The World in Your Wallet: Unlocking the Benefits of an HDFC Forex Card

Planning a global adventure? Business trip overseas? Managing overseas investments? Facilitate your monetary transactions effortlessly with the HDFC Bank Forex Card. This financial instrument empowers you to make purchases and withdraw cash globally, shielded from fluctuating exchange rates and minimizing transaction costs.

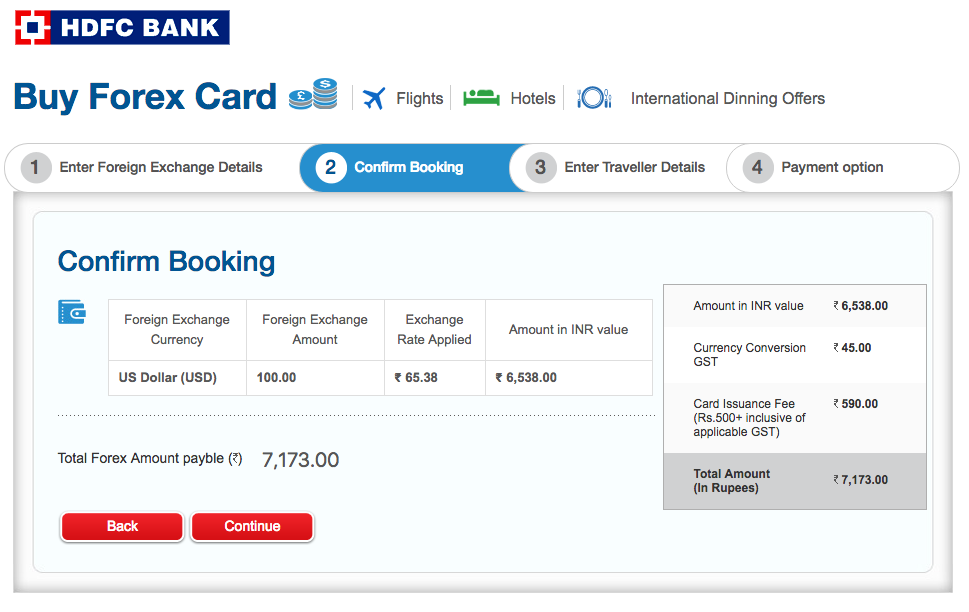

Image: jilllextre.blogspot.com

HDFC’s forex card offers a plethora of advantages:

- Ease of Use: Accepted at millions of establishments worldwide, the HDFC Forex Card simplifies your payments and eliminates the hassle of carrying cash.

- Currency Converter: Avoid the complexities of currency exchanges. The card automatically converts your Indian rupees into the respective foreign currency, ensuring accurate and real-time transactions.

- Competitive Exchange Rates: HDFC Bank’s forex card provides highly competitive exchange rates, ensuring you get the most value for your money.

- Security and Fraud Protection: Advanced security features and fraud protection measures safeguard your transactions, giving you peace of mind.

How to Activate Your HDFC Bank Forex Card

Activating your HDFC Forex Card is a straightforward process:

- Step 1: Call HDFC Bank’s Customer Care: Reach out to HDFC Bank’s dedicated customer support team at 1800-202-6161 or 1800-11-2838. They will guide you through the activation procedure.

- Step 2: Verify Your Personal Details: The customer care executive will verify your personal details to ensure your identity for security purposes.

- Step 3: Set Your PIN: Choose a 4 to 6-digit PIN for your HDFC Forex Card to authorize transactions securely.

- Step 4: Congratulations! Your Card is Activated: Once the verification and PIN setup are complete, your HDFC Forex Card will be activated.

Understanding the Latest Trends and Developments in Forex Cards

The world of forex cards is constantly evolving, with emerging trends and advancements enhancing their functionality and security:

- Contactless and Mobile NFC Payments: Many forex cards now offer contactless and mobile near-field communication (NFC) payments, enabling you to tap and pay at retail outlets with ease.

- Multi-Currency Support: Advanced forex cards allow you to load multiple currencies simultaneously, providing flexibility and convenience for international travelers.

- Dynamic Currency Conversion: Some forex cards offer dynamic currency conversion, allowing you to select the conversion rate at the point of purchase.

Expert Tips and Advice for Using Your Forex Card

Maximize the benefits of your HDFC Forex Card with these expert tips:

- Load Your Card Before Travel: Avoid last-minute stress and ensure you have sufficient funds on your card before your trip.

- Check Exchange Rates: Stay updated on the latest exchange rates to make informed decisions and optimize your currency conversion.

- Keep Your Card Secure: Store your HDFC Forex Card securely and never reveal your PIN to anyone.

- Monitor Your Transactions: Regularly check your transaction statements to monitor your expenses.

By adhering to these tips, you can enhance your financial security and maximize the value of your HDFC Forex Card.

Image: invested.in

FAQs on Forex Card Activation and Usage

Below are some common questions and their answers to help clarify any concerns you may have regarding forex cards:

Q1. How long does forex card activation take?

A1. HDFC Forex Card activation usually takes around 24 to 48 hours after you complete the activation process with customer support.

Q2. Can I use my forex card immediately after it is activated?

A2. Once your HDFC Forex Card is activated, you can use it immediately to make purchases or withdraw cash internationally.

Q3. How do I set up a PIN for my HDFC Forex Card?

A3. You can set up your PIN when you call HDFC Bank’s customer care for activation. Ensure you choose a secure and memorable 4 to 6-digit PIN.

Q4. Where can I use my HDFC Forex Card?

A4. HDFC Forex Cards are widely accepted at millions of establishments and ATMs worldwide that display the MasterCard or Visa logo.

Q5. What are the transaction fees and charges for using a forex card?

A5. Transaction fees and charges may vary depending on the issuing bank, the amount of the transaction, and the currency being exchanged. Check with HDFC Bank for specific details on their forex card fees and charges.

Hdfc Bank Forex Card Activate

Conclusion: Your Global Financial Companion

HDFC Bank Forex Card is your indispensable companion for hassle-free global transactions, empowering you to explore the world with financial confidence. Activate your card today and unlock a seamless international payment experience. Enjoy the convenience of currency conversions, competitive exchange rates, and enhanced security features, all in a single card. Whether you’re planning a business trip, a vacation, or managing investments abroad, HDFC’s forex card is your trusted financial partner. Embrace the opportunities the world offers with the HDFC Bank Forex Card by your side.

Interested in further exploring the world of finance? Visit the HDFC Bank blog for a treasure trove of insights, tips, and expert advice on banking, financial planning, and global transactions.