Are you seeking to propel your foreign exchange trading to unprecedented heights? Look no further than the world of future contracts. These powerful instruments offer a dynamic gateway to maximizing returns, hedging risks, and gaining unparalleled market exposure. Step into the captivating world of forex future contracts, where the future of financial gain converges with expert insights and actionable tips.

Image: eminitradingschool.com

What are Forex Future Contracts?

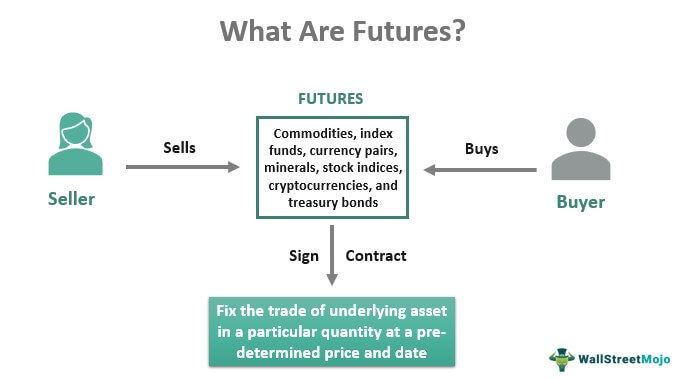

Forex future contracts, also known as currency futures, are standardized agreements to buy or sell a specific amount of a currency at a predetermined price on a future date. Unlike spot contracts that facilitate immediate exchange, future contracts lock in a price today for a transaction that will occur at a later point in time. This time-based element endows future contracts with unique advantages that can empower traders of all levels.

Benefits of Forex Future Contracts

The allure of forex future contracts lies in their inherent benefits, which include:

-

Market Exposure: Future contracts provide traders with unparalleled access to global currency markets, allowing them to tap into market trends and seize opportunities across borders.

-

Leverage: The leveraged nature of future contracts amplifies traders’ potential returns, magnifying both profits and losses. Employing leverage judiciously can propel gains to impressive heights.

-

Two-Way Street: Future contracts are not confined to buying alone; they empower traders to capitalize on both rising (long) and falling (short) markets, catering to diverse market sentiments.

-

Risk Management: Future contracts serve as a potent tool for managing currency risk. By locking in exchange rates, traders can mitigate the adverse effects of currency fluctuations and protect their investments.

Examples of Forex Future Contracts

The realm of forex future contracts encompasses a diverse array of currencies, each with its own unique characteristics and trading patterns. Some of the most widely traded forex future contracts include:

-

EUR/USD (Euro/US Dollar): This is the most actively traded currency pair globally, reflecting the dominance of the euro and the US dollar in the international financial system.

-

USD/JPY (US Dollar/Japanese Yen): The high liquidity and volatility of this currency pair make it popular among traders seeking short-term trading opportunities.

-

GBP/USD (British Pound/US Dollar): The UK’s strong economic fundamentals and global influence make the British pound a significant player in currency markets, resulting in a highly traded GBP/USD future contract.

-

AUD/USD (Australian Dollar/US Dollar): As a commodity-linked currency, the Australian dollar is heavily influenced by global economic trends, making the AUD/USD future contract attractive for traders seeking exposure to natural resources.

-

CHF/USD (Swiss Franc/US Dollar): The Swiss franc’s reputation as a safe-haven currency during periods of market volatility attracts traders looking for stability and potential appreciation.

Image: www.wallstreetmojo.com

Expert Insights on Forex Future Contracts

Seasoned forex traders and market analysts offer invaluable insights into the world of future contracts:

-

“Future contracts provide a structured and standardized approach to trading currencies, enabling traders to execute complex strategies effectively.” – John Carter, Technical Analyst

-

“Understanding the fundamentals of the underlying currencies is crucial for successful future contract trading. Knowledge is power in this realm.” – Kathy Lien, Currency Analyst

-

“Leverage can be a double-edged sword. While it can enhance profits, it can also magnify losses. Tread cautiously and employ it responsibly.” – Adam Cohen, Managing Director, Forex Brokerage Firm

Actionable Tips for Leveraging Future Contracts

To harness the potential of forex future contracts effectively, consider these actionable tips:

-

Technical Proficiency: Delve into technical analysis techniques to decipher market trends and identify potential trading opportunities.

-

Risk Management: Define your risk tolerance and implement robust risk management strategies to safeguard your capital.

-

Volatility Tolerance: Understand the volatility patterns of the currencies you trade and ensure your trading strategy aligns with your risk appetite.

-

Liquidity Assessment: Choose highly liquid future contracts to ensure seamless execution of trades at favorable prices.

-

Market Sentiment: Monitor news and economic events that may influence currency values and incorporate this information into your trading decisions.

Future Contract Examples In Forex

Conclusion

Forex future contracts stand as a testament to the transformative power of financial instruments. By embracing their versatility, traders can unlock the potential for substantial returns, mitigate risks, and expand their market reach. Start your journey today, armed with the knowledge and insights gleaned from this article, and ascend to new heights of trading success. Remember, the future of your financial endeavors is in your hands. Seize the opportunity and let forex future contracts be your guiding force towards market dominance.