In the ever-evolving landscape of forex trading, grasping the market’s pulse is paramount for profitability. One indispensable tool that empowers traders with profound insights into prevailing trends is the WRO Trend Line Indicator. This ingenious technical indicator unveils the underlying trend’s strength, direction, and potential reversals, enabling traders to strategize with precision.

Image: top-forex-indicators.com

The WRO Trend Line Indicator, an acronym for Williams %R Oscillator, harnesses the principles of momentum and volatility to unravel the market’s trajectory. It measures the relationship between a security’s closing price and its price range over a specific period, typically 14 trading days. This calculation results in a value that oscillates between -100 and 100, where readings below -80 indicate oversold conditions, and values above 80 suggest overbought territory.

Unveiling the Mechanics of WRO Trend Lines

The WRO Trend Line Indicator transforms the WRO’s raw data into a user-friendly trend line representation. It plots the high and low points of the WRO’s oscillations, connecting them to create a dynamic visualization of price swings. By analyzing the slope, position, and direction of these trend lines, traders can discern critical information about the prevailing market conditions.

Harnessing WRO Trend Lines for Forex Dominance

The WRO Trend Line Indicator empowers traders with a versatile arsenal of insights to navigate the complexities of forex trading:

-

Trend Identification: The slope of the WRO trend line reveals the underlying trend’s direction. When the trend line ascends, it signifies an uptrend, while a descending trend line indicates a downtrend.

-

Trend Strength Assessment: The steepness of the WRO trend line unveils the strength of the underlying trend. A sharply-angled trend line suggests a robust trend with significant momentum, while a flat trend line indicates a weaker trend prone to reversals.

-

Trend Reversal Detection: The WRO trend line’s interactions with extreme values (-100 and 100) can signal potential trend reversals. When the trend line breaches these levels, it often precedes a change in the market’s direction.

-

Trade Timing: The WRO Trend Line Indicator can also inform trade timing by identifying areas of potential price pullbacks. When the WRO trend line touches or intersects with support or resistance levels, it may indicate a pause or reversal in the current trend, providing opportunities for advantageous trades.

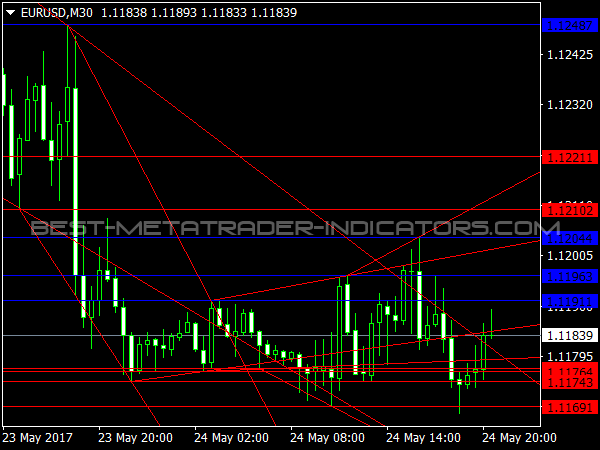

Case Study: Leveraging WRO Trend Lines to Reap Forex Profits

In a recent forex trade, the EUR/USD currency pair showed a sustained uptrend on the hourly chart. The WRO Trend Line Indicator corroborated this trend with a rising trend line that had held strong for several days. When the trend line dipped below the -80 level, indicating oversold conditions, it provided a potential entry point for a buy trade. The subsequent rise in the EUR/USD pair confirmed the accuracy of the WRO Trend Line Indicator’s signal, resulting in a profitable trade.

Image: www.best-metatrader-indicators.com

Forex Wso Wro Trend Line Indicator

Conclusion: Embracing the WRO Trend Line Indicator for Forex Mastery

The WRO Trend Line Indicator stands as a formidable tool in the hands of discerning forex traders. Its ability to unravel trend direction, strength, reversals, and trade timing makes it indispensable for those seeking to elevate their trading strategies. By harnessing its insights, traders can navigate the ever-changing landscapes of currency markets with confidence and precision, unlocking the path to consistent profitability.