Harnessing the Power of HDFC Demand Draft for Seamless Forex Trades

Embark on a hassle-free Forex trading experience with the convenience of HDFC’s Demand Draft services. As a leading financial institution, HDFC offers an unparalleled solution for individuals seeking to transfer funds seamlessly for their overseas currency transactions. In this comprehensive guide, we delve into the intricacies of using HDFC Demand Draft for Forex, outlining its advantages, intricacies, and practical tips to elevate your trading journey.

Image: www.youtube.com

Understanding HDFC Demand Draft for Forex

HDFC’s Demand Draft is a guaranteed payment instrument issued by the bank, directing another bank branch or financial institution to pay the specified amount to the beneficiary. In the context of Forex trading, it serves as a reliable and secure mode of transferring funds to foreign exchange brokers or overseas accounts.

Benefits of Using HDFC Demand Draft for Forex

HDFC Demand Draft for Forex offers an array of benefits that streamline your trading experience:

- Convenience and Accessibility: HDFC’s widespread network of branches and online banking platforms provide easy access to Demand Draft services, regardless of your location.

- Guaranteed Payments: Demand Drafts issued by HDFC are backed by the bank’s financial guarantee, ensuring timely and secure delivery of funds.

- Reduced Transfer Costs: HDFC offers competitive exchange rates and minimal transaction fees, ensuring cost-effective fund transfers for your Forex trades.

How to Use HDFC Demand Draft for Forex

Navigating the process of using HDFC Demand Draft for Forex is straightforward:

- Obtain a Demand Draft: Visit your nearest HDFC branch or access their online banking portal to initiate a Demand Draft request.

- Fill in the Details: Provide the beneficiary’s name and address, the amount to be transferred in foreign currency, and the corresponding foreign exchange rate.

- Pay the Charges: HDFC will calculate the Demand Draft charges based on the transaction amount and provide you with the total payable.

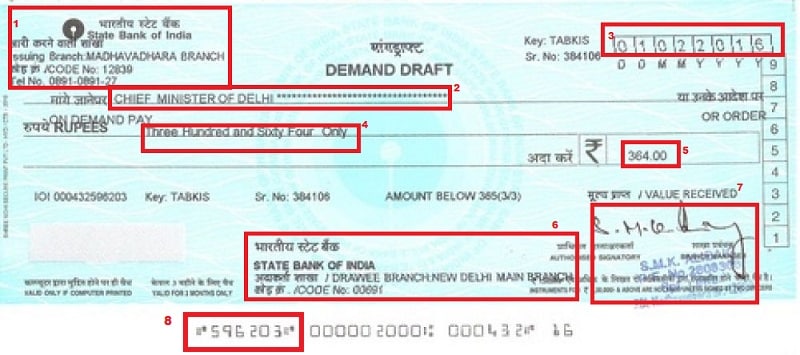

Image: bemoneyaware.com

Expert Tips for Using HDFC Demand Draft for Forex

Maximize the efficiency of your Forex trades by following these expert tips:

- Plan Ahead: Initiate Demand Draft requests well in advance of the intended delivery date, allowing ample time for processing and courier transit.

- Confirm Exchange Rates: Verify the foreign exchange rates with your Forex broker before filling out the Demand Draft to avoid potential discrepancies.

- Maintain Documentation: Keep a record of your Demand Draft transactions, including the Demand Draft number, amount transferred, and the recipient’s details, for documentation and record-keeping purposes.

Frequently Asked Questions

- Can I use HDFC Demand Draft for any Forex broker?

Yes, HDFC Demand Draft can be used to make payments to any licensed Forex broker. - What is the maximum amount I can transfer using HDFC Demand Draft for Forex?

The maximum amount for Forex transactions using HDFC Demand Draft varies depending on the individual’s account limits and regulatory requirements. - Can I track the status of my HDFC Demand Draft?

Yes, you can track the status of your Demand Draft by visiting your HDFC branch or through their online banking portal.

Hdfc Demand Draft Form Forex

Conclusion

HDFC Demand Draft for Forex empowers individuals with a secure and convenient solution to streamline their international currency transfers. By leveraging its unparalleled network, competitive exchange rates, and guaranteed payments, traders can navigate the Forex market with ease and efficiency. Whether you’re a seasoned trader or embarking on your Forex journey, HDFC Demand Draft offers a trusted gateway to seamless and successful Forex transactions.

Are you ready to explore the world of Forex trading with the convenience of HDFC Demand Draft? Join the ranks of discerning traders who have unlocked the potential of this powerful payment solution.