Maximize Returns, Enhance Investments: A Financial Guide

In today’s globalized economy, cross-border financial transactions have become crucial for businesses and individuals alike. Understanding and leveraging favorable foreign exchange rates can significantly impact wealth accumulation and investment strategies. When it comes to converting Non-Resident External (NRE) accounts to Foreign Currency Non-Resident (FCNR) accounts, HDFC Bank offers competitive forex rates, making it an advantageous choice for NRI customers. This article explores the intricacies of HDFC Bank’s NRE to FCNR forex rate, providing valuable insights and practical guidance to maximize financial returns.

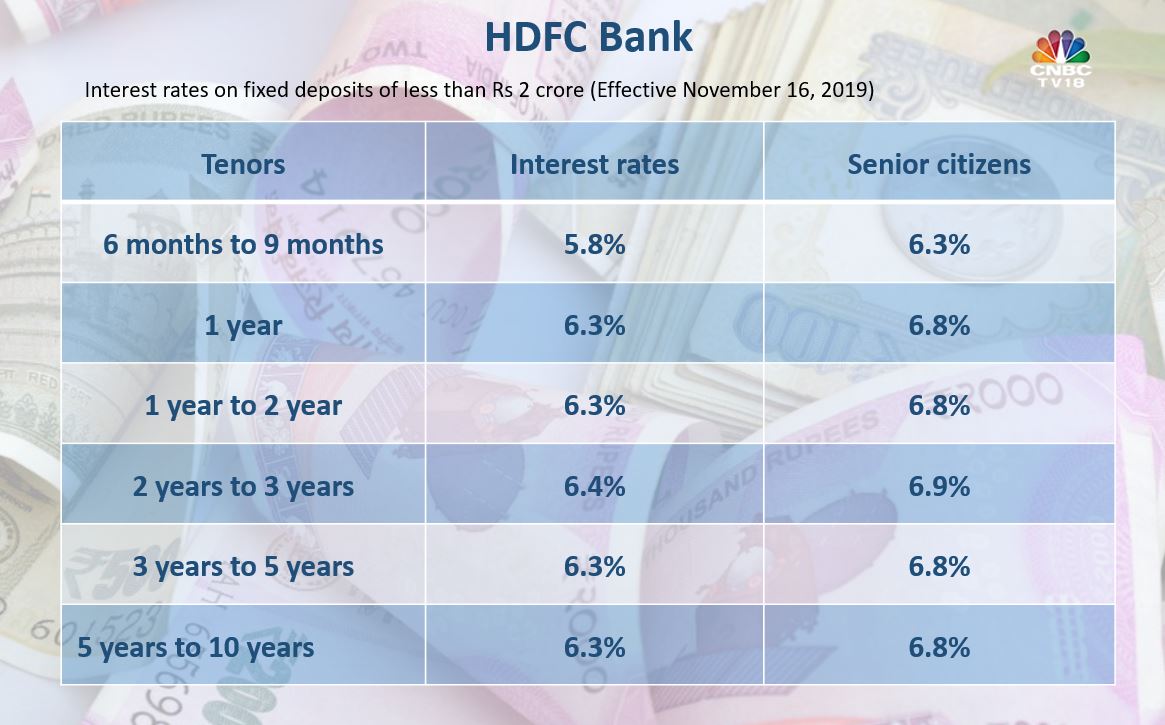

Image: www.cnbctv18.com

NRE and FCNR Accounts: A Comparative Analysis

NRE and FCNR accounts are both designed to meet the financial needs of Non-Resident Indians (NRIs). However, they possess distinct characteristics. NRE accounts are popular among NRIs who earn income outside India and wish to remit funds back home. These accounts are denominated in Indian rupees and are subject to Indian income tax regulations. On the other hand, FCNR accounts are denominated in foreign currencies, offering NRIs a hedge against currency fluctuations and providing tax exemptions on interest earned.

HDFC Bank’s Forex Rate Advantage

HDFC Bank stands out as a leading provider of NRE to FCNR forex rate conversions. The bank’s vast network of branches, both domestically and internationally, combined with its robust online banking platform, ensures seamless and secure transactions. HDFC Bank offers competitive forex rates, ensuring that NRI customers receive maximum value for their money.

Unlocking Tax Benefits and Investment Opportunities

Converting NRE funds to FCNR accounts through HDFC Bank opens up a world of investment and tax-saving opportunities for NRIs. FCNR accounts offer exemption from tax on interest earned, making them an attractive option for long-term investments. Additionally, there are no restrictions on the amount that can be deposited into FCNR accounts, providing flexibility and growth potential.

Image: youthlegal.in

NRE to FCNR Conversion: A Step-by-Step Guide

HDFC Bank’s user-friendly online banking platform makes the conversion process便捷方便. NRIs can initiate the NRE to FCNR conversion by logging into their HDFC Bank NRE account and selecting the “Transfer to FCNR” option. The bank’s online forex calculator provides up-to-date exchange rates, ensuring transparency and convenience.

Expert Assistance and Customized Solutions

HDFC Bank’s dedicated team of relationship managers is committed to providing personalized guidance and support to NRI customers. They can assist with tailored financial advice, customized forex solutions, and investment strategies. HDFC Bank’s commitment to customer satisfaction ensures a seamless and rewarding banking experience.

Hdfc Bank Nre To Fcnr Forex Rate

Maximize Returns, Secure Investments: The HDFC Bank Advantage

HDFC Bank’s competitive NRE to FCNR forex rate, coupled with its comprehensive range of financial services, makes it the preferred choice for NRIs seeking to optimize their investments and maximize their financial returns. With a solid track record, a robust global presence, and a customer-centric approach, HDFC Bank empowers NRIs to navigate the intricacies of forex conversions and make informed financial decisions.