Introduction

The world of currency exchange is constantly evolving, with the introduction of Goods and Services Tax (GST) on forex transactions bringing forth a significant shift. For individuals and businesses engaged in international trade or cross-border transactions, understanding the implications of GST on forex is crucial. This article delves into the intricacies of GST on forex transactions, empowering you with knowledge and clarity amidst the ever-changing financial landscape.

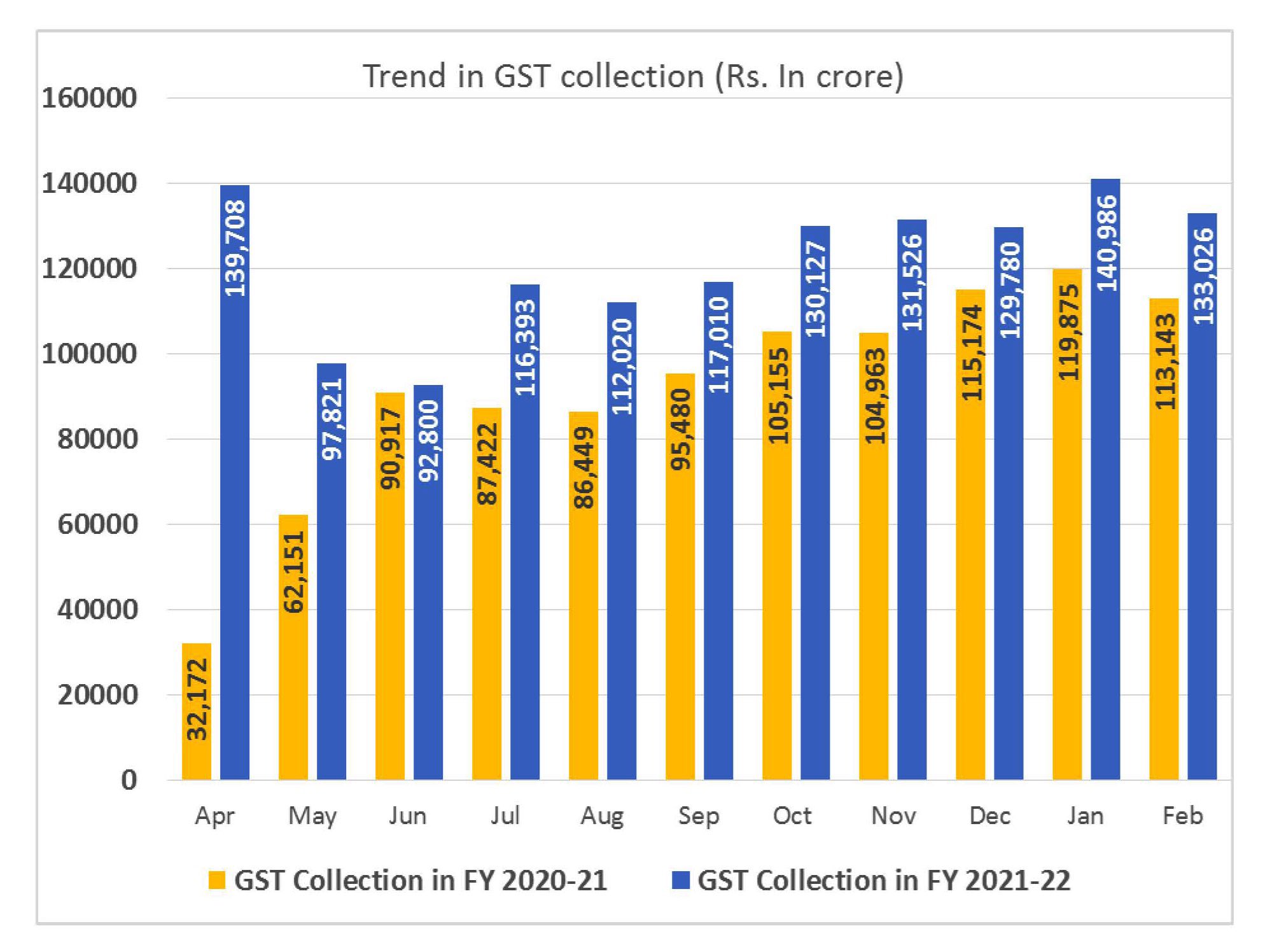

Image: blog.saginfotech.com

Deciphering the GST Maze: Forex Transactions and their Implications

GST, a comprehensive indirect tax system implemented in India, has levied its presence on forex transactions as well. Every purchase or sale of foreign currency is subject to GST, impacting the overall cost and implications for stakeholders. The GST rate applicable to forex transactions stands at 18%.

Unraveling the Layers: Understanding the GST Structure in Forex

As individuals or entities engage in forex transactions, they essentially trade foreign currency with a designated authorized dealer. These dealers then play a pivotal role in the GST payment process. The GST payable on a forex transaction is calculated based on the transaction value, including both the cost of acquisition and any applicable service charges.

Expert Insights: Embracing the Perspectives of Financial Luminaries

“GST on forex transactions presents an additional layer of complexity, emphasizing the importance of meticulous record-keeping and accurate GST reporting,” advises Mr. Avinash Trivedi, a renowned Chartered Accountant. “By adhering to these guidelines, businesses can ensure compliance and avoid potential penalties.”

Image: help.tallysolutions.com

Practical Imperatives: A Roadmap to GST Compliance

Compliance with GST regulations is paramount for businesses and individuals engaging in forex transactions. To adhere to these regulations, the following steps are of paramount importance:

- Maintain meticulous records of all forex transactions, including trade details and invoices.

- File GST returns on a timely basis, reflecting the GST payable on forex transactions.

- Engage with a GST Suvidha Provider (GSP) for seamless GST filing and reconciliation.

Evolving Horizons: The Future of GST and Forex Transactions

The dynamic nature of GST and forex markets underscores the importance of staying abreast of regulatory updates and industry best practices. As technology advances and global economies intertwine, the interplay between GST and forex transactions is likely to continue evolving.

Gst On Top Of Forex Transactions

Conclusion: Empowered with Knowledge, Navigating the GST Labyrinth

Understanding the intricacies of GST on forex transactions empowers individuals and businesses with the tools to navigate the financial landscape with clarity and confidence. By assimilating the insights presented in this comprehensive guide, you can make informed decisions, ensure compliance, and optimize your financial endeavors. May this knowledge illuminate your path and empower you to navigate the complexities of GST on forex transactions effectively.