Introduction

The foreign exchange (forex) market is a vast global marketplace where currencies are traded. As the world’s largest and most liquid financial market, forex attracts traders seeking opportunities to profit from exchange rate fluctuations. One popular trading strategy involves capitalizing on correlations between currency pairs, such as the British pound sterling (GBP) and the euro (EUR). Understanding the GBPUSD and EURUSD correlation can significantly enhance trading efficiency and profitability.

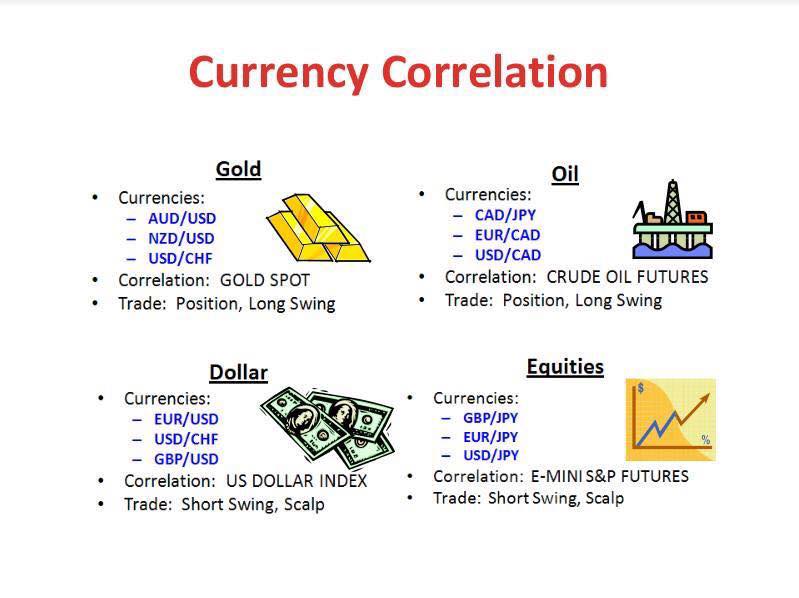

Image: forums.babypips.com

GBPUSD and EURUSD Correlation

The GBPUSD represents the value of one British pound in relation to the US dollar, while the EURUSD indicates the worth of one euro against the US dollar. As both the British pound and the euro are traded against the US dollar, their exchange rates often exhibit a positive correlation. This means that when the GBPUSD increases (meaning the British pound strengthens against the dollar), the EURUSD tends to follow suit and rise as well.

The GBPUSD and EURUSD correlation is influenced by various factors, including economic fundamentals, geopolitical events, and market sentiment. Strong economic growth in the United Kingdom and the European Union can lead to an increase in demand for their currencies, thus causing both GBPUSD and EURUSD to appreciate. Conversely, negative news or events can cause their currencies to weaken against the US dollar.

Trading Strategy

Understanding the GBPUSD and EURUSD correlation can provide valuable insights for trading strategies. One such strategy involves going long on GBPUSD and EURUSD simultaneously. When both currencies are expected to rise against the dollar, traders can capitalize on this correlation by entering long positions in both pairs. This strategy aims to benefit from the appreciation of both the British pound and the euro.

To implement this trading strategy effectively, it is crucial to monitor economic news and market sentiment that could affect the GBPUSD and EURUSD. Correlation does not imply that the two currency pairs will always move in the same direction, and traders should be aware of potential divergence.

Correlation Strength and Limitations

It is important to note that the GBPUSD and EURUSD correlation is not always perfect or constant. Factors such as unexpected events or market volatility can disrupt the correlation. Traders should monitor the correlation strength over time to assess its reliability.

While understanding GBPUSD and EURUSD correlation can enhance trading efficiency, traders should not solely rely on this correlation for their trading decisions. It is a useful tool when used in conjunction with other trading strategies and risk management techniques.

Image: kagels-trading.com

Risks and Considerations

Like all forex trading, this strategy has inherent risks. Traders should carefully consider their risk tolerance and manage their positions prudently. Leveraged trading can amplify both profits and losses, making risk management paramount.

Traders should also be aware of economic data releases and major news events that could impact the GBPUSD and EURUSD correlation. Staying up-to-date with market developments and analyzing economic indicators can help traders make informed trading decisions.

Gbpusd And Eurusd Correlation Forex Trading Strategyea

Conclusion

Understanding the GBPUSD and EURUSD correlation can provide traders with a powerful tool to enhance their trading strategies. By identifying opportunities to exploit the relationship between the two currency pairs, traders can increase their potential for profit. However, it is essential to remember that correlation does not guarantee identical movements and should be used in conjunction with other trading strategies and risk management techniques. By carefully planning and properly managing risks, traders can harness the GBPUSD and EURUSD correlation to navigate the forex market more effectively.