In the tumultuous world of currency markets, the pound sterling (GBP) and US dollar (USD) have maintained a special relationship, influencing global trade and investment. As we approach a pivotal juncture in their interplay, it’s crucial to delve into the gbp usd forecast forex crunch and unravel the factors shaping their destinies.

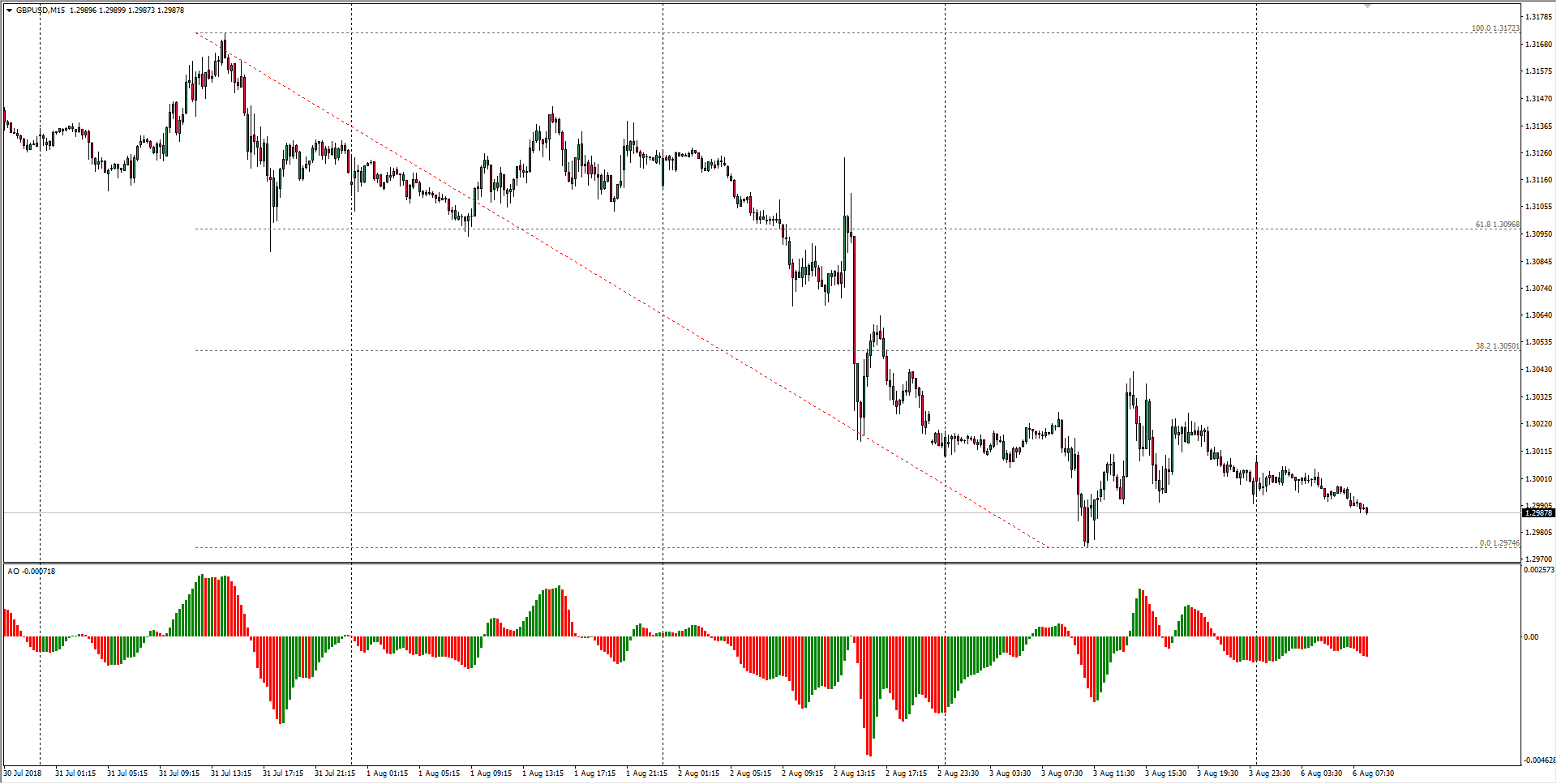

Image: microforextrading.blogspot.com

The GBP/USD exchange rate has been on a rollercoaster ride recently, influenced by a myriad of economic data, political uncertainties, and global developments. To unravel the intricate tapestry of this currency pair, let’s embark on a journey into their past, present, and projected future.

