forex will process the transaction and convert the foreign currency into INR.

Advantages of Transferring Foreign Currency with HDFC Forex

-

Competitive Exchange Rates: HDFC Forex offers competitive exchange rates to ensure you get the best value for your money.

-

Wide Range of Currencies: HDFC Forex supports a multitude of foreign currencies, including major ones like USD, EUR, GBP, and many more.

-

Convenience and Security: The online portal provides a convenient and secure platform to initiate transfers from anywhere, anytime.

-

Transparency and Tracking: You can track the status of your transfer in real-time, ensuring peace of mind.

Conclusion

HDFC Forex has revolutionized the way individuals and businesses transfer foreign currency in India. With its robust infrastructure, competitive rates, and unwavering commitment to customer satisfaction, HDFC Forex stands as a trusted partner in your foreign exchange needs. Whether you’re planning international travel, managing cross-border trade, or making investments abroad, HDFC Forex provides a seamless and secure platform to transfer foreign currency to your account effortlessly.

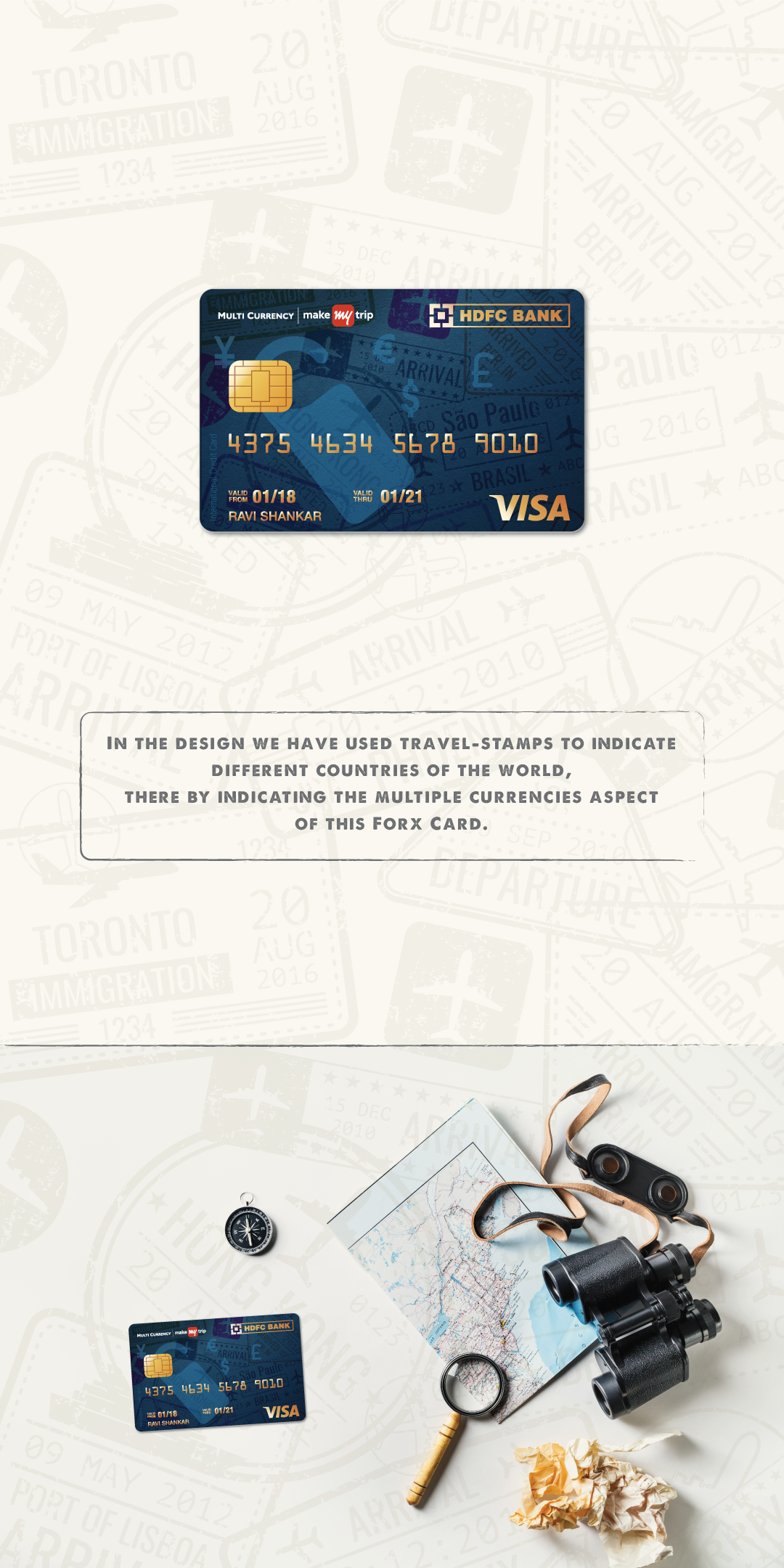

Image: www.behance.net

Hdfc Forex Currency To Account Transfer

https://youtube.com/watch?v=OvRQLGqyi9s