Embarking on the exhilarating realm of forex trading, traders navigate a world of fluctuating currencies and economic indicators. Amidst this dynamic environment, charting emerges as an indispensable tool, revealing intricate patterns that empower traders to make informed decisions and maximize profitability. This article delves into the extraordinary tale of a trader who harnessed the power of forex charts to transform a $3500 account into an impressive $8500, unlocking a wealth of insights and valuable strategies along the way.

Image: goldpredictors.com

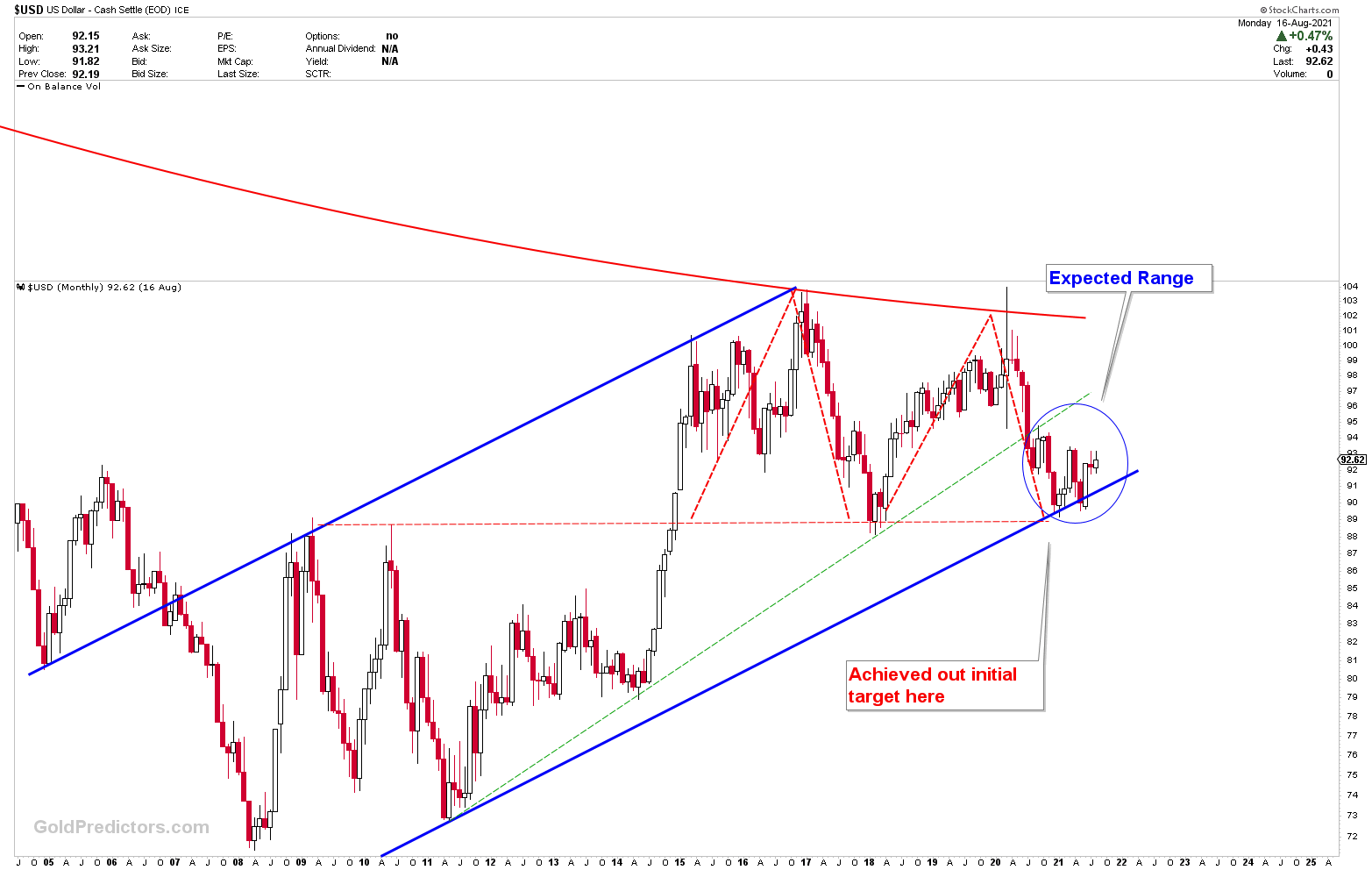

At the inception of their forex journey, this trader recognized the paramount importance of technical analysis. Charts became their unwavering companions, providing a visual representation of market behavior and uncovering hidden trends. With meticulous attention, they deciphered candlestick patterns, moving averages, and support and resistance levels, transforming complex data into actionable insights. Each chart became a roadmap, guiding their trading strategies and illuminating optimal entry and exit points.

Candlesticks Illuminate Market Sentiment

The art of candlestick charting proved to be a cornerstone of the trader’s success. These graphical representations of price action, with their distinct silhouettes and colored bodies, conveyed invaluable information about market sentiment and momentum. By studying candlestick patterns such as bullish engulfing patterns, traders gained a profound understanding of market reversals and potential trading opportunities. Recognizing the significance of wicks — the thin lines extending from the top and bottom of candlesticks — traders identified areas of support and resistance, using these levels to guide their trade entries and exits.

Moving Averages: Smoothing Market Volatility

Moving averages, with their ability to smooth market volatility, played a crucial role in the trader’s quest for profitable trades. By calculating the average price of a currency pair over a specified period, moving averages create a more stable representation of price trends. The trader skillfully employed different types of moving averages, such as the simple moving average (SMA), exponential moving average (EMA), and weighted moving average (WMA), each with its unique characteristics and applications. By incorporating moving averages into their trading strategy, the trader gained a clearer perspective on market trends and identified potential trend reversals.

Support and Resistance: Defining Boundaries

