Unleash a World of Financial Freedom with HDFC Forex Card

Prepare to embark on a hassle-free global adventure with the HDFC Forex Card, a convenient and secure payment solution designed to elevate your international travel experience. As a modern-day traveler, you deserve a financial companion that seamlessly adapts to your needs, empowering you with the freedom to explore the world without the constraints of exchange rate fluctuations or exorbitant transaction fees.

Image: jilllextre.blogspot.com

Understanding HDFC Forex Card Money Limit: The Key to Financial Peace of Mind

The HDFC Forex Card sets you free from the hassle of carrying large amounts of foreign currency, offering a convenient and secure alternative for your travel expenses. However, to ensure responsible financial management, HDFC has established a daily transaction limit and a maximum aggregate limit for each card.

-

Daily Transaction Limit: This refers to the maximum amount you can spend on your HDFC Forex Card within a single day. The daily limit varies depending on the type of card you hold and the country you are visiting.

-

Maximum Aggregate Limit: This represents the total amount you can load onto your HDFC Forex Card over its validity period, usually ranging from 6 to 12 months. The aggregate limit is also card-type and country-specific.

Factors Influencing HDFC Forex Card Money Limit

HDFC determines the transaction and aggregate limits based on various factors:

-

Individual Risk Profile: Your credit history, income, and spending patterns play a crucial role in determining your card limits.

-

Destination Country: The daily transaction limit may vary depending on the country you are traveling to. Countries deemed higher risk may have lower limits.

-

Card Type: Different HDFC Forex Cards, such as Platinum and Classic, come with varying transaction and aggregate limits.

Maximizing Your HDFC Forex Card Money Limit

To make the most of your HDFC Forex Card experience, consider the following tips:

-

Select the Right Card: Choose an HDFC Forex Card that aligns with your travel needs and preferred spending habits.

-

Stay Informed: Before you travel, check with HDFC to confirm the transaction and aggregate limits for your specific card and destination country.

-

Plan Your Expenses: Estimate your daily expenses, considering factors such as accommodation, dining, and activities. This will help you stay within the daily transaction limit.

-

Avoid Excessive Reloads: While you can reload your HDFC Forex Card multiple times, excessive reloading may raise concerns and potentially impact your future transaction limits.

-

Use Multiple Cards: If you anticipate exceeding the daily transaction limit, consider carrying multiple HDFC Forex Cards or combining them with a debit or credit card.

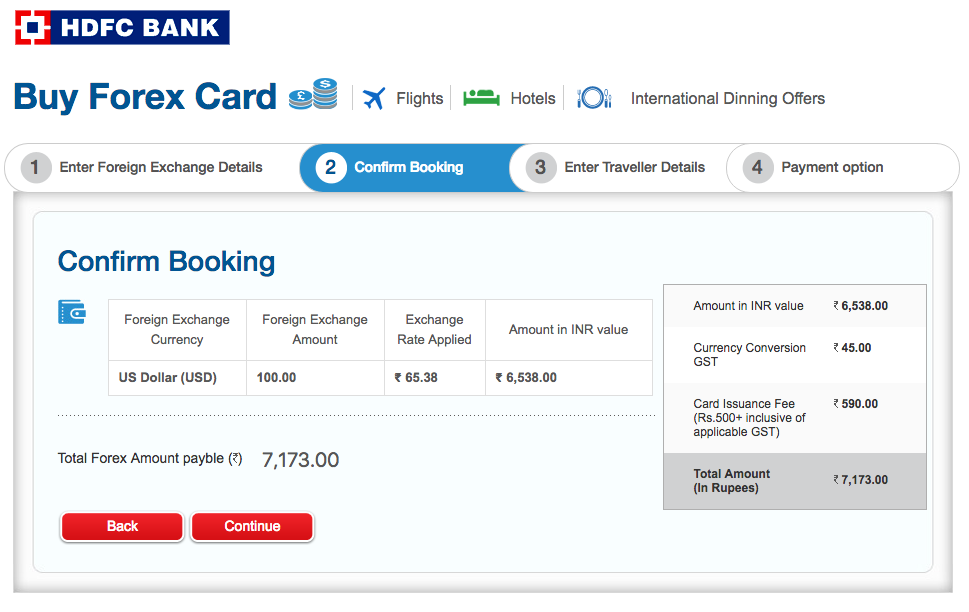

Image: www.hdfcbank.com

Expanding Your HDFC Forex Card Money Limit

In certain circumstances, you may need to request an increase in your HDFC Forex Card money limit. To do this, contact HDFC customer service and provide valid reasons for your request. HDFC will evaluate your financial profile and the specific circumstances before granting an increase.

Hdfc Forex Card Money Limt

Conclusion: Empowering Global Explorers

The HDFC Forex Card is an indispensable tool for today’s discerning travelers. With its smart features, secure platform, and customizable money limits, it empowers you to experience the world with confidence and financial freedom. Whether you are an occasional traveler or a globetrotter, the HDFC Forex Card is your trusted companion, ensuring you make the most of every adventure.