Planning Your Dream Vacation? Here’s Your Essential Travel Companion!

Imagine exploring exotic destinations without the stress of currency exchange woes. Say hello to the HDFC Bank MakeMyTrip Forex Card, your gateway to seamless and budget-conscious global adventures.

Image: www.forex.academy

The Convenience of a Forex Card Combined with Exclusive Rewards

The HDFC Bank MakeMyTrip Forex Card combines the convenience of a prepaid forex card with exclusive rewards and discounts. Load multiple currencies onto your card, reducing the hassle of carrying cash or exchanging money at the airport. Enjoy the convenience of using it like a regular debit card at ATMs, POS terminals, or online. Moreover, earn MakeMyTrip Miles on every transaction, which can be redeemed for exciting travel experiences.

Unlocking the Secrets of the HDFC Bank MakeMyTrip Forex Card

Tailored for the Discerning Traveler:

This card is crafted exclusively for frequent travelers who demand convenience and flexibility. It eliminates the need for cash withdrawals and currency exchange, providing peace of mind and security.

Image: www.makemytrip.com

Multiple Currency Loading:

The card allows you to load up to 22 foreign currencies, empowering you to explore multiple destinations without the inconvenience of multiple cards.

Zero Markup on Currency Rates:

Unlike traditional currency exchange methods, this card offers competitive exchange rates with no markup, saving you money on your travel expenses.

Additional Features and Benefits:

- Free accidental insurance up to $10,000

- Online card management and transaction tracking

- Lost card reporting and replacement assistance

- 24×7 customer support

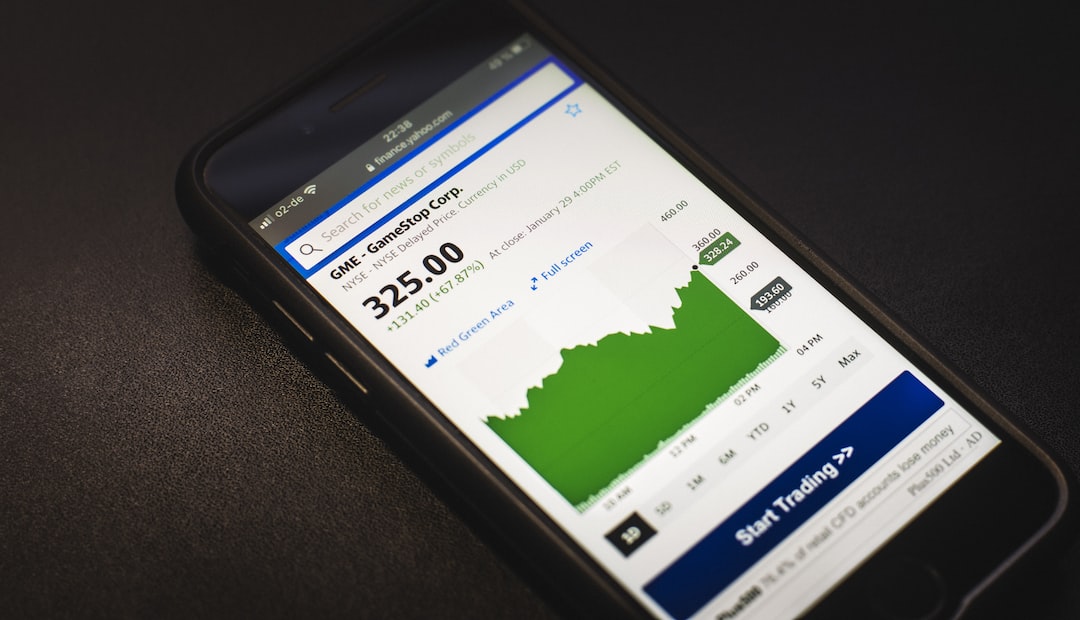

Latest Trends and Developments in the Forex Industry

The forex market is constantly evolving. Emerging trends include:

- Mobile-friendly forex platforms: Accessing forex markets on the go

- AI-powered currency exchange: Enhanced accuracy and efficiency

- Digital wallets: Streamlined cross-border transactions

Tips and Expert Advice for Navigating Forex

Before embarking on your forex journey, consider these expert tips:

- Research and compare forex providers to find the best rates and fees

- Use a currency converter to track exchange rate fluctuations

- Monitor economic news and geopolitical events that impact currency values

- Consider hedging strategies to minimize currency risks

Frequently Asked Questions

Q: Can I withdraw local currency from ATMs using the HDFC Bank MakeMyTrip Forex Card?

A: Yes, you can withdraw local currency at ATMs worldwide.

Q: What are the card issuance and renewal fees?

A: Issuance fee: INR 100 (+ GST)

Renewal fee: INR 0

Q: How do I activate my HDFC Bank MakeMyTrip Forex Card?

A: Activate your card online or via SMS using the details provided at the time of application.

Hdfc Bank Makemy Trip Forex Card

https://youtube.com/watch?v=AmT3IviB_1c

Conclusion

The HDFC Bank MakeMyTrip Forex Card empowers travelers with peace of mind and flexibility. Its zero markup rates, multiple currency loading, and exclusive discounts make it the ultimate travel companion. Whether you’re planning a weekend getaway or an extended adventure, let this card enhance your journey.

So, are you ready to unlock the world of seamless travel with the HDFC Bank MakeMyTrip Forex Card?