Introduction

Embarking on an international adventure or conducting business overseas? Navigating foreign currency exchanges can be a daunting task. But with the HDFC Forex Card Reload Form, you can effortlessly manage your finances abroad and enjoy a hassle-free travel or business experience. In this comprehensive guide, we delve into the intricacies of the HDFC Forex Card Reload Form, empowering you with the knowledge and tools to make informed decisions about your currency exchange needs.

Image: yvydarajyxix.web.fc2.com

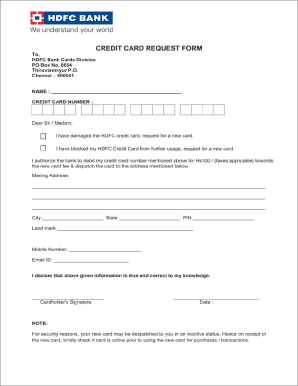

Understanding the HDFC Forex Card

The HDFC Forex Card is a prepaid card that allows you to load multiple currencies onto a single card. It’s akin to carrying multiple currencies in the palm of your hand, offering you the flexibility to pay for goods and services or withdraw cash in over 200 countries and territories worldwide.

Purpose of the HDFC Forex Card Reload Form

The HDFC Forex Card Reload Form enables you to add funds or reload your forex card account. This form facilitates currency conversion from Indian Rupees (INR) into foreign currencies. By submitting this form, you authorize HDFC Bank to debit your INR account and credit the equivalent amount in the specified foreign currency to your forex card.

Step-by-Step Guide to Completing the HDFC Forex Card Reload Form

-

Obtain the Form: Visit your nearest HDFC Bank branch or download the reload form from the HDFC Bank website.

-

Fill in Personal Details: Clearly indicate your name, address, contact number, and email address.

-

Provide Forex Card Details: Enter your 16-digit HDFC Forex Card number and the card’s expiry date.

-

Specify Currency and Amount: Choose the foreign currency you wish to load onto your card and specify the amount you wish to convert in INR.

-

Account Information: Provide the account number, IFSC code, and branch name from which the INR funds will be debited.

-

Signature and Declaration: Sign and date the form, verifying that all the information provided is accurate.

-

Submission: Submit the completed reload form at your preferred HDFC Bank branch.

Image: www.uslegalforms.com

Benefits of Using the HDFC Forex Card Reload Form

-

Convenient and Secure: The HDFC Forex Card Reload Form provides a secure and convenient way to load foreign currencies onto your card without carrying large sums of cash.

-

Wide Currency Options: The form allows you to reload your card with a wide range of foreign currencies, ensuring you have the flexibility to meet your travel or business needs.

-

Competitive Exchange Rates: HDFC Bank offers competitive exchange rates, ensuring you get the most value for your money when converting currencies.

-

Real-Time Tracking: After submitting the reload form, you can track the status of your transaction online or via the HDFC Bank mobile app.

-

Customer Support: HDFC Bank provides dedicated customer support to guide you through the reload process or address any queries you may have.

Expert Insights and Practical Tips for Using the HDFC Forex Card

-

Reload Your Card Before You Travel: Avoid the inconvenience of exchanging currency at airport exchange counters, often known for unfavorable exchange rates. Reload your card in advance to secure the best rates.

-

Monitor Exchange Rates: Keep an eye on the currency exchange rates to identify the ideal time to convert your money. HDFC Bank’s website provides real-time exchange rate updates.

-

Consider Using ATMs: If you require cash, withdraw it from ATMs displaying the HDFC Bank logo. This ensures secure transactions and reduces the risk of additional charges.

-

Preserve Your Card: Keep your HDFC Forex Card safe and avoid sharing your PIN with anyone. Report any unauthorized transactions or card loss immediately.

Hdfc Forex Card Reload Form

Conclusion

The HDFC Forex Card Reload Form empowers you to manage your foreign currency needs efficiently and conveniently. By following the steps outlined in this guide and leveraging the expert insights provided, you can confidently embark on your international journey or business endeavor, knowing that your financial transactions are secure and hassle-free. For further information or assistance, don’t hesitate to reach out to HDFC Bank’s dedicated customer support team, available 24/7 to provide you with personalized guidance and support.