When it comes to navigating the complexities of the Goods and Services Tax (GST) in India, it’s essential to unravel the intricacies surrounding forex transactions. As global trade flourishes, understanding the GST implications on foreign exchange trading becomes imperative for businesses and individuals alike.

Image: www.youtube.com

In this comprehensive guide, we will delve into the GST applicability on forex, exploring its nuances and unraveling the key considerations. Join us as we embark on this journey, ensuring your forex transactions are GST compliant.

Defining Forex and GST

Forex Trading

Forex trading, often referred to as foreign exchange trading, involves the exchange of currencies between different countries. Participants in this global market seek to capitalize on fluctuations in currency values, aiming to profit from these movements.

GST

The Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services in India. It encompasses a unified tax structure, subsuming various indirect taxes like value-added tax (VAT), central sales tax (CST), and service tax, among others.

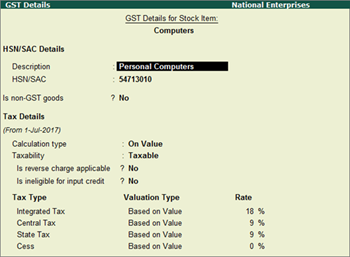

Image: help.tallysolutions.com

GST Applicability on Forex Transactions

As per the GST framework, forex transactions are generally not considered a supply of goods or services. Consequently, they fall outside the ambit of GST. This exemption stems from the fact that forex trading involves the exchange of currencies, not the sale or purchase of goods or services.

However, certain scenarios may arise where GST could become applicable on forex transactions. For instance:

- When a brokerage firm involved in forex trading provides additional services beyond currency exchange. These services may include financial advice, portfolio management, or research reports.

- In cases where a non-resident individual or entity receives income from forex trading in India.

Understanding the Nuances: Brokerage Fees and Service Charges

In most forex transactions, brokerage fees are incurred by traders to access the services of a brokerage firm. These fees are typically charged as a percentage of the transaction value. GST is not applicable on brokerage fees as they are considered a reimbursement of expenses rather than a supply of services.

However, some brokerage firms may charge additional service charges, such as platform fees or account maintenance fees, which are distinct from brokerage fees. These service charges may be subject to GST if they meet the criteria of being a supply of services.

Expert Advice and Practical Tips

To ensure GST compliance in forex trading, adhering to the following tips is crucial:

- Maintain clear and accurate records of all forex transactions, including details on currency pairs traded, dates, and amounts.

- Seek professional advice from a chartered accountant or GST consultant to gain a thorough understanding of GST implications on forex transactions.

- Regularly review GST guidelines and updates to stay abreast of any changes or clarifications.

Understanding GST Records and Professional Guidance

Accurate record-keeping is essential for forex traders. Detailed documentation of transactions serves as a valuable reference in case of GST audits or inquiries. Consulting a chartered accountant or GST consultant can provide invaluable insights into GST compliance, ensuring that you stay on the right side of the law.

Moreover, keeping up with GST updates and regulations is crucial. The GST regime in India is constantly evolving, and staying informed ensures that you stay compliant with the latest requirements.

FAQs on GST Applicability on Forex Transactions

1. Is GST applicable on forex trading profits earned by resident individuals or entities?

Ans: No, GST is not applicable on forex trading profits earned by resident individuals or entities in India.

2. Can brokerage fees charged by forex brokers be subject to GST?

Ans: No, brokerage fees are not subject to GST as they are considered reimbursement of expenses.

3. Are service charges levied by forex brokers taxable under GST?

Ans: It depends. Service charges that fall under the ambit of a supply of services may be subject to GST.

Gst Applicable On Forex Or Not

Conclusion: Embracing Clarity and Compliance

Understanding GST applicability on forex transactions is crucial for businesses and individuals engaging in foreign exchange trading. By adhering to the guidelines outlined in this comprehensive guide, you can ensure that your forex transactions are compliant with GST regulations, providing peace of mind and avoiding potential penalties.

Remember, GST compliance is not merely about fulfilling a legal obligation but also about contributing to the nation’s revenue and supporting the development of public services. As you navigate the world of forex trading, keep these insights close at hand to ensure your journey is marked by both profitability and unwavering compliance.

Are you interested in delving deeper into the fascinating world of GST and its implications on various business activities? Share your thoughts and questions in the comments section below, and let’s continue this engaging conversation.