Introduction

In the realm of banking, the Treasury Forex Management Department plays a pivotal role in managing the bank’s foreign exchange (forex) activities. As a financial hub, banks facilitate the exchange of currencies, enabling global trade and investments. The Treasury Forex Management Department is tasked with ensuring the smooth functioning of these transactions, safeguarding the bank from currency fluctuations, and maximizing financial benefits.

Image: www.eguardian.co.in

Functions of the Treasury Forex Management Department

- Foreign Exchange Transactions: The department handles the buying and selling of foreign currencies, facilitating international payments and trade settlements.

- Currency Risk Management: It identifies and mitigates currency risks by implementing hedging strategies, such as forward contracts and options, to protect the bank and its clients.

- Asset Management: The department manages the bank’s forex reserves, investing in foreign currency instruments to generate returns or maintain liquidity.

- Liquidity Management: It ensures adequate liquidity for forex transactions by monitoring currency supply and demand, providing access to reliable liquidity providers.

- Market Analysis and Reporting: The department closely tracks global currency markets, analyzes market trends, and provides advisory services to clients based on its insights.

- Compliance and Regulation: It adheres to regulations and anti-money laundering laws to combat financial crime and maintain ethical practices in the forex market.

Benefits of Treasury Forex Management

- Exchange Rate Stability: Effective forex management helps maintain stability in exchange rates, facilitating smooth cross-border transactions.

- Protection from Currency Fluctuations: It provides a protective shield against adverse currency fluctuations, safeguarding the bank’s financial performance.

- Capital Optimization: The department maximizes the bank’s capital by arbitraging between currencies and exploiting interest rate differentials.

- Informed Decision-Making: The valuable insights and advisory services provided by the department aid clients in making informed financial decisions.

- Enhanced Operational Efficiency: It streamlines forex operations, minimizing transaction costs and enhancing overall efficiency.

Case Studies on Treasury Forex Management

- Central Bank Intervention: Central banks use forex management to stabilize exchange rates during periods of market volatility, preventing economic turmoil.

- Corporate Hedging: Companies operating internationally rely on forex management to mitigate currency risks and protect their profits from adverse fluctuations.

- Exchange Traded Funds (ETFs): ETFs that invest in foreign currencies provide an accessible way for investors to diversify their portfolios and participate in the forex market.

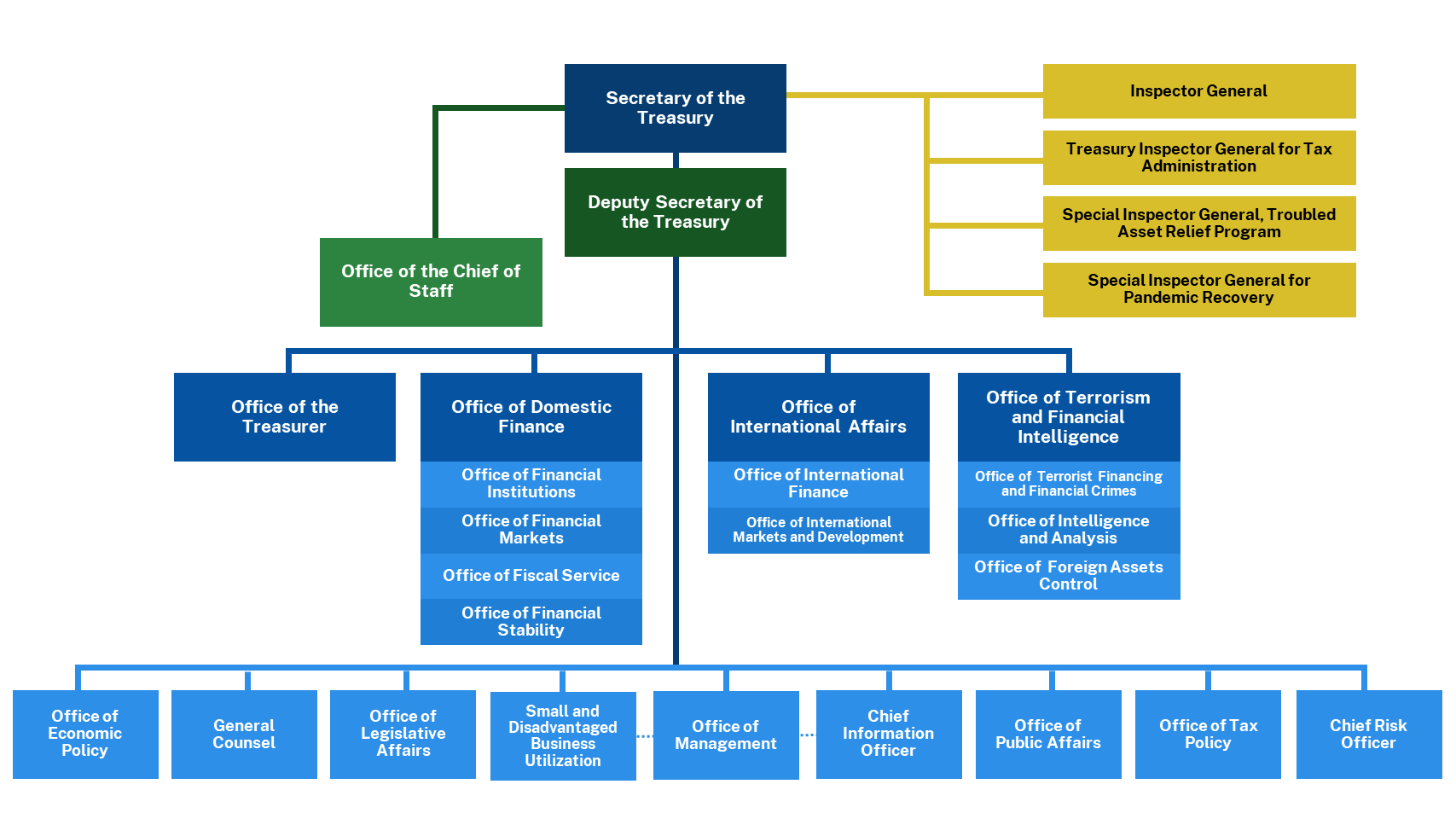

Image: www.eatlife.net

Functions Of Treasury Forex Management Dept In Bank

Conclusion

The Treasury Forex Management Department is an integral part of a bank’s operations, facilitating global financial transactions, managing currency risks, and maximizing financial returns. Its role is crucial in ensuring the smooth functioning of international trade, protecting financial institutions from market uncertainties, and providing investors with opportunities to participate in the global currency market.