Navigating the world of finance can be complex and overwhelming, especially when it comes to cross-border transactions and foreign exchange. However, with the convenience of forex cards, individuals and businesses can facilitate international payments effortlessly. While forex cards offer many advantages, they also raise concerns about fraud and unauthorized transactions. In this comprehensive guide, we will explore the intricacies of forex card fraud, shedding light on its nature, common scenarios, and effective preventive measures to safeguard your hard-earned money.

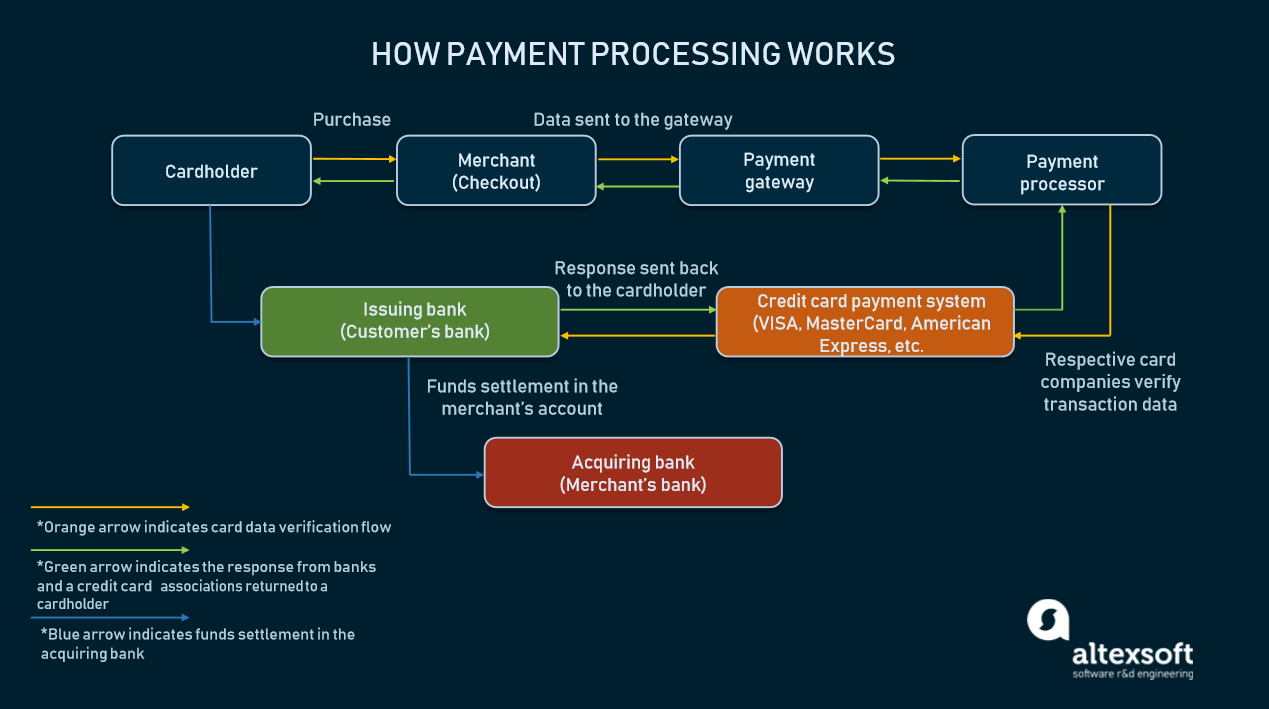

Image: www.altexsoft.com

Understanding Forex Card Fraud: A Definition

Forex card fraud, also known as unauthorized transactions, occurs when an individual gains illegal access to your forex card information and uses it to make fraudulent purchases or withdrawals. Cybercriminals employ various sophisticated techniques to compromise your sensitive data, including phishing scams, skimming devices, and data breaches.

Recognizing Common Forex Card Fraud Scenarios

Fraudulent transactions can manifest in numerous ways. Here are a few prevalent scenarios to be aware of:

-

Unauthorized Card Use: Your forex card details can be compromised, allowing unauthorized individuals to make purchases online or offline without your knowledge or consent.

-

Phishing Scams: Fraudsters send deceptively genuine emails or text messages that mimic the official communication of forex card providers. These messages often contain links that redirect you to malicious websites to collect your personal and card details.