The concept of support and resistance levels proved to be an invaluable tool in the trader’s arsenal. Support refers to a price level at which a currency pair tends to find buyers, preventing further decline. Resistance, on the other hand, denotes a price level at which the currency pair encounters sellers, limiting its upward movement. By identifying these key levels on the chart, the trader was able to anticipate potential price movements and make informed trading decisions. Breaking through support or resistance levels often signaled a significant change in trend, providing opportunities for profitable trades.

Image: www.dailyforex.com

Indicators Enhance Decision-Making

In addition to traditional charting techniques, the trader also incorporated technical indicators into their trading strategy. These mathematical tools, applied to price data, provided additional insights into market trends and helped identify potential trading opportunities. Indicators such as the Relative Strength Index (RSI), Stochastic Oscillator, and Moving Average Convergence Divergence (MACD) became valuable weapons in the trader’s quest for profitability. By combining chart analysis with technical indicators, the trader gained a comprehensive understanding of market conditions, increasing their chances of making profitable trades.

Risk Management: Protecting Profits

While charting techniques played a pivotal role in identifying trading opportunities, risk management emerged as an equally crucial aspect of the trader’s success. Understanding the inherent risks involved in forex trading, the trader meticulously implemented a comprehensive risk management strategy. This included setting appropriate stop-loss orders to limit potential losses, employing leverage judiciously to balance risk and reward, and maintaining a healthy risk-to-reward ratio. By adhering to disciplined risk management practices, the trader preserved their capital and ensured the sustainability of their trading journey.

Growth Of 3500 Usd To 8500 Usd Forex Charts

Charting the Path to Success

As the trader’s skills and knowledge expanded, so too did their account balance. The $3500 initial investment transformed into an impressive $8500, a testament to the transformative power of mastering forex charts. This journey underscores the significance of technical analysis in the world of forex trading. By embracing the art of chart reading, traders can unlock valuable insights into market behavior, identify trading opportunities, and make informed decisions that lead to profitability.

For those aspiring to embark on a similar path of success, the lessons learned from this trader’s experience are invaluable. Dedicating time to studying chart patterns, moving averages, support and resistance levels, and technical indicators is essential.