Unveiling the Golden Truth: A Comprehensive Guide to Gold Price Live Rate in Daily Forex Market

Image: ysifopukaqow.web.fc2.com

In the realm of precious metals, gold reigns supreme, captivating investors, traders, and collectors alike with its timeless allure and enduring value. Understanding the intricacies of its price fluctuations in the dynamic foreign exchange (forex) market is crucial for anyone navigating the financial landscape. This comprehensive guide will unravel the complexities of gold’s daily price dynamics, empowering you with the knowledge to make informed financial decisions.

Delving into the Essence of Gold

Gold, a precious metal revered throughout history, has served as a currency, a symbol of wealth, and a hedge against inflation for centuries. Its physical properties, including its rarity, malleability, and resistance to corrosion, have made it a highly sought-after commodity.

In the modern financial world, gold plays a pivotal role in the forex market, where currencies are traded in pairs. Its value is denominated in terms of the U.S. dollar (USD), making it a global benchmark for precious metal trading.

Live Tracking of Gold Price Fluctuations

The live gold price, updated in real-time, reflects the prevailing market sentiment and trading activity. These dynamic fluctuations are influenced by a myriad of factors, including economic data, geopolitical events, supply and demand dynamics, and investor expectations.

Deciphering the Forces Shaping Gold’s Value

Understanding the key drivers of gold price movements is essential for effective market navigation. Here’s a closer examination:

-

Economic Indicators: Gold is often considered a safe-haven asset during economic downturns or periods of geopolitical uncertainty. Strong economic data may weaken gold’s allure, while negative news can boost its value as investors seek refuge in precious metals.

-

Interest Rates: Rising interest rates generally reduce gold’s appeal, as investors can earn higher yields on alternative investments such as bonds and money market accounts.

-

Inflation: Gold often serves as a hedge against inflation, as its value tends to rise when the general price level increases.

-

Demand and Supply: Changes in the supply and demand for gold can significantly impact its price. Increased demand for gold jewelry, for example, can push prices higher.

Harnessing Market Insights for Intelligent Decisions

Knowledge is power, and in the gold market, this adage rings true. By leveraging live price updates and understanding the underlying factors that shape gold’s value, investors and traders can make informed decisions.

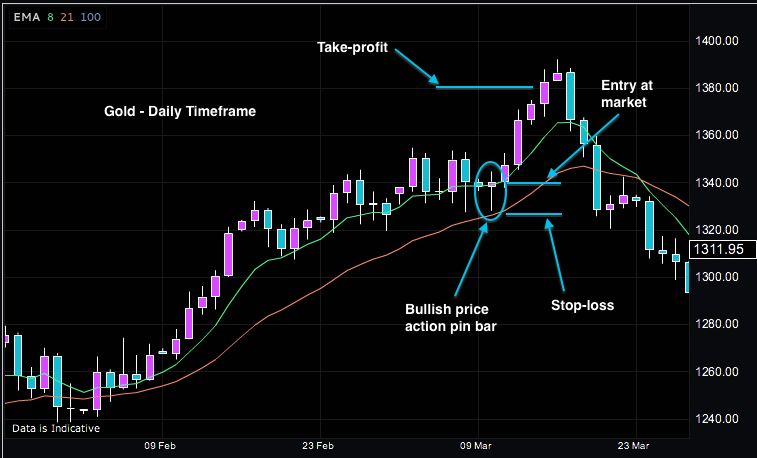

The Power of Charts and Technical Analysis

Charting tools and technical analysis can provide valuable insights into gold’s price movements. Analyzing historical price patterns, including support and resistance levels, can help identify potential trading opportunities.

Seeking Expert Guidance from Trusted Sources

Amidst the complexities of the gold market, turning to reputable sources for expert insights is crucial. Financial analysts, market commentators, and industry experts can offer valuable perspectives to enhance your understanding and decision-making.

Conclusion

Navigating the daily vagaries of gold price movements in the forex market demands a comprehensive understanding of the underlying factors, a keen eye on real-time price updates, and the ability to harness available market insights. By embracing this knowledge, individuals can navigate the complexities of precious metal trading with greater confidence and informed decision-making.

Image: www.seeitmarket.com

Gold Price Live Rate Daily Forex