Introduction

Image: swing-trading-strategies.com

In the dynamic world of foreign exchange trading, navigation can be treacherous. As a trader, you constantly grapple with market complexities and seek an edge to stay ahead. Free forex trade signals emerge as an invaluable tool, empowering traders of all levels to make informed decisions and boost their account performance.

Understanding Forex Signals

Forex signals provide actionable recommendations on currency pairs, trade entry and exit points, and other critical trading parameters. They’re typically generated by experienced analysts or automated trading systems that monitor market conditions and identify potential trading opportunities. By adhering to these signals, traders can gain valuable insights into the market’s direction and execute trades accordingly.

Types of Forex Signals

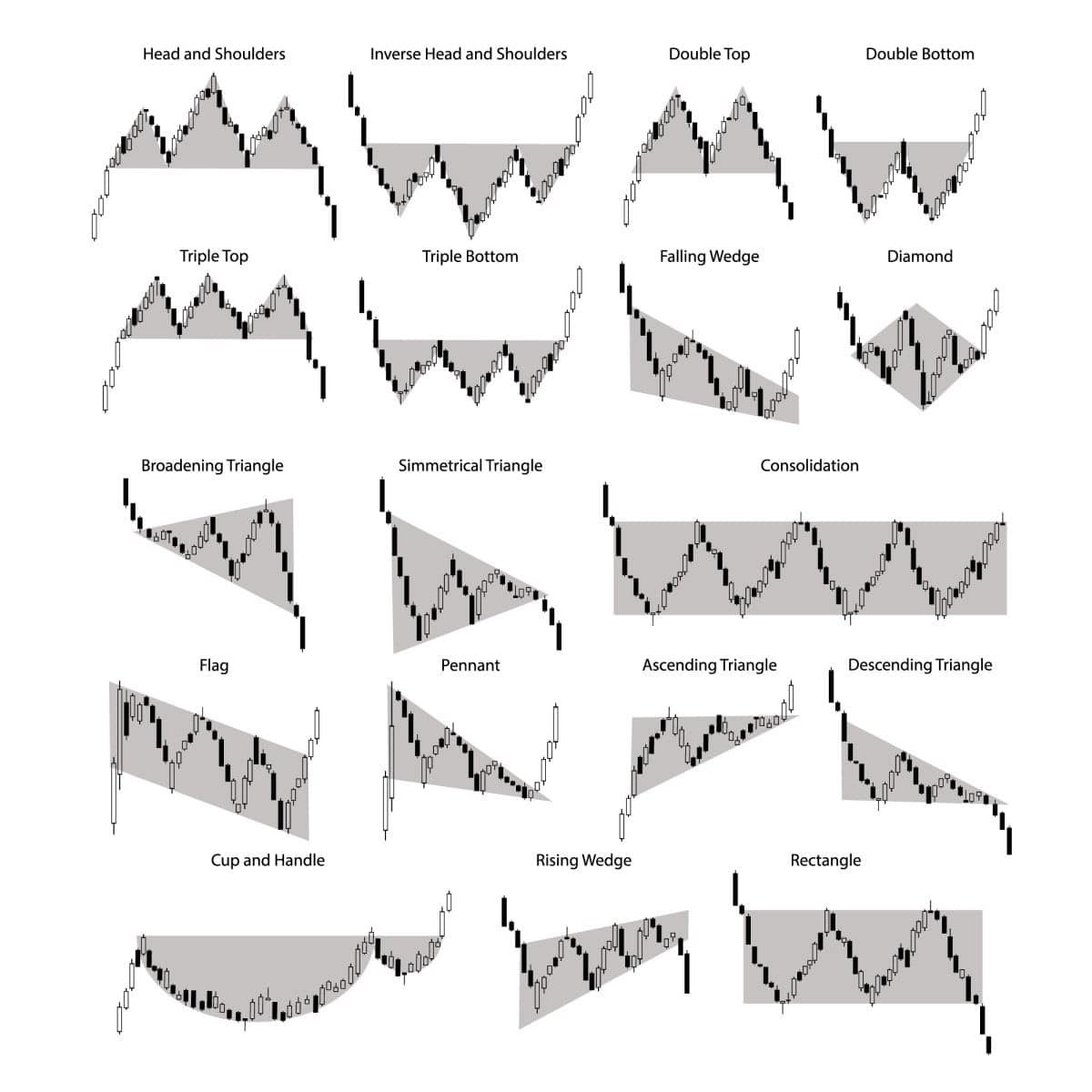

- Technical Signals: Based on price chart analysis, technical signals identify patterns and trends to predict future price movements.

- Fundamental Signals: Consider economic events, news releases, and macroeconomic indicators to assess market sentiment and anticipate potential shifts.

- Automated Signals: Utilize algorithms to analyze market data and generate trading recommendations based on predefined parameters.

Benefits of Free Forex Trade Signals

- Enhanced Accuracy: Signals provided by experienced analysts or reputable providers often boast high accuracy rates, increasing your chances of making profitable trades.

- Time-Saving: Trade signals eliminate the need for extensive market analysis, saving you precious time and effort.

- Risk Management: Signals typically include stop-loss and take-profit levels, helping you define risk parameters and manage potential losses.

- Suitable for All Levels: Whether you’re a seasoned trader or just starting out, trade signals can cater to your specific skillset and knowledge level.

Expert Tips for Using Forex Signals

To maximize the effectiveness of free forex trade signals, follow these expert recommendations:

- Verify Reliability: Research the signal provider’s track record, reputation, and success rates before using their signals.

- Understand the Signals: Familiarize yourself with the trading parameters used to generate signals, including technical indicators and market conditions.

- Manage Risk: Always set stop-loss orders to limit potential losses, even when using signals from trusted sources.

- Learn from Signals: Analyze the signals you receive to identify patterns and market behavior that contribute to successful trades.

Image: libertex.org

Free Forex Trade Signals With Trading Account

FAQ on Forex Signals

- Are forex signals always accurate? While signals can provide high accuracy rates, they should not be considered 100% accurate, as Forex trading involves inherent risk.

- Can I rely solely on forex signals? Signals offer valuable insights, but it’s crucial to use them in conjunction with your own analysis and trading strategy.

- How much do forex signals cost? Many reputable providers offer free forex signals, while some may charge a fee for premium services.

Conclusion

Incorporating free forex trade signals into your trading strategy can significantly enhance your performance. By harnessing the expertise of seasoned analysts and utilizing automated trading systems, you can gain an advantage in the competitive world of Forex trading. Embrace these signals, apply expert advice, and embrace the opportunity to amplify your trading account’s potential.

Are you eager to delve deeper into the world of Forex signals and revolutionize your trading experience? Share your thoughts and participate in the conversation below. Let us embark on the path to trading success together!