-

Skimming Devices: Imposters may install skimming devices on ATMs or POS machines to capture your card data when you make a transaction. These devices work in conjunction with hidden cameras to record your PIN, providing criminals with all they need to commit fraudulent activities.

-

Counterfeit Cards: Fraudsters create counterfeit copies of your forex card using stolen data and use them to make purchases or withdraw funds. They often target vulnerable areas where security measures are lax.

-

Data Breaches: Reputable financial institutions and retailers can experience data breaches, exposing customer information, including forex card details, to unauthorized access. Cybercriminals exploit these vulnerabilities to perpetuate fraud.

Understanding these common scenarios is crucial to preventing and detecting forex card fraud. By being vigilant and adopting proactive measures, you can protect your financial well-being from malicious actors.

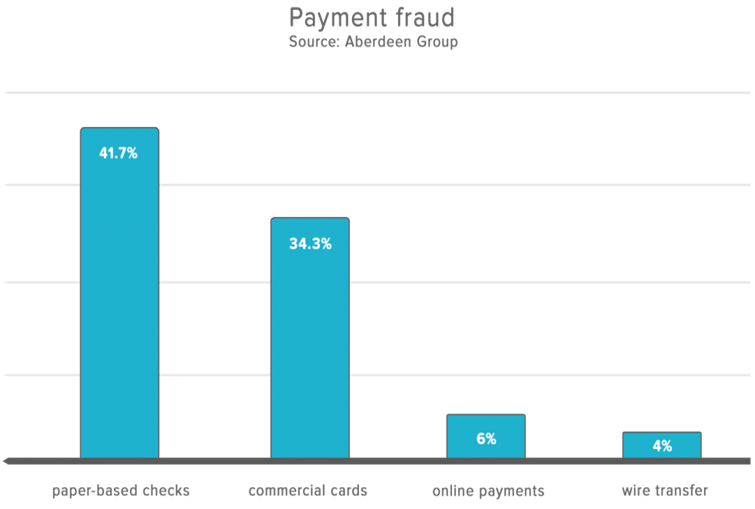

Image: www.ijraset.com

Fraud Transaction In Forex Card

Protecting Your Forex Card: Essential Preventive Measures

Safeguarding your forex card from fraud requires a combination of vigilance, proactive measures, and collaboration with your forex card provider. Here are some effective preventive strategies to consider:

-

Secure Your Personal Information: Avoid sharing your forex card details over unsecure channels like public Wi-Fi or unsecured websites. Be cautious of unsolicited emails or text messages requesting sensitive information.

-

Enable Two-Factor Authentication (2FA): Implement 2FA for your forex card account, requiring an additional verification step when making transactions. This adds an extra layer of security, making it more challenging for fraudsters to compromise your account.

-

Monitor Your Transactions Regularly: Regularly review your forex card statements to identify any suspicious or unauthorized transactions. Early detection allows you to promptly report fraudulent activities to your provider and minimize potential losses.

-

Enable Transaction Alerts: Enroll in transaction alert services offered by your forex card provider. This way, you will receive notifications for every transaction made on your card. Prompt alerts empower you to challenge unauthorized transactions swiftly.

-

Use Secure Online Payment Methods: When making online purchases, ensure you are on a secure website (look for “HTTPS” in the URL) and that the payment gateway is reputable. Avoid providing your forex card details on unknown or suspicious platforms.

-

Be Aware of Skimming Devices: Inspect ATMs and POS machines for any suspicious attachments or modifications before inserting your card. If you notice any anomalies, abort the transaction and inform the relevant authorities.

-

Stay Updated with Your Forex Card Provider’s Security Measures: Financial institutions continuously enhance their security protocols. Stay informed about the latest updates and take advantage of any additional security measures they may offer.

-

Report Lost or Stolen Cards Promptly: If your forex card is lost or stolen, report it to your provider immediately. The sooner you report the incident, the faster your card can be blocked, preventing further unauthorized transactions.

By adhering to these preventive measures, you can significantly reduce the risk of falling victim to forex card fraud. Remember, protecting your financial assets is a shared responsibility, and working closely with your forex card provider is essential to ensure your funds remain safe and secure.