Image: financeandtradingmadeeasy.blogspot.com

Navigating the complexities of forex trading can be daunting, but with the help of innovative tools like the Google Sheets Forex Position Size Calculator, traders can tackle the challenges with enhanced precision and risk management. This comprehensive guide delves into the intricacies of the position size calculator, empowering you to make well-informed decisions and maximize your trading potential.

Defining the Position Size Calculator: Your Risk Management Ally

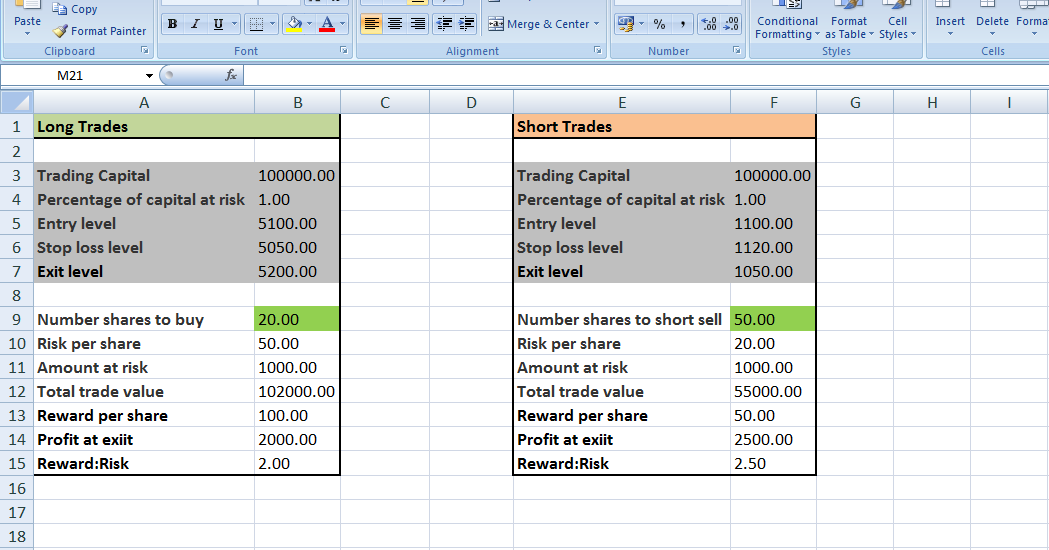

At the heart of successful forex trading lies the ability to determine the optimal position size—the amount of a currency pair to buy or sell—based on your risk tolerance, account balance, and market volatility. The Google Sheets Forex Position Size Calculator automates these calculations, taking the guesswork out of risk management. By inputting key parameters, traders can quickly and efficiently calculate the appropriate position size for any given trade, ensuring they align with their risk appetite and overall trading strategy.

Unleashing the Benefits of the Position Size Calculator

Precision Position Sizing: By using historical data and real-time market conditions, the calculator provides highly accurate position size recommendations, ensuring traders stay within their predetermined risk guidelines.

Customization and Flexibility: Adapt the calculator to suit your unique risk preferences and trading style. Whether you’re a conservative trader or an aggressive risk-taker, the tool offers customizable settings to cater to your individual needs.

Educational insights: The built-in formula and detailed explanations help traders understand the factors that influence position sizing. This fosters a deeper understanding of risk management principles and empowers them to make better-informed trading decisions.

How to Use the Position Size Calculator Effectively

-

Input your trading account balance: Specify the total funds available in your forex trading account.

-

Set your risk tolerance: Determine the percentage of your account balance you’re willing to risk on each trade. This should align with your risk management strategy and trading experience.

-

Select a currency pair: Choose the currency pair you intend to trade and input it into the calculator.

-

Set the stop-loss level: Define the maximum acceptable loss for the trade. This represents the point at which you’re willing to exit the position to minimize potential losses.

-

Enter market volatility: The calculator requires an estimate of market volatility. This can be obtained from historical data or real-time market indicators.

-

Calculate the position size: With all the necessary parameters set, click on the “Calculate” button to generate the recommended position size.

Image: www.brookstradingcourse.com

Risk Management Strategies: The Guardian of Your Capital

-

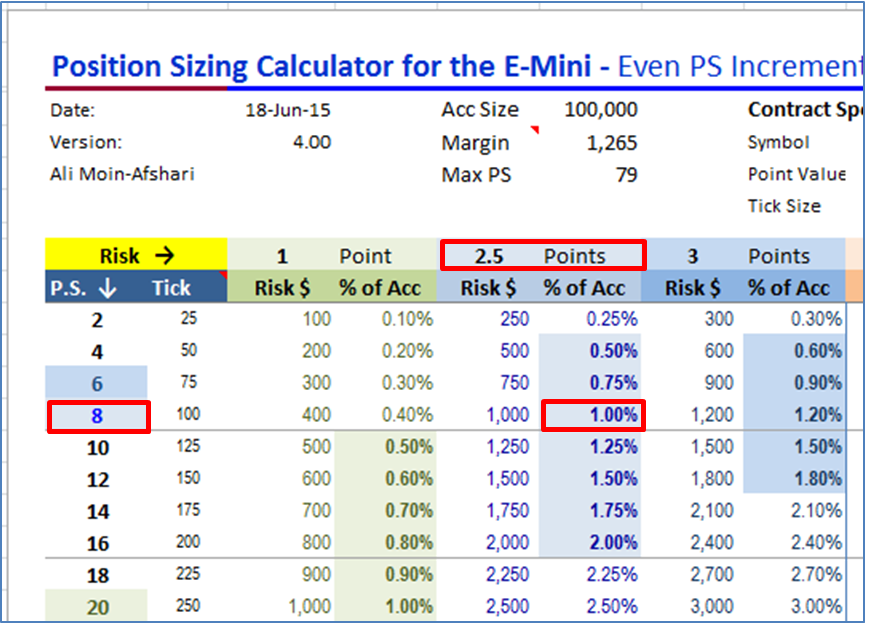

Fixed Ratio Method: This approach sets a fixed percentage of your account balance as the risk tolerance, typically ranging from 1% to 5%, depending on your risk tolerance.

-

Volatility-Based Method: This method adjusts position size based on market volatility. When volatility is low, you can allocate a larger position size, and when volatility is high, a smaller position size is recommended.

-

ATR-Based Method: The Average True Range (ATR) is a technical indicator that measures market volatility over a specific period. Traders can use the ATR as a basis for determining position size, allocating larger positions in less volatile markets and smaller positions in more volatile markets.

Google Sheets Forex Position Size Calculator

Conclusion

The Google Sheets Forex Position Size Calculator is a must-have tool for forex traders seeking to maximize their risk management and trading success. By employing this powerful tool, you can make informed and strategic trading decisions, ensuring you navigate market fluctuations with confidence. Embrace the benefits of accurate position sizing, customize it to your unique preferences, and delve into the risk management strategies discussed above. Remember, responsible trading practices empower you to unlock the full potential of forex trading while preserving your precious capital.