Navigating the dynamic world of forex trading demands nimble strategies and a profound grasp of market dynamics. Among the crucial factors that shape currency price fluctuations is trading floor volume, which offers astute traders a window into the sentiments and actions of institutional players. By understanding the significance of trading floor volume forex and leveraging its insights, you can elevate your trading prowess and outmaneuver market complexities.

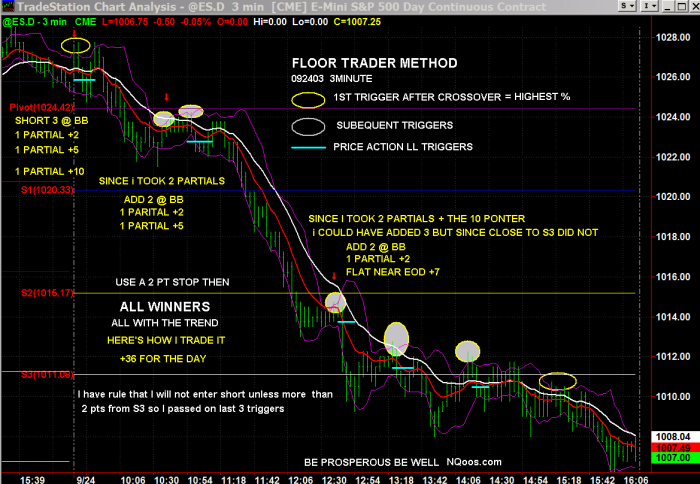

Image: forex-strategies-revealed.com

Delving into Trading Floor Volume Forex

Trading floor volume forex measures the real-time volume of currency transactions executed on global trading floors, including physical exchanges like the London Interbank Offered Rate (LIBOR) and electronic platforms such as EBS and Reuters. This data provides unparalleled transparency into the activities of major banks, hedge funds, and institutional investors – the market giants whose orders often steer market trends. By harnessing the knowledge embedded within trading floor volume forex, savvy traders can gain a competitive edge and optimize their trading decisions.

Benefits of Tracking Trading Floor Volume Forex

Integrating trading floor volume forex into your analytical toolkit unlocks numerous advantages for ambitious traders:

Early Identification of Market Trends

Institutional investors typically anticipate market movements, and their substantial orders can have a significant impact on currency prices. Monitoring trading floor volume forex enables you to detect shifts in their collective position before price action confirms them. By anticipating the direction of institutional money flow, you can position yourself for potentially lucrative opportunities.

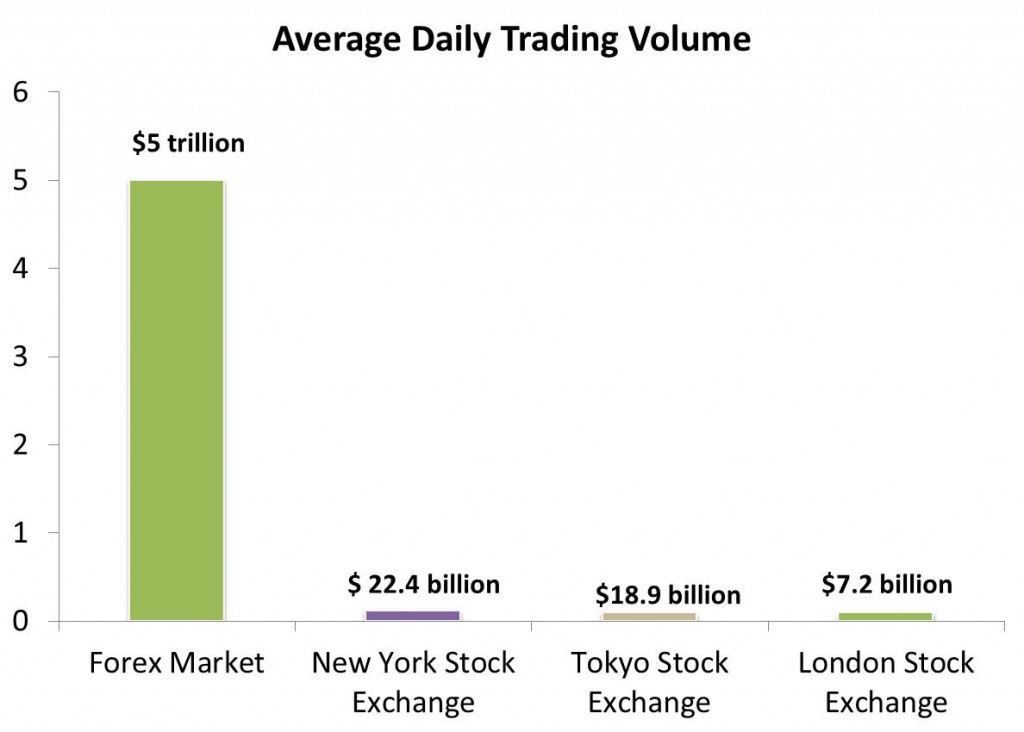

Image: www.educba.com

Gauging Market Sentiment

Trading floor volume forex provides invaluable insights into the prevailing market sentiment, particularly during periods of uncertainty or volatility. A spike in trading volume often indicates a surge in institutional participation, suggesting elevated market interest and conviction. Whether bullish or bearish, understanding the sentiment underlying these trades empowers you with informed decision-making.

Risk Management and Stop Loss Placement

Trading floor volume forex can enhance your risk management strategies by assisting in identifying potential market reversals. Abrupt declines in trading volume, particularly during strong trending conditions, can signal an impending shift in momentum. By referencing these signals, you can optimize your stop loss placement to mitigate losses effectively.

How to Interpret Trading Floor Volume Forex

Deciphering trading floor volume forex involves a multifaceted approach, considering various factors:

Absolute Volume:

High absolute volume levels generally indicate increased institutional activity and elevated market volatility, while low volume periods suggest a lull in market participation.

Relative Volume:

Compare trading floor volume forex to historical data to establish a baseline. Higher-than-average volume indicates unusual activity that could be indicative of significant market moves.

Order Flow:

Analyze the direction of institutional orders, whether buying (offers) or selling (bids), to identify potential supply and demand imbalances that could influence currency prices.

Becoming a Trading Floor Volume Forex Expert

Mastering trading floor volume forex requires dedication, analytical thinking, and the right resources:

1. Education and Research:

Invest in educational courses and books to solidify your understanding of forex trading dynamics and the nuances of trading floor volume analysis.

2. Reliable Data Providers:

Partner with credible data providers that offer accurate and real-time trading floor volume forex data to fuel your analysis.

3. Technological Tools:

Employ advanced charting platforms and technical indicators designed for trading floor volume forex analysis, empowering you with a comprehensive view of market activity.

Get Trading Floor Volume Forex

4. Patience and Discipline:

Successful application of trading floor volume forex requires patience and disciplined risk