Introduction

In the ever-evolving global economy, foreign exchange (forex) plays a pivotal role in facilitating international trade, investments, and financial transactions. Banks, as the backbone of financial systems, have established specialized forex departments to cater to the complex nature of currency exchange. Understanding the intricate functions of a forex department is paramount for businesses, investors, and individuals engaging in cross-border transactions.

Image: tradingpoints.blogspot.com

Functions of the Forex Department

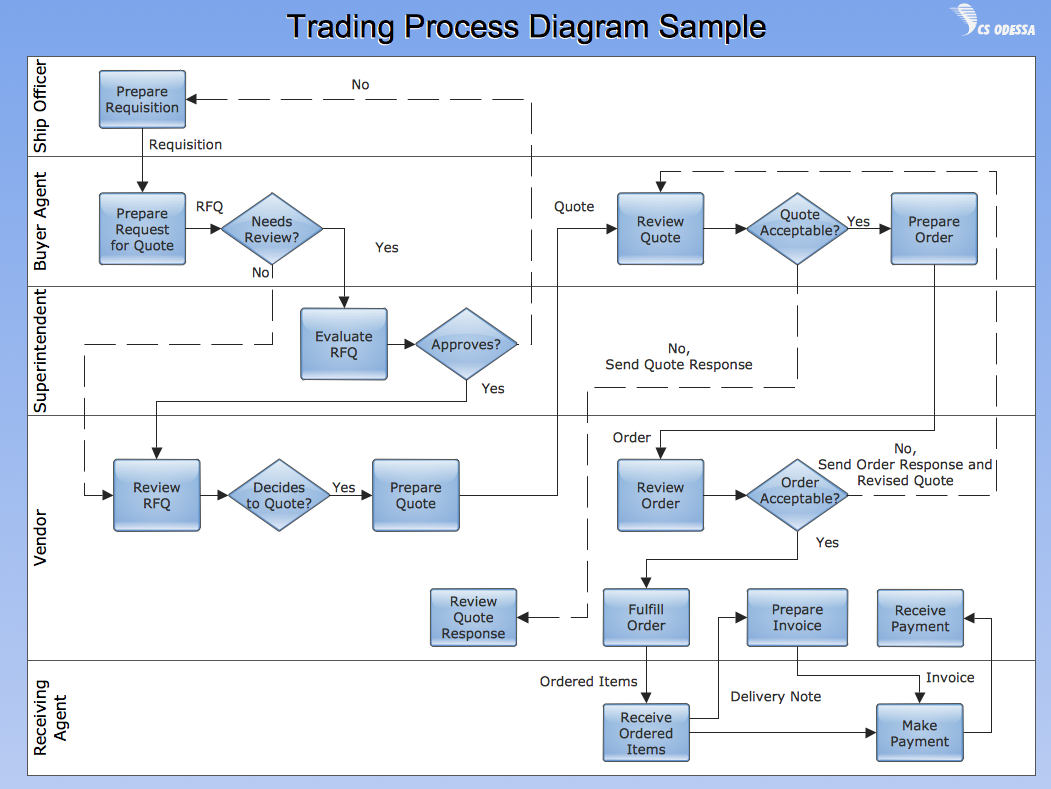

The forex department in a bank assumes a multitude of responsibilities, each contributing to the smooth flow of international currency exchange. A comprehensive flow chart can effectively illustrate these functions, providing a clear visual representation of the processes involved.

1. Monitoring Currency Markets

The forex department constantly monitors global currency markets, analyzing exchange rates, market trends, and economic indicators. This real-time monitoring enables banks to identify potential opportunities, manage risk, and adapt to market fluctuations effectively.

2. Foreign Currency Trading and Brokerage

The department executes foreign currency transactions on behalf of clients and the bank itself. Acting as currency brokers, they facilitate the buying and selling of currencies in the interbank market, ensuring competitive rates for clients.

Image: japaneseclass.jp

3. Risk Management

Forex trading involves inherent risks, such as exchange rate volatility and credit risks. The forex department implements comprehensive risk management strategies to mitigate potential losses. This includes setting limits, monitoring exposure, and using hedging techniques to minimize currency risks.

4. Providing Currency Advisory Services

Bank employees within the forex department offer expert advice and guidance to clients on currency exchange strategies, market forecasts, and risk management. They assist clients in making informed decisions on currency transactions and investment portfolios.

5. Transaction Settlement and Reconciliation

The department handles the settlement and reconciliation of foreign exchange transactions. This involves ensuring timely transfers of funds between banks, verifying transaction details, and reconciling accounts to maintain accurate financial records.

6. Supporting International Trade and Investment

The forex department plays a critical role in facilitating international trade and investment. It provides currency exchange services to businesses and individuals involved in cross-border transactions, enabling them to conduct business efficiently and minimize foreign exchange risks.

7. Treasury Management and Liquidity Optimization

The bank’s treasury is responsible for managing the bank’s financial resources, including foreign currencies. The forex department collaborates with the treasury team to optimize liquidity, manage potential imbalances, and ensure the bank maintains an adequate supply of foreign currencies to meet client demand.

8. Compliance and Regulatory Oversight

The department adheres to stringent compliance requirements and regulatory guidelines governing foreign exchange transactions. This includes implementing anti-money laundering (AML) and know-your-customer (KYC) measures to prevent illegal activities and ensure compliance with international financial standards.

Functions Of Forex Department In A Bank On Flow Chart

Conclusion

The forex department in a bank constitutes an indispensable unit that facilitates global financial transactions, manages currency risks, and enhances international trade and investment. Its multifaceted functions, as illustrated in the comprehensive flow chart, empower banks to navigate the dynamic world of foreign exchange, providing valuable services to their clients while contributing to economic growth and stability on a global scale.