Introduction

In the dynamic and fast-moving world of forex trading, every millisecond matters. To capitalize on market opportunities and minimize losses, traders employ a range of strategies, including the use of specific order types. Among these, OSPL stands out for its flexibility and efficiency. OSPL, an acronym for Opening, Stop, Profit, and Limit, is a comprehensive order that allows traders to set multiple parameters for their trades, maximizing their potential for success.

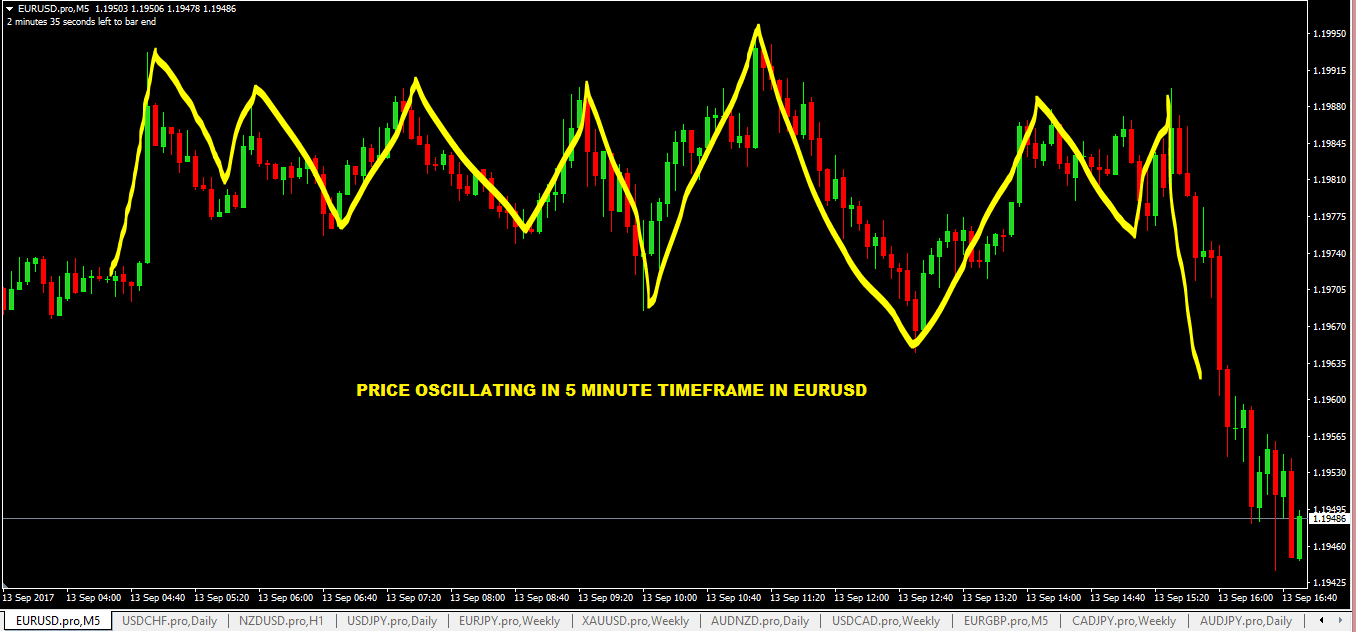

Image: www.forexcracked.com

Understanding OSPL Orders

An OSPL order encompasses four essential components: the opening price, stop price, profit target, and limit price. Let’s delve into each:

-

Opening Price: This is the price at which the trade will be executed. Traders can choose a specific price or use market orders to open a trade at the current market price.

-

Stop Price: This price level serves as a safety net. If the market moves against the trader’s position, the stop loss will automatically close the trade to minimize potential losses.

-

Profit Target: This represents the trader’s desired profit goal. Once this level is reached, the trade is automatically closed, securing the profits.

-

Limit Price: The limit price is usually used in conjunction with stop loss orders. Once the market price reaches the limit price, the order automatically cancels, preventing the trade from being executed.

Benefits of Using OSPL Orders

OSPL orders offer numerous advantages that make them a preferred choice among traders:

-

Automated Trading: OSPL orders automate the trading process, relieving traders from the need to constantly monitor the market and manually adjust their positions.

-

Enhanced Risk Management: The stop price protects traders from substantial losses by automatically closing trades when the market moves against them.

-

Predefined Profit Targets: By setting a profit target, OSPL orders help traders lock in profits and minimize the risk of greed.

-

Efficient Execution: OSPL orders can be placed and executed quickly, allowing traders to take advantage of sudden market movements.

Types of OSPL Orders

Depending on the trading strategy, traders can use different types of OSPL orders:

-

Buy OSPL: This order is placed when traders expect the market price to rise. The opening price is set above the current market price, with the other parameters adjusted accordingly.

-

Sell OSPL: This order is used when traders anticipate a fall in prices. The opening price is fixed below the current market price, and the other parameters are modified to match the trading strategy.

Image: www.tradingview.com

Application of OSPL Orders in Practice

Let’s consider a practical example to illustrate OSPL orders:

Imagine a trader who wants to buy the EUR/USD currency pair. The trader sets an opening price of 1.1200, a stop loss of 1.1150, a profit target of 1.1250, and a limit price of 1.1300.

If the market price reaches 1.1200, the trade will be executed. Should the market move down to 1.1150, the stop loss will close the trade, limiting the trader’s loss. Conversely, if the price climbs to 1.1250, the profits will be secured by closing the trade. Finally, if the market reaches 1.1300 before the profit target is achieved, the order will automatically cancel, protecting the trader from unfavorable market swings.

Full Form Of Ospl In Forex

Conclusion

OSPL orders are powerful tools in the forex trader’s arsenal. By combining opening, stop, profit, and limit parameters, OSPL orders automate trade execution, enhance risk management, and maximize profit potential. Whether you’re a seasoned pro or a novice venturing into the forex market, mastering OSPL orders will significantly improve your trading efficiency and put you on the path to success. Embrace OSPL orders today and unlock a new level of control and profitability in your forex trading endeavors.