Introduction

In the realm of financial markets, foreign exchange (Forex) trading plays a significant role, facilitating the exchange of currencies between various nations and enterprises. With its growing popularity, it’s crucial to delve into the intricacies of GST (Goods and Services Tax) as it applies to Forex dealer-to-dealer transactions, thereby establishing clarity and ensuring compliance.

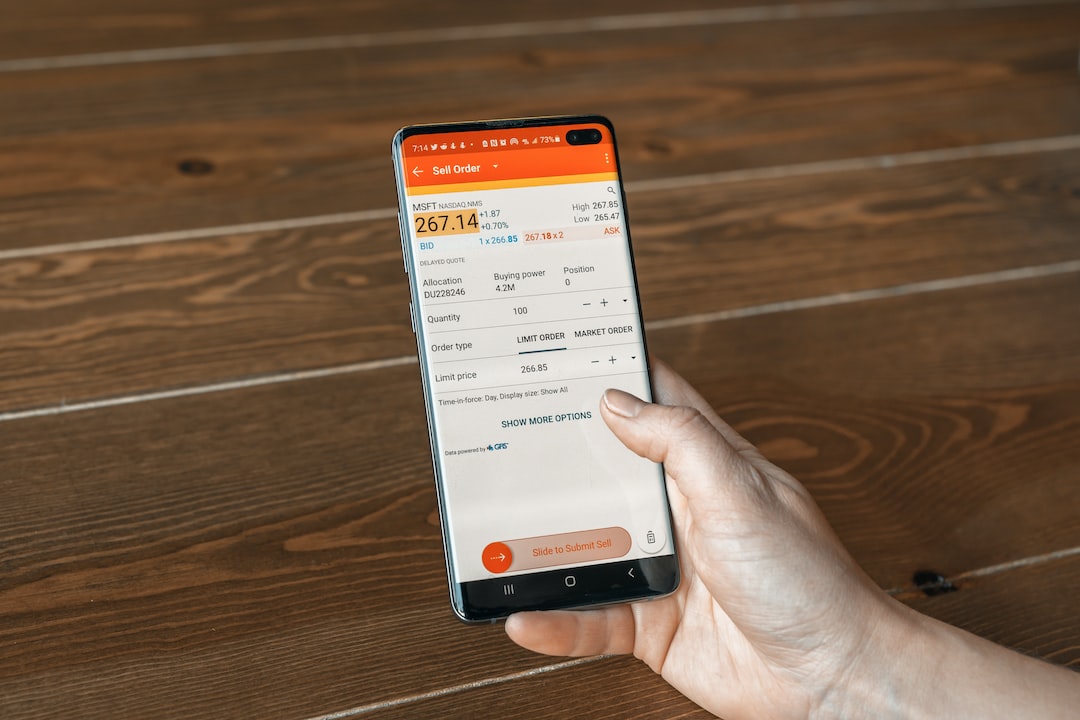

Image: www.forex.academy

Understanding GST on Forex Transactions

GST, a comprehensive indirect tax system implemented in India, impacts various economic activities, including Forex transactions. These transactions, whether between dealers or non-dealers, fall under the GST ambit and are subject to specific tax provisions outlined in the GST Act.

GST on Forex transactions between dealers (also referred to as authorized persons) bears immense significance as these transactions constitute a significant portion of the Forex market. The GST treatment of such transactions aims to regulate the taxation process and ensure transparency and accountability within the Forex industry.

Taxability of Forex Dealer-to-Dealer Transactions

Forex dealer-to-dealer transactions primarily involve the exchange of currencies between authorized dealers. These transactions are considered “supply” under the GST Act and, as such, are subject to GST. The supply of Forex by one authorized dealer to another constitutes a taxable event, attracting GST implications.

Tax Rate Applicable to Forex Dealer-to-Dealer Transactions

The GST rate applicable to Forex dealer-to-dealer transactions is 0%. This means that no GST is payable on such transactions, essentially exempting them from GST liability. This exemption is a crucial aspect of Forex market operations, promoting ease of doing business and facilitating seamless currency exchange between authorized dealers.

Image: www.slideshare.net

GST Exemption for Forex Dealer-to-Dealer Transactions

The GST exemption for Forex dealer-to-dealer transactions is a significant provision that has simplified GST compliance in the Forex market. It has eliminated the burden of GST payment on Forex transactions between authorized dealers, thereby fostering a conducive environment for Forex trading operations.

Benefits of GST Exemption for Forex Market Participants

The GST exemption for Forex dealer-to-dealer transactions offers several benefits to market participants, including:

- Reduced Compliance Burden: The exemption simplifies GST compliance for authorized dealers, reducing the associated administrative burden and compliance costs.

- Tax Neutrality: The absence of GST on Forex dealer-to-dealer transactions maintains tax neutrality, ensuring that Forex transactions are not subject to undue tax burdens compared to other financial transactions.

- Enhanced Market Liquidity: By eliminating the tax liability on Forex dealer-to-dealer transactions, the GST exemption promotes market liquidity and depth, as participants can engage in trading activities without incurring GST costs.

- Global Competitiveness: The GST exemption aligns India’s Forex market with global norms, fostering competitiveness and attracting foreign investment.

GST Implications on Non-Forex Transactions of Forex Dealers

It is important to note that while Forex dealer-to-dealer transactions are exempt from GST, other non-Forex activities carried out by Forex dealers may be subject to GST. For instance, Forex dealers providing financial services, such as brokerage or advisory services, may be liable to pay GST on these services.

Understanding the Difference: Forex Dealer vs. Non-Dealer

Distinguishing between authorized forex dealers and non-dealers is crucial for proper GST compliance. Authorized forex dealers are those financial institutions or individuals approved by the Reserve Bank of India (RBI) to conduct forex transactions, whereas non-dealers are individuals or businesses not authorized by the RBI to engage in Forex trading.

Gst On Forex Dealer To Forex Dealer

Conclusion

The GST exemption for Forex dealer-to-dealer transactions is a well-conceived provision that recognizes the unique nature of Forex trading and facilitates efficient market operations. This exemption fosters market liquidity, simplifies compliance, and aligns India’s GST regime with global practices. As the Forex market continues to evolve, staying abreast of GST implications and complying with regulatory requirements remains essential for both authorized dealers and non-dealers.