Traveling abroad can be an exhilarating experience, but managing currency can often be daunting. If you’re planning an unforgettable trip to the vibrant metropolis of Bangkok, carrying a reliable forex card is essential to alleviate financial hassles and maximize your money’s worth. Among the leading options, the HDFC Forex Card stands out as an exceptional choice, offering competitive exchange rates to help you unlock the ultimate value during your stay in Thailand.

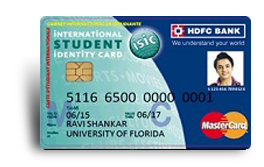

Image: www.hdfcbank.com

Understanding Forex Cards and HDFC’s Competitive Advantage

A forex card is a prepaid card that allows you to load multiple currencies and access them while traveling internationally, often offering exchange rates more favorable than traditional currency exchange services. HDFC Bank’s Forex Card is a trusted choice among travelers, providing a secure and convenient way to manage your finances overseas. With widespread acceptance at ATMs and merchants across Thailand, you can enjoy seamless transactions without the need to carry large amounts of cash.

Decoding HDFC’s Exchange Rates for Thai Baht

HDFC Forex Card’s exchange rates for Thai Baht are constantly updated and fluctuate based on market conditions. To stay informed about the latest rates, you can visit HDFC Bank’s website or refer to reliable currency converters. The current rate is a crucial factor to consider when loading your card, as it directly impacts the amount of local currency you’ll receive. Comparing rates from different sources ensures you secure the most favorable exchange.

Strategies to Enhance Currency Value in Bangkok

To make the most of your HDFC Forex Card in Bangkok, consider these expert tips:

- Monitor Exchange Rates: Keep a close eye on currency fluctuations and load your card when the Thai Baht is strong against the Indian Rupee.

- Utilize ATMs: Withdraw cash from HDFC-affiliated ATMs in Bangkok to benefit from the bank’s preferential exchange rates.

- Make Large Purchases: Use your forex card for substantial expenses, such as hotel bookings or tours, to take advantage of the favorable rates for higher amounts.

Image: www.pdfprof.com

Frequently Asked Questions about HDFC Forex Card in Bangkok

Q: How do I load my HDFC Forex Card?

A: You can load your HDFC Forex Card through net banking, a mobile app, or by visiting an HDFC Bank branch.

Q: Can I use the card anywhere in Bangkok?

A: Yes, the HDFC Forex Card is widely accepted at ATMs and merchant establishments throughout Bangkok.

Q: Are there any additional charges associated with using the card?

A: No, HDFC Bank does not charge additional fees for using the Forex Card in Thailand. However, foreign exchange charges may apply.

Hdfc Forex Card Exchange Rate In Bangkok

Conclusion

Unveiling the fascinating world of Bangkok with the HDFC Forex Card empowers you to traverse the vibrant streets and immerse yourself in the city’s captivating charm without financial worries. By strategically monitoring exchange rates and following our expert tips, you can maximize the value of your money and create unforgettable memories in the Land of Smiles.

Call to Action:

Are you eager to embark on an extraordinary adventure in Bangkok? Don’t let currency concerns dampen your spirits. Arm yourself with an HDFC Forex Card today and enjoy seamless financial experiences while you revel in the vibrant culture and breathtaking beauty of this captivating city.