Historic Interplay and Economic Fundamentals

TheGBP/USD exchange rate has a rich history,marked by periods of stability and volatility.Historically, the pound sterling enjoyed a commanding position as the world’s reserve currency, but the rise of the US dollar in the post-World War II era has challenged its dominance.

In recent years, the GBP/USD exchange rate has been heavily influenced by economic fundamentals, particularly interest rate differentials between the United Kingdom and the United States. When interest rates are higher in the UK than in the US, it makes the pound more attractive to investors, leading to an increase in its value against the dollar. Conversely, when interest rates are lower in the UK, investors tend to shift their investments to the US, causing the pound to weaken.

Brexit Saga and Political Unrest

Brexit, the United Kingdom’s withdrawal from the European Union, has cast a significant shadow over the GBP/USD exchange rate. The uncertainty surrounding the terms of Brexit and its potential impact on the UK economy has caused market volatility and fluctuations in the pound’s value.

Political unrest, both within the UK and the US, has also contributed to the GBP/USD forex crunch. Domestic political uncertainty in the UK, including changes in leadership and the ongoing debate over Scottish independence, has affected investor confidence in the pound.

Global Economic Forces and Central Bank Policies

The global economic outlook, particularly the growth prospects of the UK and US economies, plays a pivotal role in shaping the GBP/USD exchange rate. A strong and growing UK economy, relative to the US, tends to boost the value of the pound, while a weakening economy exerts pressure on its value.

Central bank policies, especially those of the Bank of England and the Federal Reserve, also have a significant impact on the GBP/USD exchange rate. Changes in interest rates, quantitative easing, and other monetary policy tools influence the attractiveness of the pound and dollar for investors, leading to fluctuations in their exchange rate.

Image: www.forexcrunch.com

GBP/USD Forecast: Experts’ Perspectives

Financial experts and economists closely monitor the GBP/USD exchange rate, providing their insights and predictions. While there is no consensus among experts, some common themes emerge from their forecasts.

Many experts believe that the GBP/USD exchange rate will remain volatile in the near term, as the Brexit saga continues to unfold and global economic conditions remain uncertain. However, they also predict a gradual recovery in the value of the pound in the long term, as the UK economy recovers from the pandemic and Brexit-related uncertainties subside.

Actionable Tips for Smart Investors

Navigating the GBP/USD forex crunch requires astute judgment and prudent investment strategies. Here are a few actionable tips for savvy investors:

-

Diversify your investments to mitigate risks associated with currency fluctuations.

-

Use currency exchange platforms that offer competitive rates and low fees to save on transaction costs.

-

Keep abreast of economic news and political developments that could impact the GBP/USD exchange rate.

-

Consider hedging your currency exposure if you have substantial investments in the UK or US.

-

Consult with a financial advisor to tailor an investment strategy that aligns with your specific goals and risk tolerance.

Gbp Usd Forecast Forex Crunch

Conclusion: Embracing the GBP/USD Dance

The GBP/USD exchange rate is a dynamic and ever-evolving force in the global currency market. Its fluctuations reflect a complex interplay of economic fundamentals, political uncertainties, and global economic conditions. By understanding the historical, present, and projected dynamics shaping this currency pair, investors can make informed decisions and navigate the GBP/USD forex crunch with greater confidence and success.

As the world continues to grapple with uncertainty, the GBP/USD relationship will undoubtedly face further challenges and opportunities. Embracing the dance of these two currencies, with its twists and turns, can empower investors to harness its potential and achieve their financial objectives.